{kanada_flagge}With 100 kilometers of drilling, Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF; FWB: 8X00) is currently completing one of the largest drilling programs among junior mining companies at its Moss Lake project in northwestern Ontario, Canada. The goal of the extensive drilling on the Moss Lake project’s more than two-kilometer-long parallel vein system is to determine a new 43-101 compliant resource at higher resolution, expected by April 2023. Most recently, Goldshore submitted a resource of 4.17 million ounces (1.1 g/t) in the Inferred category in November 2022. This estimate already includes a higher-grade core of 34.7 million tonnes of ore at 2.0 g/t and 2.2 million ounces of gold, which could grow with new high-grade discoveries.

{kanada_flagge}With 100 kilometers of drilling, Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF; FWB: 8X00) is currently completing one of the largest drilling programs among junior mining companies at its Moss Lake project in northwestern Ontario, Canada. The goal of the extensive drilling on the Moss Lake project’s more than two-kilometer-long parallel vein system is to determine a new 43-101 compliant resource at higher resolution, expected by April 2023. Most recently, Goldshore submitted a resource of 4.17 million ounces (1.1 g/t) in the Inferred category in November 2022. This estimate already includes a higher-grade core of 34.7 million tonnes of ore at 2.0 g/t and 2.2 million ounces of gold, which could grow with new high-grade discoveries.

Figure 1: Goldshore last provided a resource estimate in November 2022. An update and extension is planned for late April 2023.

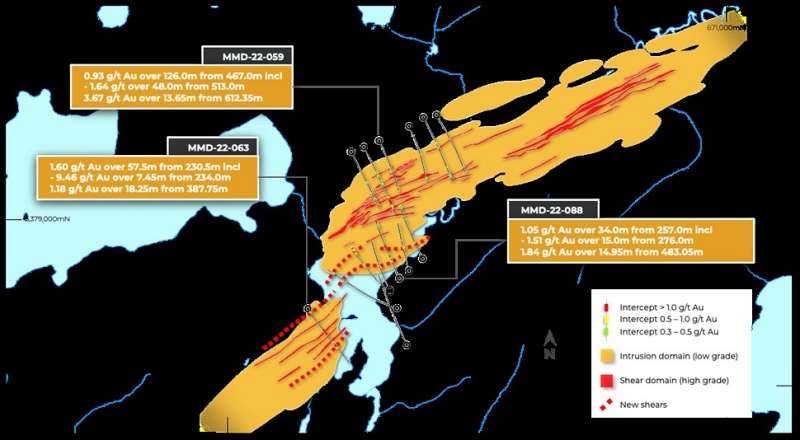

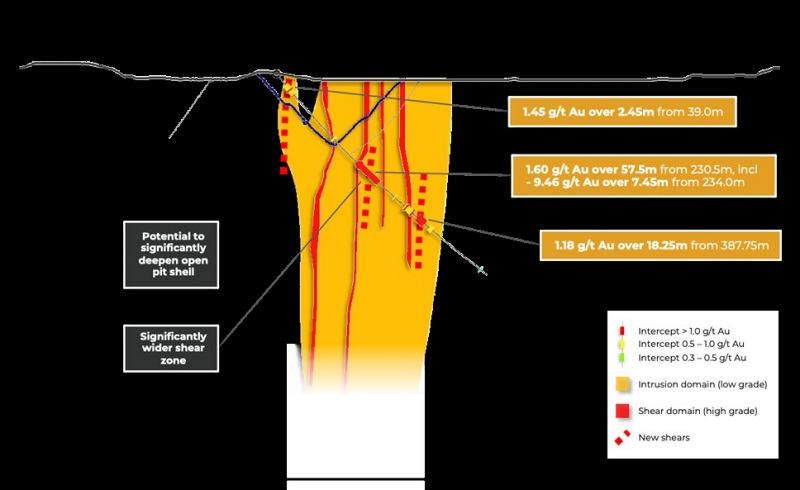

Results from thirteen holes drilled to test the northern and southern flanks of the mineralized shear zone system in the Main Zone (see Figures 2 and 3) have expanded the cumulative width of several closely spaced, high-grade gold shears by 150-200 meters to over 550 meters in the Main Zone with the best intercepts. Drill hole MMD-22-063 has confirmed the presence of high grade mineralization within the Southwest Zone, previously classified as low grade and barrel poor, and has shown the zone to be nearly 300 metres wide. The best intersections include: 1.60 g/t Au over 57.5 m from 230.5 m depth in MMD-22-063 including: 9.46 g/t Au over 7.45 m from 234.0 m depth and 1.18 g/t Au over 18.25m from 387.75m.

