{australien_flagge}In a heavily oversubscribed placement, Australian copper explorer Tennant Minerals (ASX: TMS; FRA: UH7A) has raised A$4.5 million in fresh capital to accelerate exploration of its Bluebird high-grade copper-gold discovery in the Northern Territory. The placement was made at a price of A$0.045 per share. Tennant’s shares resumed trading today (Monday), closing at A$0.058 on nearly 40 million shares traded.

Tennant is planning a two-part exploration program of six drill holes totaling up to 1,500 m to follow up on the exceptionally thick and high-grade drill intercepts at the Bluebird project, which included 50.0 m of 2.70% copper and 0.52 g/t gold from 158 m (downhole) in BBDD00091. Drilling to date on the Bluebird copper-gold discovery has tested mineralization from 100 m to just over 200 m vertical depth and over a 150 m strike length. Mineralization is open to the west as well as up-dip and down-dip.

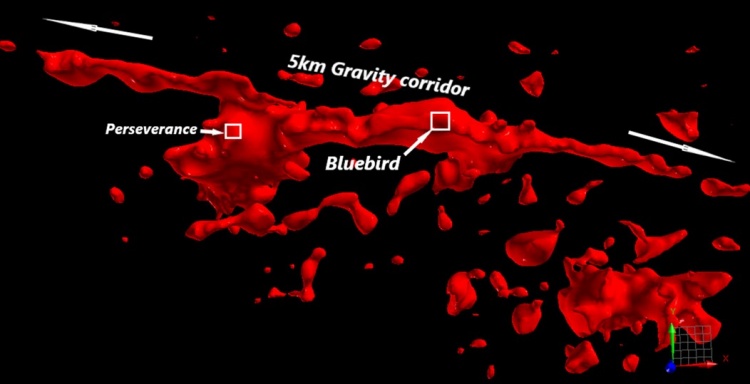

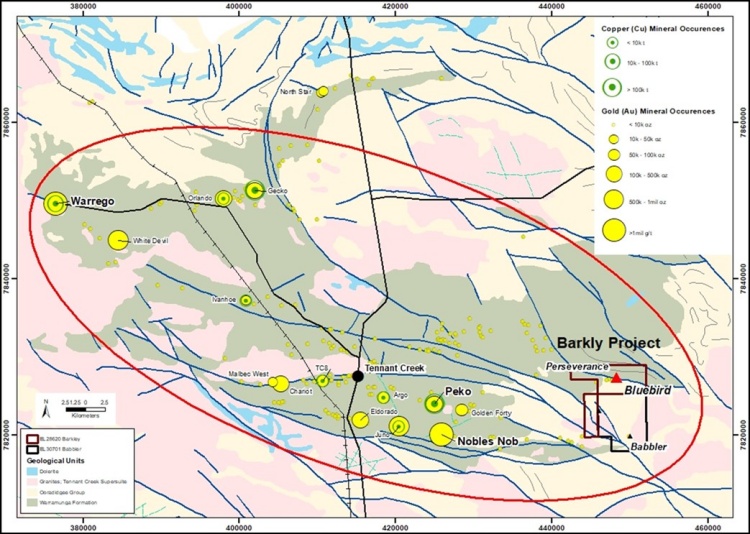

In addition, a further ten step-out drill holes totaling up to 3,000 m are planned to extend the footprint of the Bluebird copper and gold discovery. These holes will be guided by downhole electromagnetic (EM) surveys and gravimetric/magnetic targeting models (see longitudinal projection, Figure 1). The planned Phase 2 step-out drilling will extend the mineralized zone test to a strike length of over 300m and a vertical depth of 300m. The delineated dimensions of the targeted zone are similar in size to other large copper-gold deposits in the Tennant Creek mineral field, such as the Peko deposit 20 km west of Bluebird, which produced 147,000 tonnes of copper at a grade of 4% Cu and 414,000 ounces of gold at 10 g/t Au between 1934 and 19814.

The second focus of the accelerated program is the high-resolution drone-based magnetics survey, which will begin shortly. This will help delineate the numerous magnetics targets associated with the 5km Bluebird gravity corridor, which includes the historic Perseverance gold mine that historically produced short intercepts of up to 3m at 50 g/t Au3 from shallow depth.

Detailed gravity modeling suggests that Bluebird’s zone of iron enrichment (high density) extends strongly to the west and may be associated with the historic Perseverance gold workings, 1.5 km west of Bluebird (Figure 2), where previous drilling intersected high-grade gold at shallow depth: 3 m of 50.0 g/t Au from 42 m in PERC015 and 3 m of 43.2 g/t Au from 72 m in PERC001, as reported by Posgold in October 1995.

Figure 1: Extended longitudinal projection of Bluebird showing previous intercepts and new proposed drill holes from Phases 1 and 2.

Figure 2: Inversion model of detailed Bouger gravity data showing Bluebird and Perseverance deposits. The gravity ridge is most pronounced between Bluebird and the historic Perseverance gold mine, and appears to become stronger with depth, dipping shallowly to the west.

Figure 3: Bluebird is part of the larger Barkly exploration license. Only 20 kilometers away are the historic Peko and Nobles Nob mines.

Summary: The high-grade historic gold and copper-gold mines around Bluebird have been discovered because these deposits extend to surface and prospectors could easily take rock samples. The Bluebird discovery, on the other hand, is not visible at the surface. Instead, modern geophysical methods now provide insights that earlier generations of geologists could only dream of. Both with the Bluebird discovery itself, but even more so with the 5-kilometer gravity corridor in which Bluebird lies, Tennant may have just discovered the tip of the iceberg. Just to facilitate later comparisons, let’s note that Tennant Minerals is valued at less than A$30 million today.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Tennant Minerals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Tennant Minerals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.