New program follows best RC gold drilling to date

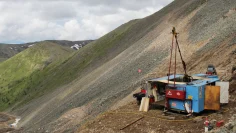

Here we go again! Following the major exploration and drilling successes of the past year, Sitka Gold (WKN A2JG70 / CSE SIG) intends to start the next drill program at its main RC Gold project in Yukon, Canada, shortly. The fact that Sitka, unlike many other explorers in northern Canada and especially in the Yukon, can already start drilling again is due to the fact that the extremely promising project is accessible all year round.

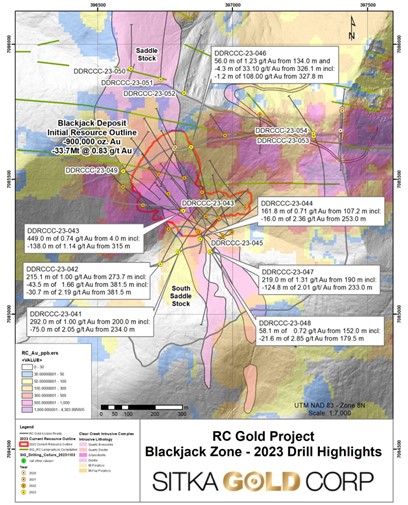

CEO Cor Coe’s company is planning up to 15,000 meters of drilling on the property in the resource-rich Tombstone Belt to build on the successes of 2023. At the beginning of 2023, Sitka had already announced an initial, pit-constrained resource totaling 1.34 million ounces of gold, spread across the Blackjack (900,000 gold at 0.83 g/t gold) and Eiger (440,000 ounces of gold at 0.50 g/t gold per ounce) deposits.

New program follows best RC gold drilling to date

Since then, Sitka has consistently presented excellent drill results, including an intercept of 219.0 meters of 1.34 g/t gold. This also included 124.8 meters of 2.01 g/t gold and 55 meters of 3.11 g/t gold. Drill hole DDRCCC-23-047 thus returned the highest grade mineralization the company has ever intersected at RC Gold!

And it is precisely there, at the southern extension of the Blackjack Zone, that Sitka, or the service provider now engaged, Kluane Drilling, will begin drilling. Kluane has over 30 years of experience with diamond core drilling in the Yukon and worldwide and has already carried out the company’s last drill programs. Crew and equipment preparations have now begun and mobilization for the winter drill program at RC Gold is expected to commence next month.

Conclusion: As already mentioned, Sitka Gold had a very successful year in 2023. And in contrast to the performance of many other explorers, this has also been reflected in the share price. Which has risen by around 65% in the last 12 months – despite the difficult environment. We are excited to see what the new drill program will bring, in particular whether it will reveal further high-grade intersections such as DDRCCC-23-047, which would be significant in our opinion. The high grades in hole 47, for example, were one of the reasons that the experts at Crescat Capital and their technical advisor Quinton Hennigh, personally, recently decided to invest in Sitka.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.