Comparison with "sister company" Goliath Resources very encouraging

The PDAC in Toronto, the world’s largest mining trade fair, attracted over 1,100 exhibitors and almost 27,000 visitors this year, according to official figures. It is an opportunity for companies to make contact with existing and new investors, meet with partners and financiers, and much more. For us at Goldinvest.de, it is a chance to look for new, exciting stories. At the same time, PDAC also gives us the opportunity to meet with company leaders that we could previously only see via video conferencing, which gives new weight to many an equity story!

One of the most interesting conversations (that we did not also record on camera) this year was with Dan Stuart, CEO of gold explorer Juggernaut Resources (WKN A2PTXU / TSXV JUGR). Dan gave us a detailed presentation of the company, which is active in the Canadian province of British Columbia, and also shared his plans for the current year. His conclusion: Juggernaut is like a golfer who has made it onto the green and now “only” has to hole out – and that with two projects at once! (As a North American, however, his analogy came from baseball…)

Bingo Property: Version 2.0 of Goliath Resources’ Surebet Discovery?

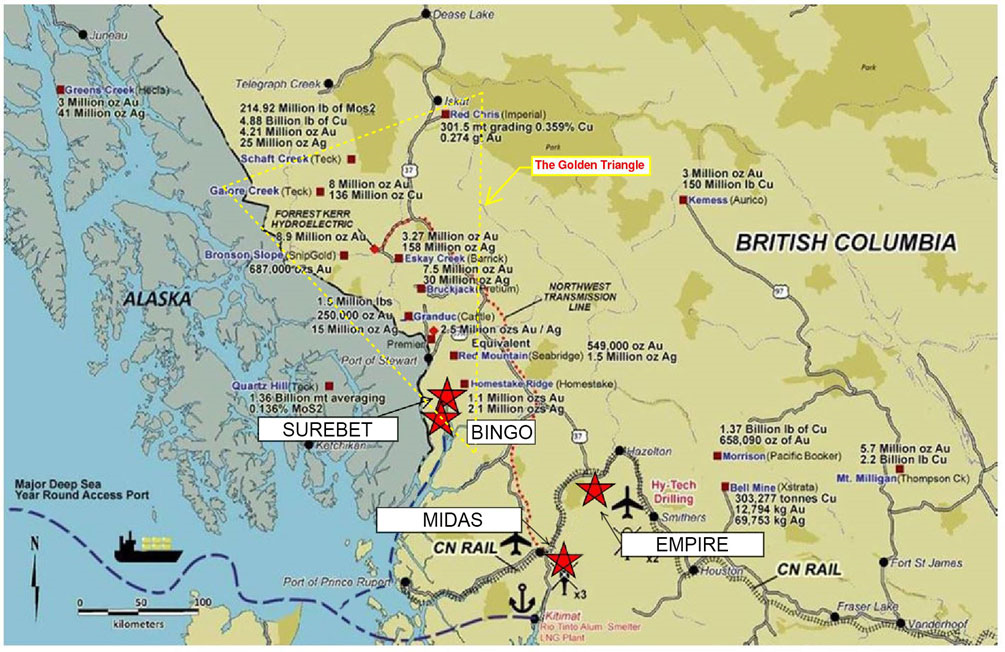

The Bingo property, which is located 45 kilometers south-southwest of Stewart and 28 kilometers west of Kitsault in British Columbia, is particularly promising. Bingo is only 4 kilometers from Anyox mines and smelters that produced during its 25-year existence 140,000 ounces (4 tonnes) of gold, 8,000,000 ounces (230 tonnes) of silver, and 760,000,000 pounds (340,000 tonnes) of copper. Bingo covers 1,008 hectares of the so-called Eskay Rift and Golden Triangle. This is the region where most of BC’s significant mineral deposits have been discovered to date.

Bingo, Dan went on to explain, is located in the southern part of the Eskay Rift, which is a geological control structure for more than 60 VMS deposits. This includes the most resource-rich VMS deposit in the world, the Eskay Creek gold and silver mine. Between 1994 and 2008, 3.3 million ounces of gold and 160 million ounces of silver were mined here at average (!) grades of 45 g/t gold and 2,224 g/t silver! There are several past-producing mines and new deposits in the immediate vicinity of the Juggernaut project. These include Anyox, Dolly Varden, Homestake Ridge, and Goliath Resources‘ (TSXV GOT) Surebet discovery on the Golddigger project.

Watch latest Bingo overview video here:

Significant geological similarities

And this is where it gets particularly interesting, because not only is the Bingo project in the immediate vicinity of Golddigger/Surebet, but Juggernaut has also identified the same geological units and indicated structures there as at the Surebet discovery.

