{australien_flagge}FYI Resources (ASX: FYI; FRA: SDL) and Alcoa (NYSE: AA) have achieved their defined goal in the third test run of the HPA pilot plant in Western Australia: refinements in process control have resulted in consistent and reliable HPA production to the 99.999% (5N) Al2O3 mark. Higher purity levels were achieved as well as an increase in the overall average purity. An originally planned fourth pilot test can be omitted due to the good results. The commercialization phase has now finally begun.

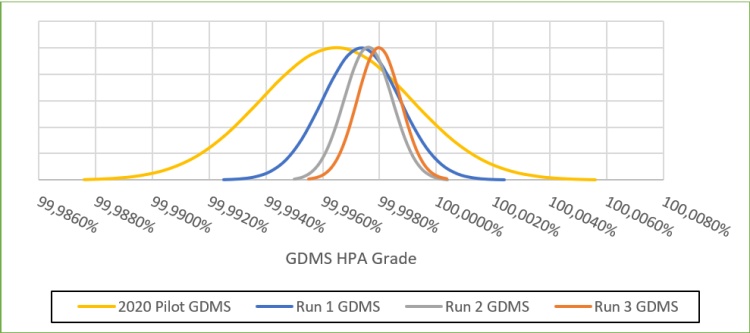

Figure 1: The graph shows the steadily decreasing spread in the total of four test runs since 2020. Optimized process control enabled an ever tighter spread and more uniform purity during the various pilot plant trials.

Commenting on the results of the third test phase, Roland Hill, Managing Director of FYI, said, “Reaching 5N is a milestone. However, it is equally satisfying that the results of the third trial in the pilot plant clearly demonstrate the progress of our development in terms of the higher purity level achieved and the narrower operating range that enables a much more uniform purity level. With the impressive trial result and the successful completion of the pilot plant phase, the joint development team will now pursue its clearly defined HPA marching plan and bring the project one step closer to commercialization.”

Summary: Not long ago, the market would have reacted euphorically to the news that kaolin-based HPA could be reliably produced in (and near) 5N grade. After all, the advantages over conventional HPA production from the raw material bauxite are significant. Kaolin-based HPA is “greener” and much cheaper to produce to boot. In particular, the 5N mark can only be achieved with bauxite-based HPA – if at all – with the greatest effort. But investors’ expectations are governed by their own laws. No sooner has one milestone been reached than they demand the next. Institutional investors in particular now want to see concrete steps toward economic implementation. Their question is no longer “if,” but when and in what quantities production will take place at what cost, and how high the investments will be. It is probably only the answers to these questions that are likely to move the FYI price decisively again.

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but explicitly promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH, partners, authors, principals or employees of GOLDINVEST Consulting GmbH hold shares of FYI Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company.

GOLDINVEST Consulting GmbH currently has a remunerated contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on FYI Resources. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.