President and CEO Brett Richards stated, “These results once again support our thesis that the size and scale of the Moss Lake Gold Project will be large enough to support a material Mineral Resource Estimate (“MRE”) update in April 2023. We are working on a preliminary economic assessment (“PEA”) based on an updated resource. We continue to find extensions to the resource in step-out drill holes laterally and along strike of the historic resource profile, and we would like to further explore the impact of these extensions on the resource model and guide future drill targets.”

Pete Flindell, VP Exploration at Goldshore, said, “The high-grade drill results in the Southwest Zone provide confidence that this area has significant resource potential. The results along the northern and southern flanks of the Main Zone also represent a significant expansion in the thickness of the mineralized zone, which should support our goal of potentially expanding the mineral resource and improving its grade early in the second quarter.”

Figure 2: Drill plan showing the best of several +1 g/t Au intercepts compared to the current Mineral Resource and highlighting the additional shear areas.

Figure 3: Drill intersection through MMD-22-063 relative to the current Mineral Resource and highlighting the additional shear areas and potential for significant deepening of the open pit envelope.

In January, a second drill pass was completed on the Southwest Zone, filling the newly discovered high-grade shear zones and exploring additional shear zones.

Results from thirteen drill holes that explored the margins of the Main Zone on its northern and southern flanks are also available. Six holes targeted the north side of the shear system and seven holes targeted the south side. These holes intersected high-grade shear zones in a zone 200 meters wider than previously thought, making the Main Zone over 550 meters wide at its widest point.

As with the center of the Main Zone, these shear zones lie within broad zones of lower grade mineralization within the altered diorite intrusive host. Examples include 0.84 g/t Au over 37m of 608m in MQD-22-058; 0.33 g/t Au over 35.65m of 231.35m, 0.42 g/t Au over 34m of 273m and 0.86 g/t Au over 126m of 467m in MMD-22-059; 0.58 g/t Au over 75m of 543. 5m in MMD-22-060; 0.91 g/t Au over 33m of 257m in MMD-22-088; 0.58 g/t Au over 75m of 422m in MMD-22-089; 0.39 g/t Au over 40.5m of 453.8m in MQD-22-091; and 0.72 g/t Au over 15m of 207 in MMD-22-095.

The shear areas to the north and south have been sparsely drilled by historic drill holes and provide an opportunity to expand the mineral resource and understand the mineralization system in detail.

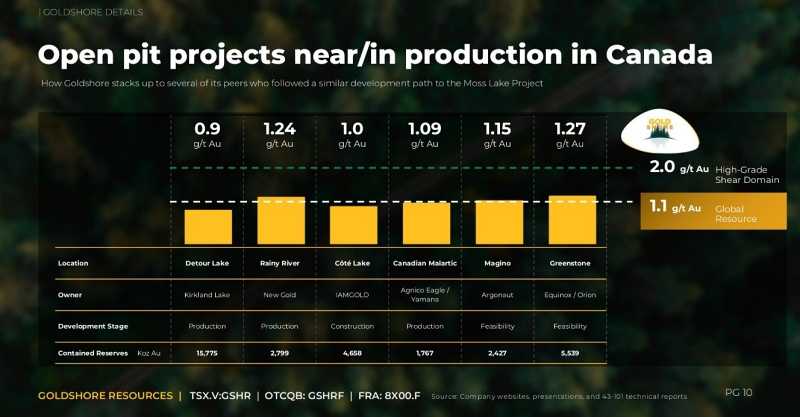

Figure 4: Goldshore compared to other open pit projects already in production or nearing production.

Conclusion: Goldshore is already clearly playing in the upper league of gold explorers with the higher grade portion of its resource of 2.2 million ounces of gold at 2.0 g/t gold released to date. The Moss Lake project does not need to shy away from comparison with other Canadian open pit projects that are already in the portfolios of large gold companies such as Kinross, New Gold, Iam Gold, Agnico Eagle, Argonaut or Equinox (see Figure 4). The aforementioned names also form the future target group for Goldshore. Recent drilling success in step-out holes indicates that the resource will continue to grow – both in quality and quantity. Together with the planned PEA, this should whet the appetite of one or more major companies. The market has been paying >90 CAD per ounce for defined high-grade gold resources (see Probe Metals and Marathon Gold). Goldshore is still far away from this with <16 CAD per high-grade ounce. The market cap of Goldshore currently stands at CAD 35 million (at CAD 0.21). Analysts at Laurentian Bank have just issued a speculative buy recommendation with a price target of CAD 2. It’ worth keeping an eye on the further development of Goldshore.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as a promise of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the penny stock sector, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for actuality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares in Goldshore Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Goldshore Resources and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.