Dan explained why this is so significant by pointing out that Goliath gave its shareholders a profit of no less than 1,700% within just nine months at the start of exploration activities! Those who participated in the financing round at 10 Canadian cents at the time were even able to record a “twenty-five bagger” at the peak!

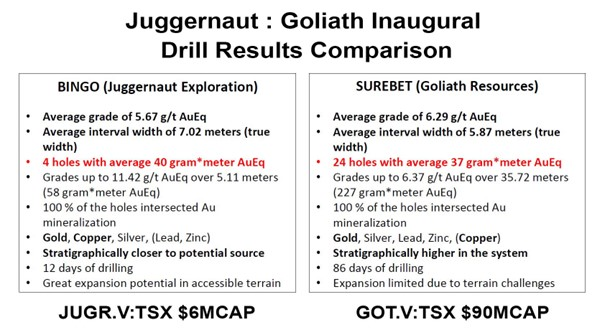

Of course, there is no guarantee that Juggernaut will be able to repeat this feat, but there are promising initial indications when comparing the first drilling program at Bingo and Golddigger, for example. The latter, with four holes at Bingo, returned a strong average grade of 5.67 g/t gold equivalent with an average width of 7.02 meters of mineralization intersections. Goliath’s initial program (24 holes) at Surebet intersected a highly comparable 6.29 g/t gold equivalent over an average width of 5.87 metres of mineralization. (The highest values were 11.42 g/t gold equivalent over 5.11 meters (Bingo) and 6.37 g/t gold equivalent over 35.72 meters). This means an average of 40 grams*meters gold equivalent for Juggernaut and 37 grams*meters gold equivalent for Goliath, which are also close to each other.

Both projects had a 100% hit rate for the discovery of gold mineralization! However, Juggernaut discovered mainly gold and copper as well as some silver and zinc, while at Goliath, it is primarily gold with silver, lead, and zinc. An interesting factor that the Juggernaut CEO pointed out is that the Bingo mineralization is stratigraphically closer to the suspected source of the mineralization than is the case at Goliath’s Surebet discovery. This has, of course, since been considerably enlarged by extensive further drilling. Incidentally, at the time of the first drilling program, Juggernaut was valued at 6 million dollars, while Goliath was valued at around 90 million dollars. Different times…

Plans for this year’s drilling are in place

Bingo and Juggernaut are now set to continue with a new drilling program. The initial plan is to drill 2,500 meters from six drill sites, primarily to expand the known mineralization. In addition, according to Stuart in Toronto, further shear zones will be investigated.

Incidentally, the company works closely with its neighbor Goliath. Due to the close proximity, they share the camp, some of the drilling equipment and even the geologist in charge. As a result, Juggernaut is not only able to keep its costs significantly lower than would otherwise be possible, but is also often more flexible in its work. This is particularly important as work in the area is often dependent on the weather which can change quickly.

Second chance at a home run

The second chance for a hole-in-one (or a home run), according to Juggernaut CEO Dan Stuart, is the Midas property, which spans 20,803 acres and is 100% owned by the company.

Access to the project is via forest roads and Midas is only 14 kilometers from power, rail and major roads. It is a further 10 kilometers to the town of Terrace and major infrastructure and another 45 kilometers to the deep-water port of Kitimat. Incidentally, Rio Tinto, Shell and Mitsubishi, among others, are represented in the area, meaning that infrastructure worth the equivalent of 40 billion dollars is either in place or currently being built.

According to Juggernaut, the Midas property is a world-class geological prospect with high potential for mineralization in the style of the Eskay Creek VMS deposit. As early as 2007, the British Columbia Geological Survey stated: “Regional and local mapping has clarified the stratigraphy of Paleozoic and Jurassic volcanics in the area southeast of Terrace and identified a new unit that is a candidate for VHMS deposits.”

As a reminder, the Eskay Creek mine produced 3.3 million ounces of gold and 160 million ounces of silver between 1994 and 2008 at average grades of 45 g/t gold and 2,224 g/t silver! Interestingly, according to Dan Stuart, 109 holes (!) were originally drilled in the Eskay Creek area before the decisive gold discovery was made.

