{kanada_flagge}First Lithium Minerals Corp. (CSE: FLM; OTC: PGPXF; FSE: X28) is entering the Canadian lithium hardrock exploration race with a strategic starting advantage. The company has just secured a 100% interest in a 1,900-hectare license area (Project LSL) in northwestern Ontario with proven pegmatite drilling results. Pegmatite was intersected in several drill holes in the late 1960s. Old data document several significant intervals of up to 30 m of granitic pegmatite along a srike of approximately seven kilometers (in hole 37627; source: Assessment File 52J09NW8906, Ontario Geological Survey). Lithology and geochemical anomalies also provide strong evidence for Li-Cs-Ta (LCT) pegmatite mineralization. Because geologists were looking for nickel at the time, the drill core has never been analyzed. The historical drill core is no longer available. Therefore, the Company plans to begin geological mapping and rock and soil sampling as soon as possible during the current field season.

{kanada_flagge}First Lithium Minerals Corp. (CSE: FLM; OTC: PGPXF; FSE: X28) is entering the Canadian lithium hardrock exploration race with a strategic starting advantage. The company has just secured a 100% interest in a 1,900-hectare license area (Project LSL) in northwestern Ontario with proven pegmatite drilling results. Pegmatite was intersected in several drill holes in the late 1960s. Old data document several significant intervals of up to 30 m of granitic pegmatite along a srike of approximately seven kilometers (in hole 37627; source: Assessment File 52J09NW8906, Ontario Geological Survey). Lithology and geochemical anomalies also provide strong evidence for Li-Cs-Ta (LCT) pegmatite mineralization. Because geologists were looking for nickel at the time, the drill core has never been analyzed. The historical drill core is no longer available. Therefore, the Company plans to begin geological mapping and rock and soil sampling as soon as possible during the current field season.

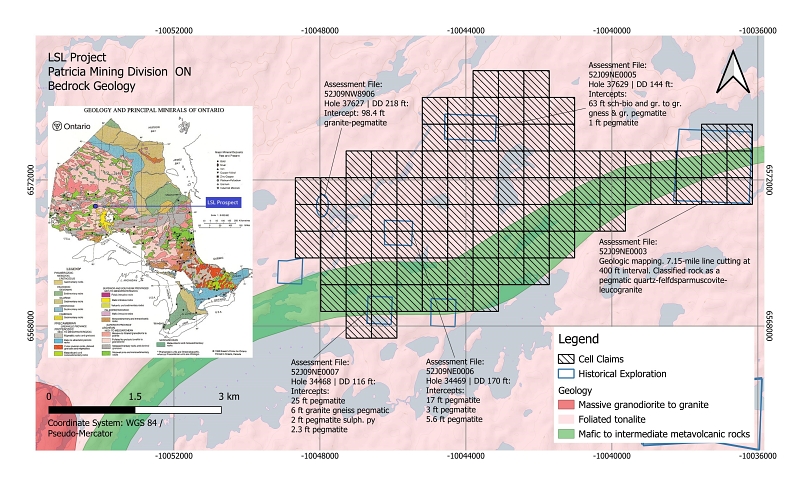

Figure 1: The LSL project has an exemplary signature for a potential lithium deposit. Lithology and geochemical anomalies provide strong evidence for Li-Cs-Ta (LCT) pegmatite mineralization.

The LSL Project is located approximately 160 km northeast of Sioux Lookout, Ontario, near Little Savant Lake and is accessible by provincial road and logging road. The LSL project consists of 93 contiguous mining claims.

The LSL Project was acquired from a private company, Hudson Humic Ltd. and by direct staking. As consideration for the acquisition of 49 mining claims of the LSL Project, the Company will issue 4,300,000 common shares to Hudson and make a payment of CAD50,000. The common shares are subject to a statutory hold period of four months.

Historical exploration activities in the project area included geological mapping, airborne gamma ray spectrometry, line cutting and core drilling. Historic drilling (1967-1968) by the International Nickel Co. Of Canada identified several pegmatite occurrences, including several significant intercepts, including 98.4 feet of granite pegmatite in hole 37627 (Source: Assessment File 52J09NW8906, Ontario Geological Survey). Magnetic data combined with lithology from historical drilling indicate the potential extent of near-surface mineralization. The area also has anomalous geochemical clusters of lithium (Li) and the relevant pathfinder elements cesium (Cs) and tantalum (Ta) present in sediments (source: Lake Geochemistry of Ontario , Ontario Geological Survey).

Rob Saltsman, CEO and Director of First Lithium Minerals, commented, “We are very pleased to add a new lithium exploration project in northwestern Ontario to our exploration portfolio. The LSL project has several areas of interest and historical work suggests that a significant opportunity has been overlooked within the project. While our focus remains on advancing our cornerstone OCA brine project and commencing our first drill program in Chile this fall, the opportunity to add a highly prospective pegmatite exploration project in northwestern Ontario, a location where recent exploration success has been achieved, was very compelling to us. Our team looks forward to testing its potential for lithium and rare earth metals.”

Summary: First Lithium went public only last year and to date has operated exclusively in Chile, where it holds a highly prospective geological license portfolio of 9,000 hectares of potential lithium brine projects. Chile is not currently high on investors’ radar for self-inflicted reasons. Therefore, it was obvious for First Lithium to also get into the Canadian lithium hard rock project business. The now reported acquisition is anything but a stopgap solution. Thanks to the historical drilling data, First Lithium is suddenly even far ahead of many of its competitors who are just starting ground exploration. Geologically, the project meets every conceivable characteristic one could want for a potentially large lithium project. As of today, First Lithium, whose share price has taken a beating since its IPO, deserves a re-rating. The LSL project could be right up the alley of large (Australian) investors who are currently scouring the Canadian market for opportunities.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of First Lithium and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss First Lithium during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a service contract between First Lithium and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists, especially since First Lithium remunerates GOLDINVEST Consulting GmbH for its reporting.