{kanada_flagge}Platinex (CSE PTX / WKN A0MVNG) originally acquired the W2 project near the so-called Ring of Fire in Ontario, Canada, primarily for the potential for copper, nickel, as well as platinum and palladium (PGE) mineralization. However, historical sampling also indicates the potential for significant gold mineralization, according to the company. Interestingly, one of the world’s largest gold companies now seems to think along similar lines!

{kanada_flagge}Platinex (CSE PTX / WKN A0MVNG) originally acquired the W2 project near the so-called Ring of Fire in Ontario, Canada, primarily for the potential for copper, nickel, as well as platinum and palladium (PGE) mineralization. However, historical sampling also indicates the potential for significant gold mineralization, according to the company. Interestingly, one of the world’s largest gold companies now seems to think along similar lines!

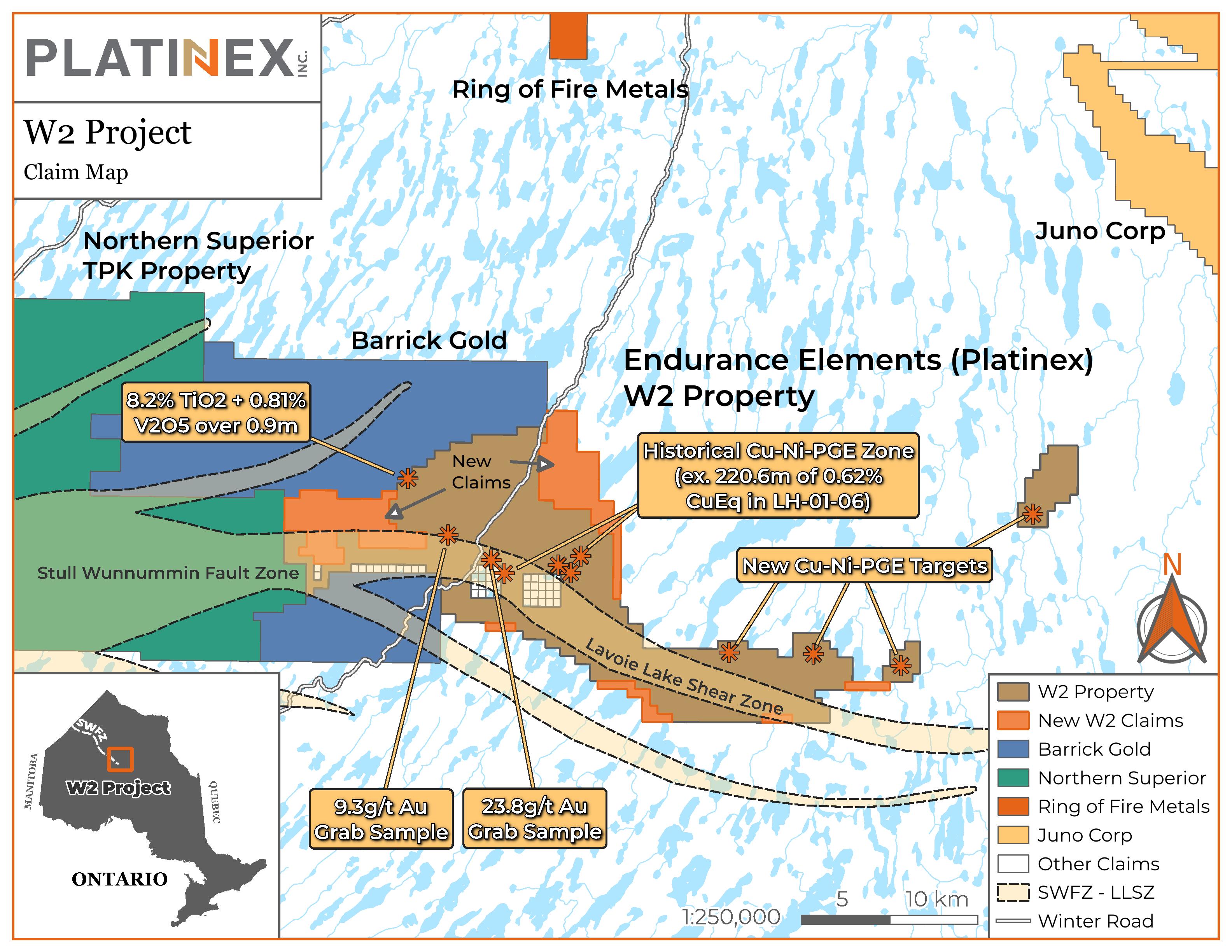

In any case, given the potential seen for W2 as a whole, Platinex has once again significantly expanded the project area by acquiring 225 additional claims through its subsidiary Endurance Elements, so that W2 now consists of 1,122 individual units covering an area of 22,094 ha or 220 square kilometers! And with that, the W2 project is now directly adjacent to land recently secured by the world’s second largest gold producer Barrick Gold (WKN 870450) … Barrick, in fact, has secured by staking 1,198 claims covering 235.65 square kilometers in the region.

Source: Platinex Inc.

For its part, since acquiring the W2 project in January 2022 – primarily for historical, drill-tested copper, nickel, platinum and palladium mineralization – Platinex has continued to push the western boundary of the property within the Lavoie Lake shear zone system toward Northern Superior Resources’ gold-focused TPK project. With the numerous acquisitions, as well as the staking of additional claims, this has more than doubled the original land area!

The Lavoie Lake shear zone system, which extends over a strike length of 35 kilometers through W2, is interpreted as a series of splay shears/faults originating from the Stull-Wunnummin Fault Zone (SWFZ), an important transcrustal regional structure. And this extends from Gods Lake in the province of Manitoba over 600 kilometers eastward through Big Trout Lake and W2 to the area of the so-called Ring of Fire in Ontario. According to Platinex, high-grade gold values of 9.3 and 23.8 g/t gold from the Sandvik and Goose outcrops, respectively, have been detected on the W2 project in the past.

Conclusion: For now, Platinex wants to focus its exploration plans for W2 on extending the historic nickel, copper and PGE mineralization in the center of the property, as well as exploring the VTEM targets in the eastern part of the project, where they already see great potential. Nevertheless, in our view, extending the property to the west represents a strategic land grab that among other things opens up the option for gold mineralization. And having a neighbor of Barrick Gold’s caliber shouldn’t hurt either, especially for a small company like Platinex, which remains a risky speculation for all its opportunities. We’ll stay on the ball!

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of the mentioned companies and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time, which could influence the price of the shares of the mentioned companies. Furthermore, there is a consulting or other service contract between the mentioned companies and GOLDINVEST Consulting GmbH, which is another conflict of interest, because the mentioned companies remunerate GOLDINVEST Consulting GmbH for the reporting.