Granite Creek Copper (TSX.V: GCX; FRA: GRK) is expanding the potential of its Carmacks copper-gold-silver project in this year’s drill program with renewed high-grade copper discoveries below the previously defined resource.

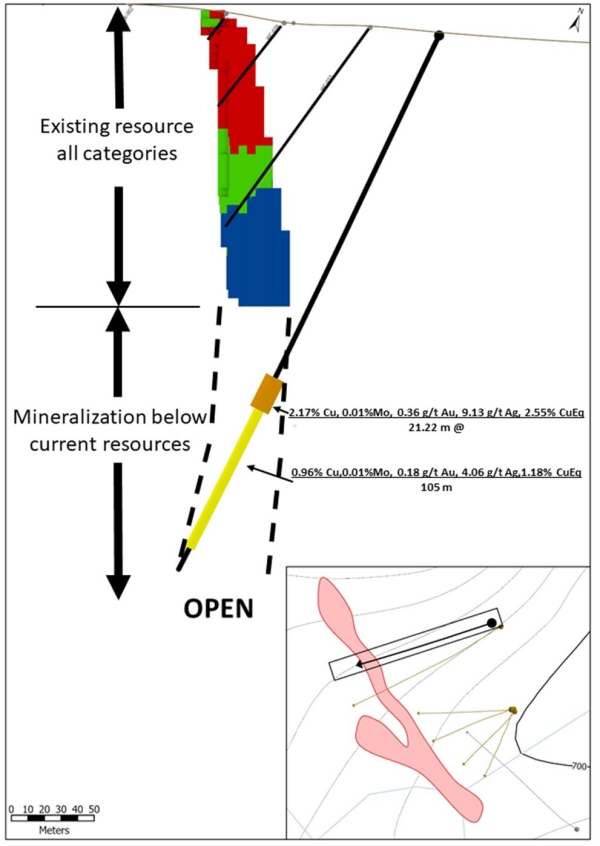

Diamond drill hole CRM21-011, still from the first of three drill campaigns at Carmacks this year, intersected copper sulfide mineralization grading 1.18% CuEq (0.96% Cu, 0.01% Mo, 0.18 g/t Au and 4.06 g/t Ag) over an interval of 105.52 meters. The long intercept contained a high-grade interval of 2.55% CuEq (2.17% Cu, 0.01% Mo, 0.36 g/t Au and 9.13 g/t Ag) over 21.22 metres. In addition, grades within the 105-meter interval reached an impressive 19.72 CuEq (18.97% Cu, 0.46 g/t Au and 38.3 g/t Ag) in 0.5 meters of semi-massive chalcopyrite (see Figure 1).

Hole CRM21-011, along with four other holes in the 2021 Phase 1 program (see news release dated July 22, 2021), has extended the known mineralization in Zone 2000S from 30 metres to 100 metres below the current block model. The Company believes these results will add significant additional tonnage to an updated NI 43-101 mineral resource estimate currently being prepared.

President & CEO Tim Johnson stated, “The extent of high-grade mineralization in this drill hole, combined with the clear potential for further zone expansion, demonstrates that despite the historical drilling to date of over 50,000 meters, there remains tremendous exploration potential at the Carmacks Project. All core samples from the remaining nine holes of the Phase 1 diamond drilling program are currently in the laboratory for assaying. The Company looks forward to releasing these results in the coming weeks, as well as results from the currently ongoing Phase 2 reverse circulation program and the upcoming Phase 3 diamond drill program as they become available.”

Average resource grades and tonnage could increase significantly

The 2000S Zone, originally discovered in 2006 following an IP geophysical survey, has the potential to increase resource tonnage in the sulfide sector. The mineral resource to date in this zone is based on a cut-off grade of 0.25% for the sulphide resource and 0.15% for the acid soluble Cu grades in the oxide resource. Using the same copper equivalent calculation used by the Company to report CuEq in this news release, the sulphide resources in the 2000S Zone would be 0.85% CuEq in the Measured and Indicated category and 0.89% in the Inferred category. Since a significant portion of the 2021 drill intercepts have a higher grade than the current resource, an updated resource estimate has the potential to not only increase tonnage in this zone, but also increase grade. Six diamond drill holes were drilled in this zone during the first phase of drilling to evaluate the continuation of bornite-chalcopyrite mineralization down dip. Results from five of the six holes have already been released (news release July 22, 2021), with all five holes intersecting mineralization below the current resource model.

Figure 1: Now that’s what you really call high-grade: CRM 21-011 yields copper grades of 18.97% Cu between 260.32m to 260.82m

Figure 2: Cross section of CRM21-011

Granite Creek Copper will participate in the Yukon Exploration Investment Summit 2021 on Tuesday, August 31 at 10am PT. This will be a live panel session with Q&A hosted by Invest Yukon and moderated by Trevor Hall. Click here to register.

Disclaimer GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Granite Creek Copper and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Granite Creek Copper and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Granite Creek Copper. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Granite Creek Copper. This is another clear conflict of interest.