The pros have long had Group Ten Metals Inc. (TSX.V: PGE; FRA: 5D32) on the radar: The company has attracted the attention of major international mining groups who want a behind-the-scenes look at Group Ten’s polymetallic Ni-Cu-Co PGE project, Stillwater West. Today’s news – an initial summary of last year’s drilling at the project – again underlines why these groups are so interested. The world-class special status of this large-scale project for battery metals in the USA is becoming increasingly clear – and this despite the fact that not even an initial resource has been published yet. Group Ten now wants to deliver this in the middle of 2021, taking into account the drillings that have just been published. By then at the latest, the broad market should also recognise the potential.

What makes Stillwater West so special? Firstly, the size. The project extends for more than 31 kilometres parallel to one of the richest platinum-palladium mines in the world, the Sibanye Stillwater Mine, with resources and past production of around 100 million ounces. All the mineralisation on the Stillwater complex owes its existence to the same geological process: the stratiform deposition of a once huge magma chamber that has gradually cooled at its edges. Depending on the time of their formation, the layers can sometimes be very thin and have extremely high platinum-palladium values, like the Sibanye mine itself, or wider, and more copper and nickel rich, like the so-called lower Stillwater complex, which is identical to the Group Ten project Stillwater West.

To put it in perspective, the entire Sibanye deposit is centred on a mere two-metre-wide but 40-kilometre-long, kilometre-deep high-grade ore deposit called the J-M Reef. At Stillwater West, the deposits of the same magma chamber are much wider and richer in base metals such as copper, nickel or cobalt. The layered nature of the structure is crucial, because it facilitates the determination of resources, but possibly the later mining of the deposits. Due to the high continuity of the mineralisation, Group Ten can explore deposits in a radius of 100 metres with one drill hole. This is an invaluable advantage for the determination of a resource.

Intriguing analogy between Stillwater and Bushfield/Platreef in South Africa

The geological conditions at Stillwater are very similar to those at Bushfield/Platfeef in South Africa, where the world’s most prolific platinum-palladium mines operate. Much of the global supply chain depends on this production. Political pile risk was probably one of the reasons Sibanye bought the Stillwater deposit a few years ago. It was all about diversification.

Group Ten was quick to emphasise the parallels with Bushfield/Platreef. They don’t just exist where there are the high-grade Reef structures. The much more important analogy is that mining methods in the Bushfield have changed in recent decades towards industrial mining and therefore more polymetallic deposits have been developed. The Bushfield is where mining giant Anglo American (NASDAQ: AAL) operates some of its highest-yielding mines ever. The Stillwater complex, according to Group Ten, has basically the same potential as Bushfield/Platreef, but is 20 years behind in development.

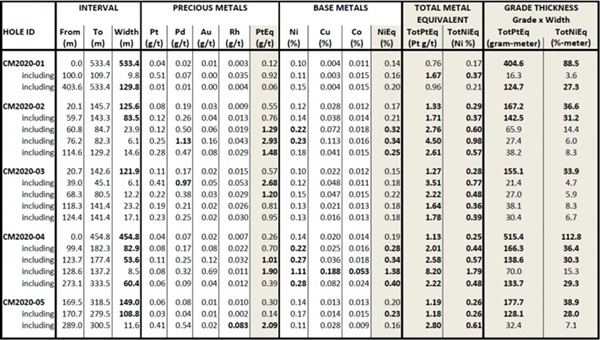

It is against this background that the five drill holes reported by Group Ten today can be categorised. Mineralisation starts close to surface in all five holes and wide intervals from 120 to 530 metres have been intersected with continuous nickel and copper sulphide mineralisation enriched in palladium, platinum, rhodium, gold and cobalt. It is also important to note that – again, each drill hole – also contains higher grade intercepts over a width of 50 to 150 metres. These intercepts mark the sweet spot for future development of a mining project.

As a tidbit, Group Ten also adds the note (for professional readers) that historical laboratory-scale metallurgical results indicate the potential for effective nickel and copper sulphide flotation and PGE metal recovery. After all, the economic evaluation of a discovery is not just about ore grades, but about its actual recoverability.

Figure 1: The bold print and the subdivision of the individual drilling sections are intended to facilitate the reading of the table. The reader can easily recognise the most productive horizons of each well. Drill hole CM 2020-04 illustrates this principle particularly well. The 455 metres of total mineralisation are impressive, but really sexy in the eyes of professional readers might be the 53.6 metres with 0.57 % nickel equivalent – at a depth of just 123 metres! What’s more, this is a new discovery that Group Ten plans to expand in future drilling.

Michael Rowley, President and CEO, expressed his satisfaction with the results: “Our 2020 drilling campaign has exceeded our expectations. It has expanded the defined mineralisation and provides a good basis for resource modelling at the Chrome Mountain target. We have identified several new, well-mineralised horizons with broad intercepts of battery metals, PGEs and gold in previously untested areas. The high-grade nickel sulphide intercepts in hole CM2020-04 are particularly exciting as they deliver very high-grade nickel horizons in a new discovery that is open to expansion.”

It is important to bear in mind when making this statement that Group Ten has drilled just around 1,800 metres in its five 2020 wells. This is almost nothing compared to the comprehensive IP data from 77 line kilometres acquired in 2020. One of the important findings of the drilling campaign is therefore that IP as a method works very well in its own right. Group Ten will be able to rely on this in its future exploration of Stillwater West.

Conclusion:

The results to date already speak to the exceptional size and potential of the lower Stillwater complex, with its ‘platreef-style’ battery metal and PGE mineralisation. In the recent campaign, each drill hole returned a hit with intercepts of hundreds of metres. We probably don’t need to point out here the particular strategic importance of a US-based large battery metal asset like Stillwater West. It may only be a matter of time before Elon Musk’s followers realize this too.

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish commentaries, analyses and news on http://www.goldinvest.de. This content serves exclusively to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly, and is not to be understood as an assurance of any price development. Furthermore, it does not in any way replace individual expert investment advice and does not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offerings, as our information only relates to the company and not to the reader’s investment decision.

The purchase of securities involves high risks which can lead to the complete loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the guarantee of the topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH held shares in Group Ten Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Furthermore, a contractual relationship exists between a third party acting on behalf of Group Ten Metals and GOLDINVEST Consulting GmbH which involves GOLDINVEST Consulting GmbH reporting on Group Ten Metals. This is another clear conflict of interest.