{kanada_flagge}Right on time for the start of the world’s largest mining trade show, PDAC in Toronto, which this year falls in the summer due to pandemics, Sitka Gold Corp. (CSE:SIG; FSE:1RF; OTCQB:SITKF) has closed its oversubscribed CAD4.69 million financing with participation from Sprott Asset Management. In the same breath, the company announced that it has already restarted its announced 10,000-meter diamond drill program (see press release dated January 6, 2022) at its RC Gold project in the Yukon. Two drill rigs are in operation.

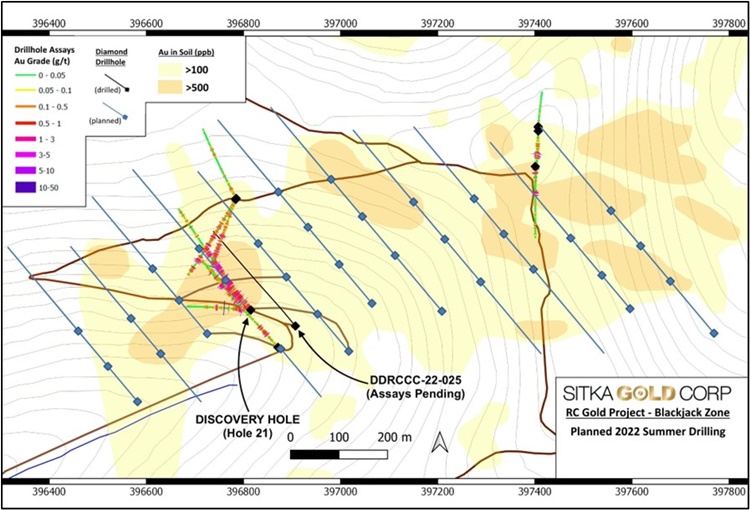

The Blackjack zone discovered last year is to be massively expanded with aggressive step-out drilling. The share price turned upward and closed at CAD 0.125 on medium volume, still just below the just completed capital round at CAD 0.14.

Sitka expects shortly the result of the fourth and last hole drilled during the winter season. The first three of these holes (drill holes 22, 23 and 24) from the winter drill program had underpinned the discovery on the so-called Blackjack Zone in drill hole 21, the last drill hole of the 2021 season, with impressive grades and widths and enabled the just completed financing. A total of 1242.8 m had been drilled in the four holes.

Cor Coe, P.Geo., CEO and director of Sitka, compared the recent drill hole results on the Blackjack Zone to those of neighboring competitors, saying, “The widths and grades encountered in drilling on our Blackjack Zone compare very significantly to our competitors Victoria Gold and Banyan Gold, who are also mining and/or exploring their deposits within the Tombstone Gold Belt.”

Victoria Gold is currently mining the Eagle Gold deposit, he said, which had pre-mining measured and indicated resources of 214 million tonnes grading 0.63 g/t gold (Au) at a cutoff grade of 0.15 g/t (4.397 million ounces). Banyan Gold recently reported a combined inferred mineral resource at the Airstrip, Powerline and Aurex Hill deposits at its AurMac project of 207.0 million tonnes grading 0.60 grams per tonne Au at an estimated cut-off grade of 0.2 to 0.3 g/t (3.99 million ounces; Jutras 2022)(5), stated.”

Hole 25, which is still pending, was drilled approximately 80 m east of hole 21 on the same orientation and inclination. Sitka indicates that further confirmation of the Blackjack discovery is expected: The release states, “This hole encountered similar geology to the previous holes, with visible gold observed in the drill core.”

Figure 1: Proposed step-out drill holes at the Blackjack zone are expected to test mineralization along one kilometer.

Summary: The discovery of the Blackjack Zone last year was the turning point for Sitka. Subsequent results from three winter drill holes have since shown that it was not a “lucky punch”. The fourth and final result, to follow shortly, should also further underpin the discovery. The step-out drill holes now planned around the Blackjack Zone will test an area extending approximately one kilometer from east to west and up to 400 meters wide. This drill grid may well be interpreted as a statement of confidence in the robustness of the Blackjack Zone. Sitka has indeed reason to be optimistic, as the gold grades measured so far are on average about twice as high as the values of its two neighbors Victoria and Banyan. Theoretically, Sitka could therefore also afford poorer drill results in order to still be on par with its competitors. Conversely, if results continue to deliver grades and widths as good as drill holes 21 to 24, Sitka’s implied resource will grow faster and with less effort than its neighbors. That’s what the market wants to see now, and that’s why the 2022 drilling season is so exciting for Sitka. We’ll definitely keep an eye on this story.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news at https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.