{kanada_flagge}Sitka Gold Corp. (CSE:SIG; FRA:1RF) continues to demonstrate the continuity and width of the Blackjack discovery at its RC project in the Yukon with the fourth and final drill hole of the past winter season. Hole 25 intersected 349 meters of continuous mineralization averaging 0.71 g/t gold from a depth of 19 meters . The intercept between 25 metres and 246 metres averaged 1.01 g/t. From 111 metres, a 48 metre thick interval assayed 1.63 g/t. Thus, since the discovery hole in drill hole 21, all subsequent drill holes (drill holes 22 to 25) have encountered wide intervals with potentially mineable gold grades. Meanwhile, Sitka has already resumed drilling at the site with two drill holes.

Cor Coe, P.Geo., CEO and Director of Sitka commented, “Gold intercepts of this magnitude are exactly what we are looking for as we continue to explore and expand a large area of potentially economic intrusive gold mineralization. The results from hole 25 show how rich and consistent the gold mineralization is in our newly discovered Blackjack Zone.” Cor emphasized that gold mineralization in this zone is open and extends at least 80 meters east of the first discovery hole (hole 21).

Drilling success to date on the Blackjack Zone must be considered in context. The Tombstone gold belt in the Dawson to Mayo area of Yukon hosts several multi-million ounce gold deposits in addition to the Eagle gold deposit (Victoria Gold). The projects, like Victoria Gold’s mine, are suitable for industrial open pit mining. Victoria Gold is currently mining the Eagle gold deposit, which had pre-mining measured and indicated resources of 214 million tonnes grading 0.63 g/t gold (Au) at a cut-off grade of 0.15 g/t (4.397 million ounces).

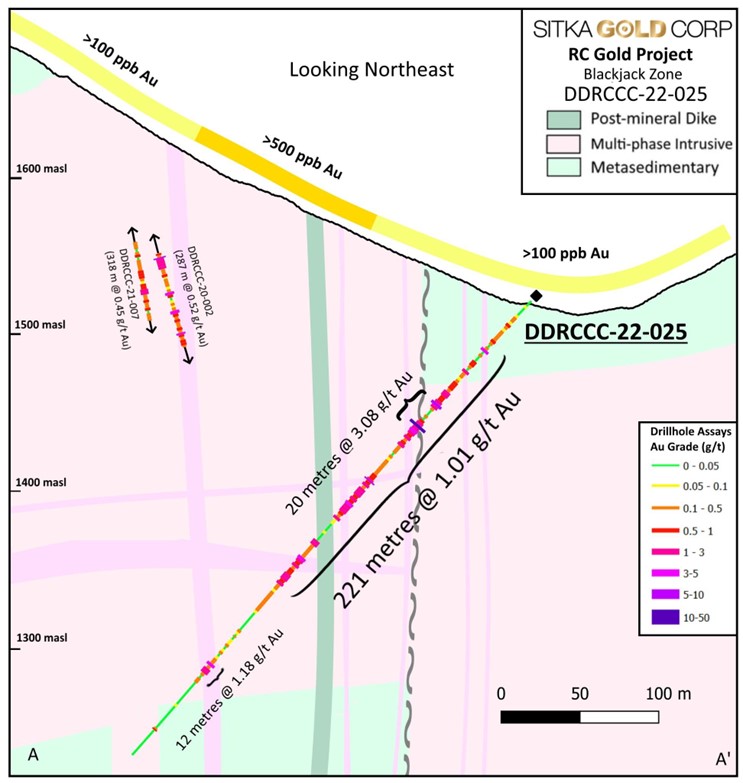

Figure 1: Cross-section of drill hole 25 in the Blackjack Zone.

