Gelogoical models holding up

Will Sitka Gold Corp (CSE:SIG; FSE:1RF; OTCQB:SITKF) make a breakthrough at its Alpha gold project in Nevada this season? The drill will start turning there as early as November 1 to provide the answer.

Since acquiring the Alpha project at the southeastern end of the famous Cortez Trend, 40 kilometres southeast of Nevada Gold Mines’ Cortez mine complex, Sitka has pieced together a geological puzzle of 12 drill holes (3,979 metres in total), some widely spaced, that paints the Alpha as a large, extensive Carlin-type gold system with thick, low-grade gold intersections. The objective of this year’s drill programme is to finally trace the high-grade core of the gold system at Alpha and better define its geometry, distribution and thickness with at least 8 holes along a corridor of approximately 2 kilometres. Sitka geologists believe there is significant potential for high-grade Carlin-style structural gold mineralisation at Alpha, particularly at the contact of two geological zones, the Horse Canyon Equivalent/Devil’s Gate contact, which is well known from other Nevada gold projects.

Cor Coe, CEO and Director of Sitka commented, “We are very pleased to build on the successful results of last year’s work at Alpha Gold, where drilling returned the best results to date and also significantly expanded the known extent of the Carlin style gold system we have discovered. The results of the individual drill holes at Alpha Gold have confirmed our geological models and show that Alpha Gold has the geological framework required to discover a large Carlin-type gold deposit. Drilling this year is focused on systematically testing the key target horizons within the host rocks present along the approximately 7.5km long NNW anticline trend at Alpha Gold. Recent interpretation of drilling and surface work to date has indicated that this new target area is the most likely zone to host gold values in excess of 5 g/t and we intend to verify this potential with the upcoming drill program.”

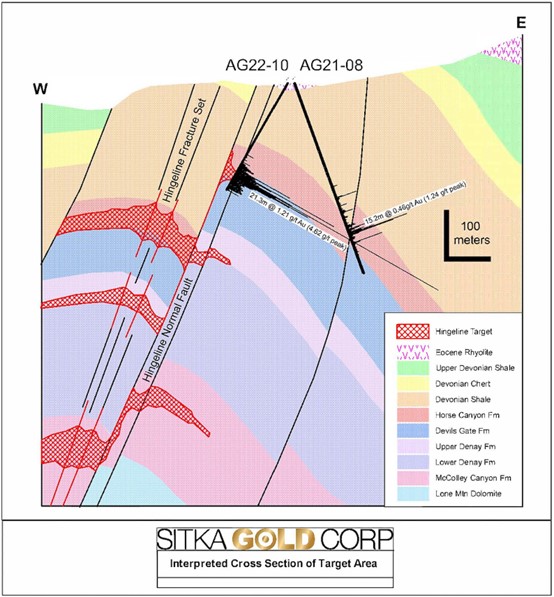

Figure 1: Sitka geologists have drawn these conclusions from previous drilling AG21-08 (15.2 m @ 0.46 g/t Au) and AG22-10 (21.3 m @ 1.21 g/t Au). The graphic shows the concept of the Alpha target in cross-section. The current evolving exploration model assumes peak grades in the hinge zone, which should be characterised by more intense fractures than the legs. The red hatching in the figure highlights the intersection of the main host rock horizons with the Hinge Zone, the most likely location for underground gold grades consistently above 5 g/t. This model should be broadly applicable along the entire 7.5km NNW anticline trend at the Alpha Gold project. Testing will be carried out at the currently approved drill sites along the northern 2km of the target trend.

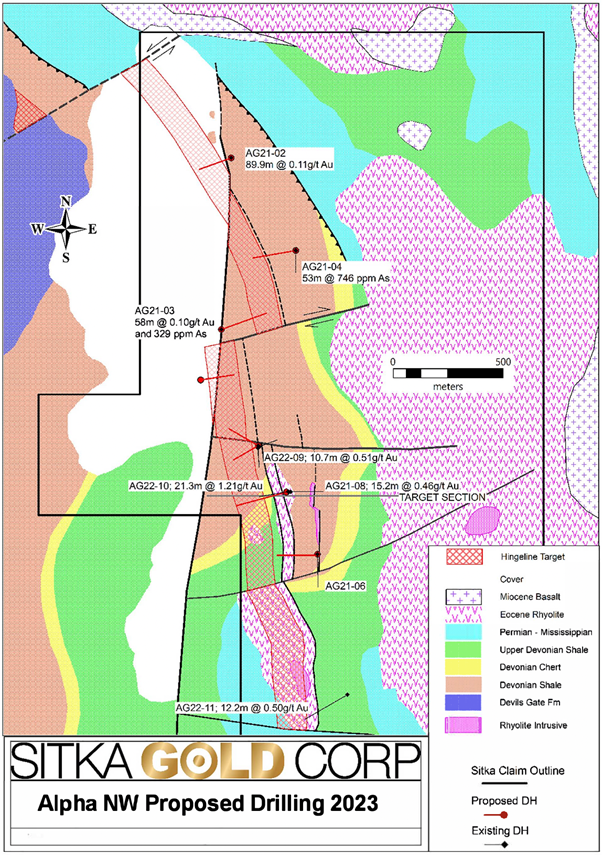

Figure 2: The overview map shows the proposed drill holes for testing the hinge target zone highlighted in red. High priority sites providing optimal angles on the target near holes 8 and 10 include the AG21-09 site, which encountered and was trapped in karst voids, causing significant sampling problems. Rocks adjacent to karst have returned anomalous gold grades at Alpha, and the voids appear to reflect dissolution of carbonate rocks by acidic fluids before or after the mineralisation phase. AG22-09 intersected 10.7 m @ 0.51 g/t Au in the immediate walls of the karst zone before all sample recovery was lost. Drilling from this location to the SW and secondarily to the NW will directly test the western dipping side of the Hingeline Fault and the hinge zone shown in Figure 1. The location of AG21-06 south of AG22-10 provides a target angle with the potential to strike the Horse Canyon to Devils Gate host horizon first on the east side of the Hingeline fault, then cross the fault and strike the host horizon again on the down-dip side of the fault.

Figure 3: Regional map of the Alpha Gold Project

Conclusion: With the least possible effort, Sitka has succeeded in recent years in proving that its Alpha project on the southwest margin of the Cortez Trend has all the characteristics that distinguish large Carlin-type gold deposits in Nevada. This type of deposit in Nevada is so famous because it hosts some of the largest and most profitable gold mines in the world. This is because the gold mineralisation in these mines is structurally bound for kilometres due to its depositional history, making it particularly well suited for industrial mining. If Sitka does indeed succeed in finding the high-grade core of the Carlin system this time – at comparatively shallow depths to boot – it would be the final link in the long chain of evidence for a potential world-class project. After all, the target corridor defined by Sitka is 7.5 km long. We look forward to the results and the potential rerating of the company that might stem from it.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.