First Midas drillings point to VHMS system

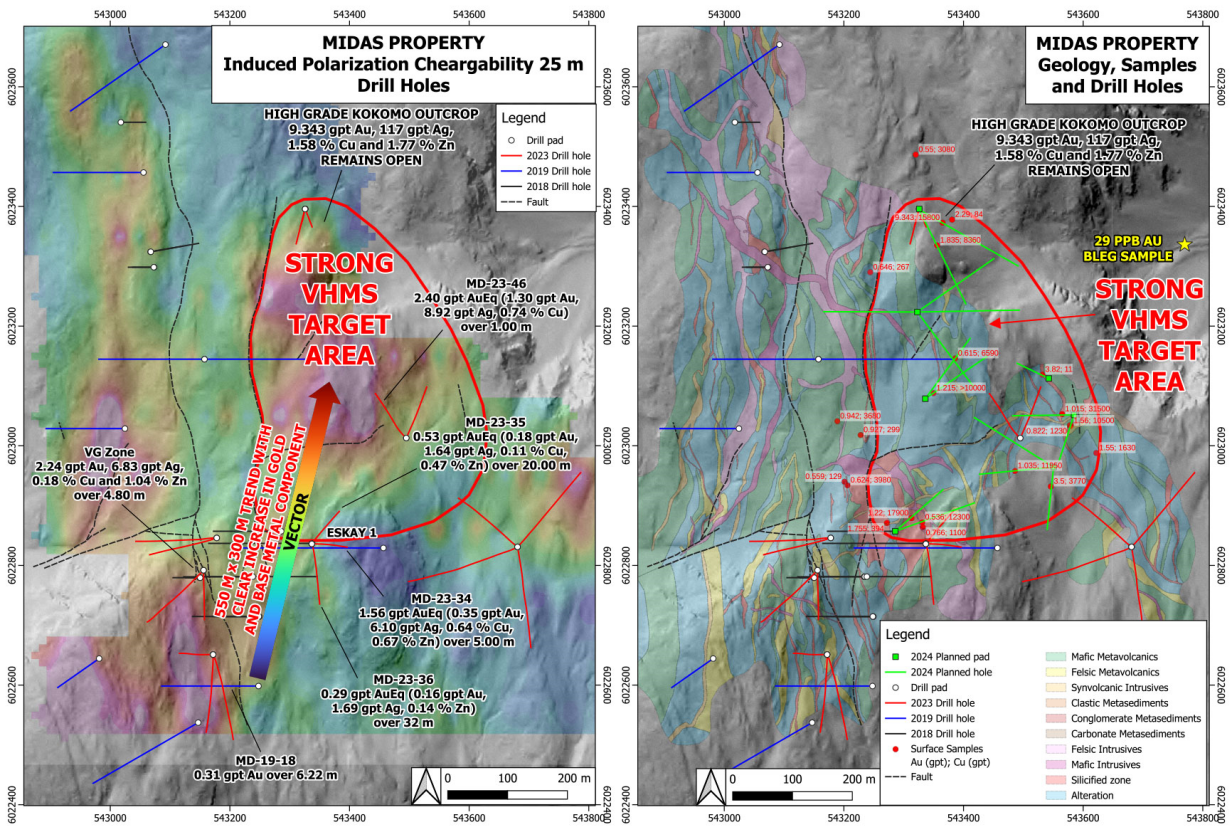

The first Midas drilling, however, which Juggernaut Resources carried out in 2023 and the results of which were only presented at the end of last year, all directly demonstrated gold mineralization. Among other things, the company encountered 1.56 g/t gold over 5 meters width in an area that included both the VG zone and the Kokomo target.

Drill results from 2023, combined with results from previous years, indicate an extensive north-south trending gold, copper and zinc mineralized trend extending 550m from the Eskay 1 pad to the Kokomo outcrop on strike with a large, relatively shallow chargeability anomaly and Induced Polarization (IP) resistivity, according to the Company. The gold and base metal component increases significantly towards the Kokomo occurrence, which may indicate proximity to the core of a Volcanogenic Hosted Massive Sulphide (VHMS) deposit.

This year, Juggernaut intends to drill further to demonstrate the full potential of this 550 x 300 metre trend of high-grade mineralization, focusing on the undrilled Kokomo target, which is believed to lie near the center of the system.

Crescat Capitals Dr. Quinton Hennigh provides a great overview of Midas and Juggernaut in this video:

Conclusion: Juggernaut Exploration has two irons in the fire that have already shown their potential. The Bingo project in particular could take the company to the next level if future drilling is as successful as it was at its analog, Goliath Resources' Surebet discovery. In any case, we are very excited to see what the 2024 exploration and drilling season will bring Juggernaut. Especially as the company currently has a market capitalization of just CAD 5.5 million with only about 76 million shares outstanding. And not to be neglected: The experts at Crescat Capital and their technical advisor Quinton Hennnigh hold 19.70% of Juggernaut shares and are providing their technical expertise!

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice, but rather represent advertising / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH hold shares of Juggernaut Exploration and therefore a conflict of interest exists. Furthermore, we cannot exclude that other stock exchange letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Juggernaut Exploration and GOLDINVEST Consulting GmbH, which means that there is also a conflict of interest.