Additional untapped potential

Canadian explorer PTX Metals (CSE PTX / WKN A403Z4) recently confirmed known (historically proven) mineralization at the polymetallic W2 project with impressive drill results. The drilling was also designed to demonstrate the extension potential of the near-surface mineralization trend on the property located near the Ring of Fire.

Now, CEO Greg Ferron’s company has used these and other recent and historical drill results for 3D and pit grade modeling to create an exploration target for mineralization near surface. This comes to potentially 59 to 135 million tons with average grades of 0.78% to 1.03% copper equivalent.

Up to 2.3 billion pounds of contained copper equivalent

Which would mean between 610,000 and 1.052 million tons or 1.23 to 2.3 billion pounds of contained copper equivalent (at a cut-off of 0.7% or 0.5%)! Assuming an even higher copper equivalent grade of over 0.9%, the exploration target for the surface mineralization of W2 is 31 million tonnes at 1.25% copper equivalent.

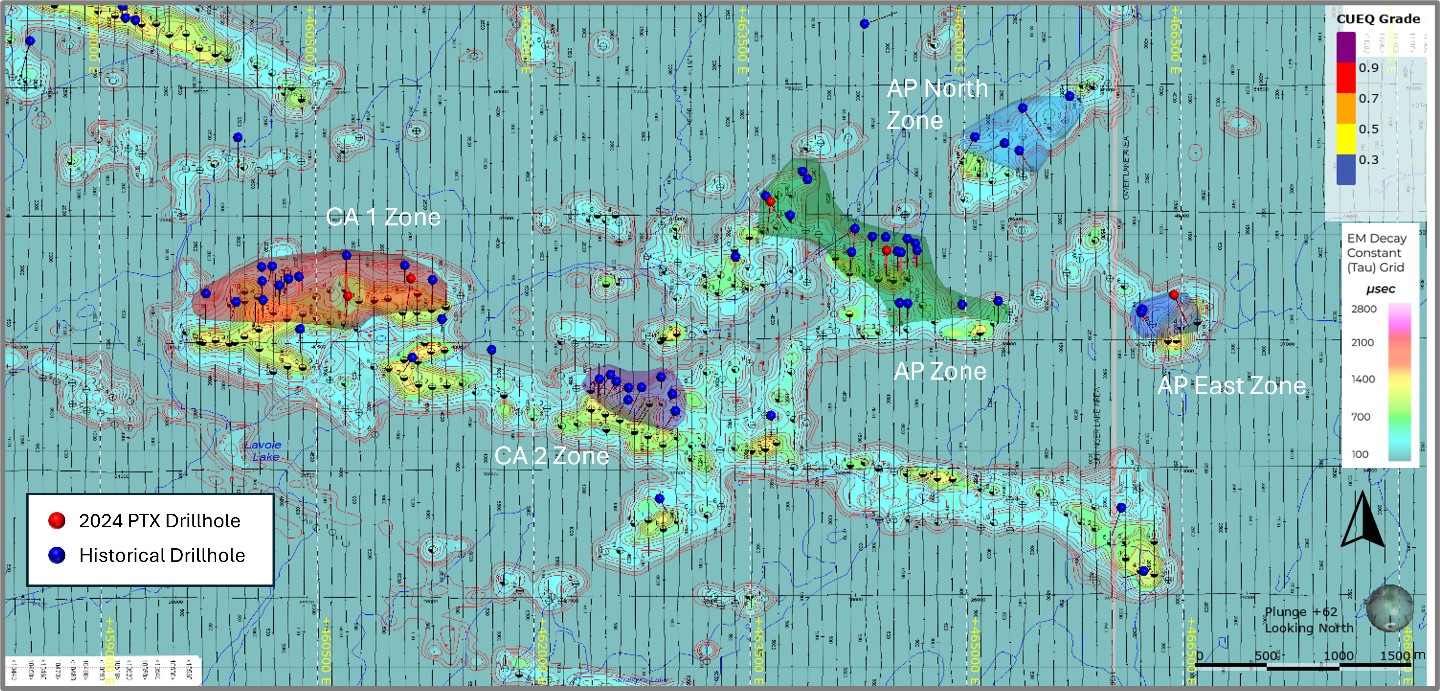

A total of five mineralization zones were defined with the help of the exploration target model: CA Zone 1, CA Zone 2, AP Main and two satellite zones called AP North and AP East. Together, these have an extensive strike length of around 7 kilometers and are mostly close to surface (<150 meters) – but are open at depth. As PTX explains, all drill hole data has been merged into the GEOVIA GEMS database, comprising 98 drill holes with a length of 16,841 meters overall from Inco, Aurora Platinum and PTX Metals.

Target zone defined by the new exploration model; PTX Metals Inc.

The highlights:

– PTX recently acquired the CA 1 and CA 2 zones. According to the exploration target model, these alone already have the potential for 24 million tons at an average of 0.98% copper equivalent and a cut-off of 0.7%. (Only ore with 0.7% copper equivalent or more was considered.)

– CA Zone 2, located to the southeast, has the highest content of 1.42% copper equivalent in 2 million tons. The cut-off here is 0.9% copper equivalent.

– In the AP Main Zone, on the other hand, a higher proportion of platinum group elements (PGEs) was observed. According to the new model, the potential here is 20 million tons at 1.25% copper equivalent, if a copper equivalent of over 0.9% is used for the estimate.

Additional potential

In addition, there are numerous other conductor structures across the W2 property that have not yet been drill tested and the first phase of drilling in 2024 also discovered previously unknown zones of mineralization with large widths along a 7-kilometre strike on the property.

Now that the exploration target model is in place, the next priority is to drill confirmation holes primarily where Inco has drilled holes in the CA zones in the past. This will be complemented by confirmation drilling in the AP Zone as well as metallurgical work and activities related to the relationship with the surrounding communities. All activities that should increase confidence in the potential of the deposit and significantly reduce the risk of the project.

“We are very pleased with the results of this initial work, which demonstrate the significant size of the W2 project and its potential to become a major mining project,” stated Greg Ferron, CEO and President of PTX Metals Inc. “The reported tonnages and grades benefited significantly from the high-quality drilling completed by Inco, Aurora Platinum and PTX. We remain confident that confirmation drilling and continued exploration will both enhance and expand the deposit.”

Conclusion: An exploration or exploration target model is much more common in the Australian mining sector than in Canada but, we think, a very helpful way to estimate the potential of a promising project like W2. Another way of putting it is that what PTX Metals puts out today is an internal resource calculation that is not compliant with NI 43-101 – yet. This is because PTX does not yet have sufficient drill results that meet 43-101 standards. However, the results PTX did not drill itself, to a large part stem from drilling by Inco which as at one point Canada’s largest mining group and the largest nickel producer in the world. As such, these drill results can be considered to be of a higher quality than what a lot of explorers produce, today… So, should PTX Metals be able to prove up its exploration thesis / confirm the exploration model through confirmation drilling, the market should – at the latest – have to acknowledge what a great project the company has in W2. And as stated above, there’s still a lot of structures not even tested by drilling on the property!

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of the mentioned companies and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time, which could influence the price of the shares of the mentioned companies. Furthermore, there is a consulting or other service contract between the mentioned companies and GOLDINVEST Consulting GmbH, which is another conflict of interest, because the mentioned companies remunerate GOLDINVEST Consulting GmbH for the reporting.