Potential for positive results from future economic studies

Australian copper explorer Tennant Minerals Ltd (ASX: TMS; FRA: UH7A) has successfully metallurgically tested initial diamond drill core samples from its high-grade Bluebird copper-gold discovery in the Northern Territory. The copper-gold concentrates recovered from four samples by conventional flotation returned high grades of 23% Cu and 1.5 g/t gold and are potentially economic at current copper and gold prices. 97% of the copper was extracted from the sample. The gold recovery rate in the flotation concentrate was substantial at 66%. The company is confident that it can further improve the results.

The gravity concentrate contained 32.6% of the gold and 15.7% of the copper. Intensive cyanidation leaching of the gravity concentrate recovered 90.2% of the gold contained in the gravity circuit. Further work will investigate additional gravity concentration and leaching stages in conjunction with flotation to potentially increase the gold recovery rate. The initial report from metallurgical consultants Strategic Metallurgy indicates that these positive results from the initial (rougher) flotation tests and the gravity and cyanidation leach tests on the Bluebird core samples can most likely be further improved in the “cleaner” flotation stage.

Potential for positive results from future economic studies

Vincent Algar, CEO of Tennant Minerals, commented: “The significant initial copper flotation results of 23% copper and 1.5 g/t gold in concentrate and high copper recoveries of up to 97% are extremely encouraging and indicate the potential for positive results from future economic studies in terms of mining and recovering a saleable copper and gold concentrate.”

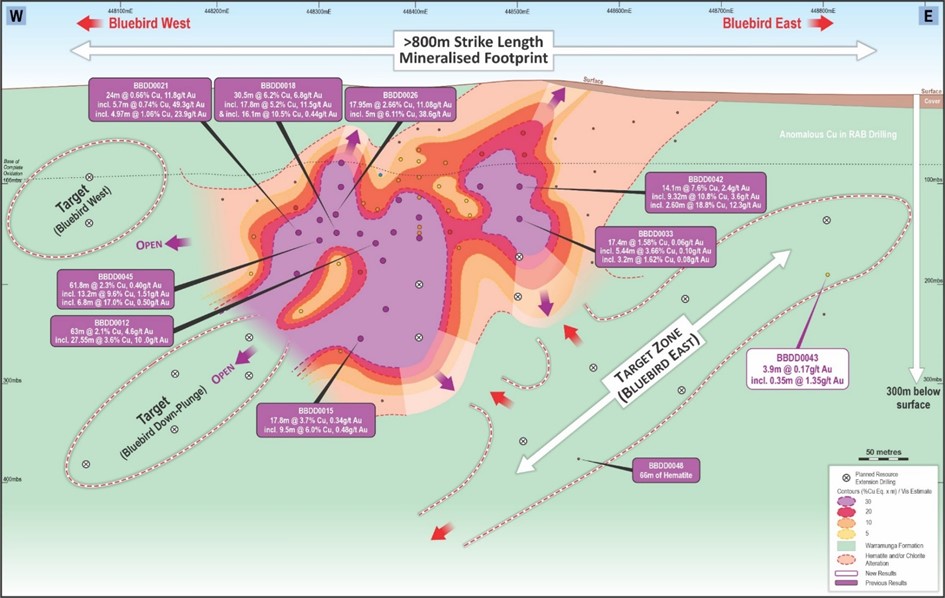

The positive metallurgical results are a strong incentive for the company to continue drilling. Multiple drill intercepts at Bluebird have already confirmed the discovery of high-grade copper and gold mineralization over a strike length of 500m and at a depth of over 300m, with further expansion potential demonstrated at a depth of over 400m and along a strike length of over 800m.

The Company is preparing to commence further drilling at Bluebird and along the highly prospective 2.5km Bluebird-Perseverance corridor in the coming weeks as the Northern Territory enters the dry season. Drilling within the Bluebird-Perseverance corridor in 2024 has two objectives: Tennant wants to define an initial mineral resource for the Bluebird project. It will also test a series of “Bluebird-style” targets along strike and at depth.

Conclusion: Copper costs more than US$4 per pound. Gold is trading at a historic all-time high of just under US$ 2200 - and gold is also more expensive than ever in Australian dollars: yesterday, AUD 3,334 was paid per ounce of gold. This means that the conditions for the development of a potential stand-alone operation at Tennant Minerals' Bluebird project are historically favorable. It is unsurprising that the initial metallurgical tests have been successful given that the mineralization intersected at Bluebird is typical of other high-grade copper-gold orebodies previously mined in the Tennant Creek mineral field. The historic mining camp produced more than 5.5 million ounces of gold and over 700kt of copper between 1934 and 2005. If Tennant proves sufficient critical mass with the first mineral resource, Bluebird could be at the beginning of a renaissance of the Tennant Creek mineral field, as there is much to suggest that there could be more Bluebird-like deposits along the 2.5km Bluebird-Perseverance corridor. Tennant is the first company to pursue this hypothesis using modern exploration methods. For this reason, the Tennant story could become much bigger in the future than the history of the Tennant Creek mineral field suggests.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and in accordance with paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares in Tennant Minerals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Tennant Minerals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.