Opinions are divided on yesterday’s update from Sitka Gold (CSE :SIG; FRA:1RF) from its RC Gold project in the Yukon: how should the 318 meters of 0.45 g/t gold be assessed? Is that okay, satisfactory, sufficient or insufficient? The first reaction of many quick readers – and in the end we all are – might have been disappointment, because although the reported intervals are longer, the gold grades are significantly lower than in the first Discovery drill holes on the Saddle and Eiger target zones. As a reminder, values from last year were 100.8 meters at 0.82 g/t gold in the best hole, DDRCCC20-002.

Patient reading will allow a better appreciation of the reported results. First, it should be noted that the three drill holes reported are part of a comprehensive drill program. Meanwhile, Sitka has already reached hole 20, so it is clear that the vast majority of the Yukon results are still pending. Secondly, topography plays a role in the evaluation of the results that should not be underestimated: all reported drill holes have been drilled from a mountain saddle and run at a shallow angle parallel to the slope. This in turn means that even at a target depth of 318 meters from the side of the slope, the drill head is only 100 meters from surface. The fact that the mineralization was measured above the valley brine and would be comparatively easy to reach horizontally could be significant for later open pit mining scenarios, as gravity would facilitate mining.

Last but not least, the zoning typical for this type of deposit plays an important role. The 318 meters at 0.45 g/t on the Saddle Zone is an average value. It is worth noting the higher grade intercepts from drill hole DDRCCC21-007: Mineralization ranges from 18 meters to 336 meters, including 104 meters of 0.57 g/t gold from 128 to 232 meters and 92 meters of 0.61 g/t gold from 262 to 353 meters and 32 meters of 1.23 g/t gold from 262 to 294 meters and 14 meters of 2.09 g/t gold from 280 to 294 meters and 2 meters of 5.49 g/t gold from 284 to 286 meters.

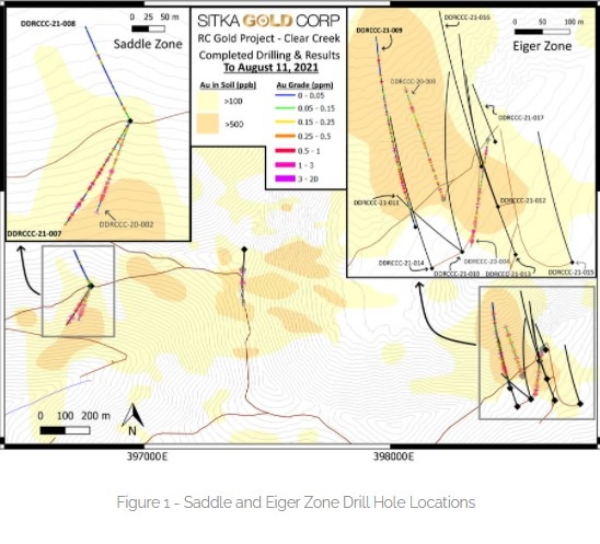

In drill hole DDRCCC21-009 (354 metres at 0.41 g/t gold) on the Eiger Zone (see Figure 1), mineralization ranges from 76 metres to 430 metres including 72 metres at 0.72 g/t gold from 76 metres to 148 metres and 12 metres at 1.52 g/t gold from 198 metres to 210 metres and 48 metres at 0.42 g/t gold from 295 metres to 234 metres and 1 metre at 5.74 g/t gold from 295 metres to 296 metres. Drill hole DDRCCC21-009 is 100 meters from Discovery drill hole DDRCCC20-003.

Cor Coe, CEO: “It’s a big system”.

Cor Coe, CEO of Sitka, feels vindicated by the progress of the drilling. He sees the potential for a multi-million ounce deposit at Eiger and Saddle more than ever. Thus, his statement in yesterday’s news release must be read, “These results continue to confirm the presence of a large, gold-enriched, multiphase intrusive system that has the potential to host both large tonnage and high-grade gold deposits. We look forward to releasing further results as they are received and we continue our 2021 diamond drilling program at RC Gold.”

Figure 1: Saddle and Eiger zones are about 1.7 kilometers apart. Just one drill hole of significance was reported from each zone. The third drill hole on the Saddle Zone was oriented to the north and showed no mineralization.

Conclusion: Sitka has only explored a tiny portion of its 376 km² RC Gold Project in the Yukon. The discovery on the Saddle/Eiger Zone show early stage parallels to Victoria Gold’s mine just 30 kilometers away. Notable deposits in the belt include: Fort Knox mine in Alaska, with current reserves of 282 million tonnes grading 0.37 g/t Au (3.4 million ounces, excluding the 7.5 million ounces of past production; Eagle Gold mine, with 155 million tonnes grading 0.65 g/t Au (3.26 million ounces; Victoria Gold Corp, 2020); the Brewery Creek epizonal deposit at 17.17 million tonnes grading 1.45 g/t gold (0.726 million ounces); and the Florin gold deposit, adjacent to Sitka’s RC Gold Project, at 170.99 million tonnes grading 0.45 g/t (2.47 million ounces). With the last example in particular, one can see how relatively and ultimately arbitrarily the stock market values different projects. The Florin gold deposit is the main asset of St. James Gold, which has the nice ticker “TSXV: LORD.” St. James has just announced a capital raise, calling a pre-money valuation of CAD 79 million. That wouldn’t be a bad prospect for Sitka, should the company manage to define a similar resource. Sitka’s current market value is around CAD 15 million. There doesn’t seem to be any imagination priced in for the pending results of the Alpha Gold project in Nevada. After all, the company has already reached drill hole 5 there. We will stay tuned to the story.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of EnviroLeach Technologies and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between EnviroLeach Technologies and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since EnviroLeach Technologies remunerates GOLDINVEST Consulting GmbH for reporting on EnviroLeach Technologies.