{kanada_flagge}P2 Gold Inc. (TSXV:PGLD;FRA:4Z) is working hard to advance the historic Gabbs gold-copper project it acquired from a financial investor’s portfolio in May of this year. After extensive geophysical studies and diamond and reverse circulation drilling programs, it is now in a position to advance a preliminary economic assessment of Gabbs, said Joe Ovsenek, P2’s president and CEO. Process specialists Kappes Cassiday & Associates, contracted by P2 Gold, have concluded that “heap leaching or milling the oxide ores with cyanide has the greatest economic potential” for the project.

P2 Gold intends to test this proposition through additional metallurgical studies in order to expeditiously advance the project towards a preliminary economic assessment (“PEA”). The Gabbs Copper-Gold Project is located in the famous Walker Lane trend of west-central Nevada, approximately 145 miles from Reno.

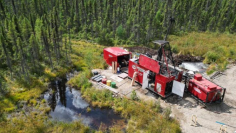

Phase One Drilling Program Completed

The Phase One drill program was completed and included 580 meters in four diamond drill holes and 4,120 meters in 27 reverse circulation (“RC”) drill holes. The primary focus of the drill holes was to define ore controls and test the full extent of mineralization at the Sullivan Zone. All four diamond and 23 RC drill holes were completed at the Sullivan Zone. Three RC drill holes were drilled at the Car Body zone and one RC drill hole was drilled at the Lucky Strike zone. Diamond drill hole results have been reported; RC drill hole results are pending.

Historically, drilling at the Sullivan Zone has focused on near-surface oxide gold mineralization, with a significant number of drill holes stopped in mineralization or not assayed for copper. The majority of these drill holes were completed between 1980 and 1995 prior to the implementation of National Instrument 43-101. Results to date from P2 Gold’s drilling program have confirmed that the zone of gold-copper mineralization is much thicker and higher grade than previously defined. In addition, the Sullivan deposit appears to be zoned with lower grade mineralization to the northwest and improving grades to the southeast.

Geophysical Exploration

From 1970 to 2011, exploration activities were carried out on the Gabbs Project by several operators. This work showed that the Sullivan and Lucky Strike zones are associated with prominent magnetic uplifts that are open at depth. Re-interpretation of ground magnetic and historical IP data has identified features that may indicate the source of surface mineralization.

Field mapping and trenching by P2 has located numerous occurrences and historic shafts, pits, and trenches that overlie some of the interpreted deep-seated sources. In a further attempt to define these targets, a magnetotelluric survey of natural springs (“NSMT”) will be conducted on the project, which covers a total of 25.7 line kilometers. This survey will cover all four known zones of mineralization and the prospective source locations between the zones.

In summary, the exploration history at the Gabbs Project spans half a century. To date, a historical resource of 1.82 million gold equivalent ounces has been recorded. For P2 Gold, this figure is just the beginning. The company is using all modern means to better understand the project and demonstrate its economics. Drill holes to date have confirmed the suggestion that gold-copper mineralization is much thicker and higher grade than previously thought. Gabbs can quickly grow into something big, even more so if the source of the surface mineralization is found at depth.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but explicitly promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH, partners, authors, clients or employees of GOLDINVEST Consulting GmbH hold shares of P2 Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company.

GOLDINVEST Consulting GmbH currently has a remunerated contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages. The above references to existing conflicts of interest apply to all types and forms of publication that GOLDINVEST Consulting GmbH uses for publications on P2 Gold. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.