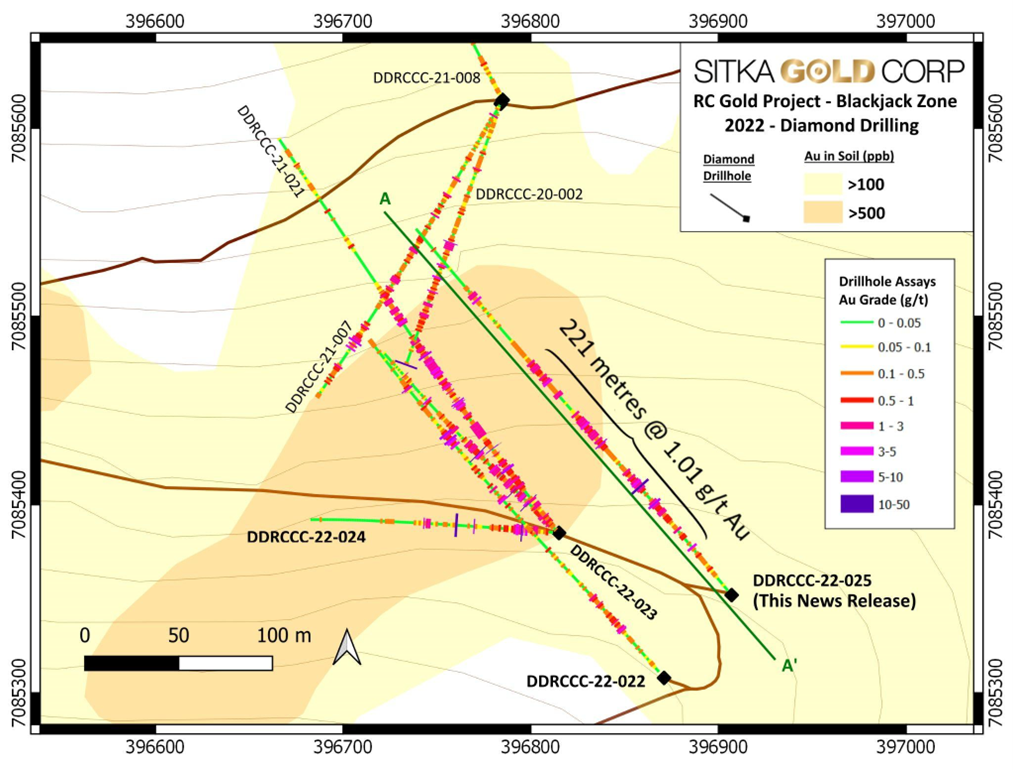

Hole 25 was drilled approximately 80 m east of hole 21 and at the same orientation and inclination. This hole encountered similar geology to the previous holes, with gold mineralization occurring in both intrusive and metasedimentary rocks and visible gold was observed in the drill core. Hole 25 started in metasedimentary rocks and then transitioned to multiphase intrusive rocks at 80m. The hole remained in multiphase intrusive rock to the final depth of 389.2 m with occasional metasediment intercalation. Broad zones of gold mineralization are associated with quartz veins and dykes, with the higher grade gold mineralization generally occurring in foliated quartz veins within zones of oxidation and sericite alteration.

This gold-bearing zone remains open in all directions and results from drill hole 25 highlight that it is a large gold mineralized system.

Figure 2: Overview map of diamond drilling in the Blackjack zone.

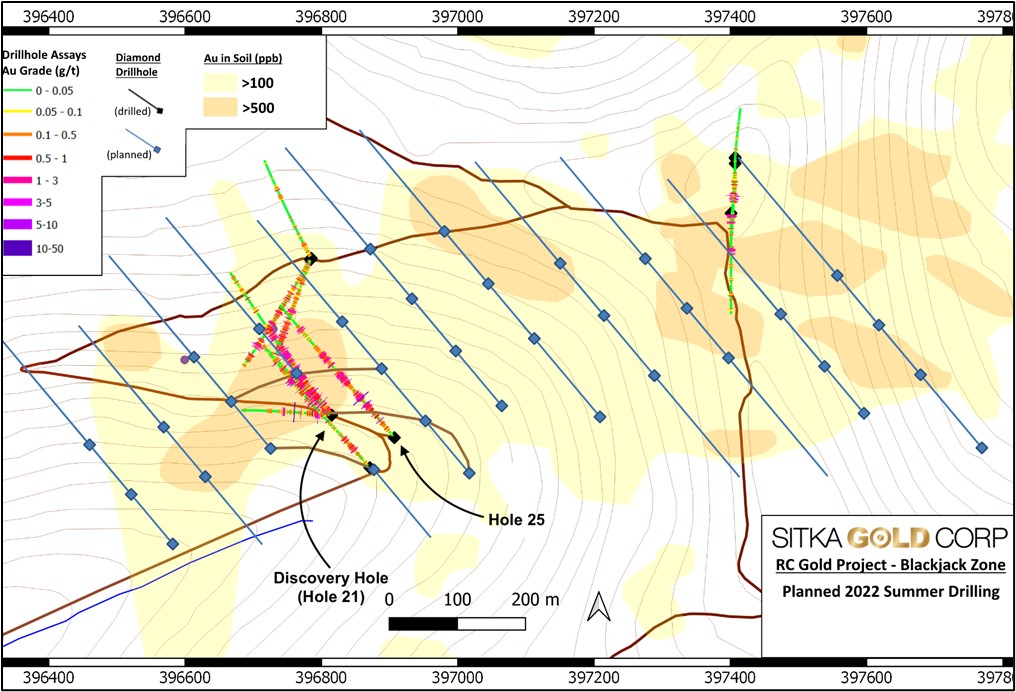

Sitka is planning a large-scale 10,000 meters of step-out drilling, as shown in Figure 3, to extend the Blackjack Zone east and west along interpreted strike. At the end of this phase of drilling, Sitka intends to be in a position to estimate an initial gold resource.

Figure 3: Proposed step-out drill holes at the Blackjack Zone.

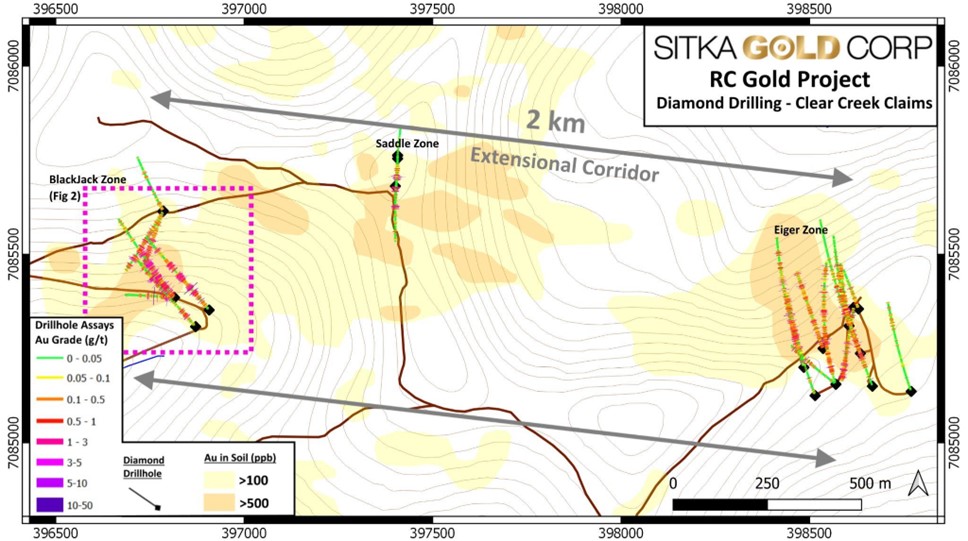

Figure 4: The 2 kilometer long extension corridor is outlined by a gold-in-soil anomaly of >100 ppb and >500 ppb.

Conclusion: the Blackjack Zone continues to deliver consistently good results. The 10,000 meters of step-out drilling now planned extends east to the so-called Saddle Zone, which in turn is halfway to the Eiger Zone, which Sitka had already drilled in 2020. Are the two zones, two kilometers apart, possibly connected? The understanding of the mineralization grows with each drill hole: regularly Sitka hits the higher-grade core of the underlying gold intrusion itself, in addition to the so-called metasediments. This could be the key advantage that could give Sitka not only a large mineable volume like its neighbors Victoria Gold and Banyan Gold, but also higher grades on average. We are keeping our fingers crossed for Sitka.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news at https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.