{kanada_flagge} 10,000 meters of drilling is underway! Granite Creek Copper (TSX.V: GCX; FRA: GRK) has mobilized two drill rigs which will be turning simultaneously at its Carmacks copper-gold-silver project in central Yukon, Canada. This is a very early start to the drill season which means assay results are expected to be released throughout the summer. Given this program will wrap up in mid-June or so, the geological team is already considering the possibility for a second drill program later in the season if market conditions are favourable.

Oxide and Sulfide drill core from Carmacks; photo by Granite Creek Copper.

The sulfide in Zone 1, which starts just 200 meters from surface, has the potential to add additional tonnage to the contained resources and could become part of an updated economic study. Results from the 2020 and 2021 drill programs are expected to be incorporated into an updated NI43-101 mineral resource estimate for the project.

The Carmacks project is part of the high-grade Minto Copper Belt, which hosts the operating Minto mine to the south and is considered a prime Canadian mining region for its exceptional mineral tenor and excellent infrastructure.

Granite Creek sees the potential for a deposit of “several billion pounds of copper” (Tim Johnson, CEO) at Carmacks. The primary purpose of the drilling is to upgrade / expand the existing 43-101 resource estimate by converting material currently classed as “inferred” to the “measured & indicated” category as well as to conduct so-called step-out drilling aimed at delineating new resources.

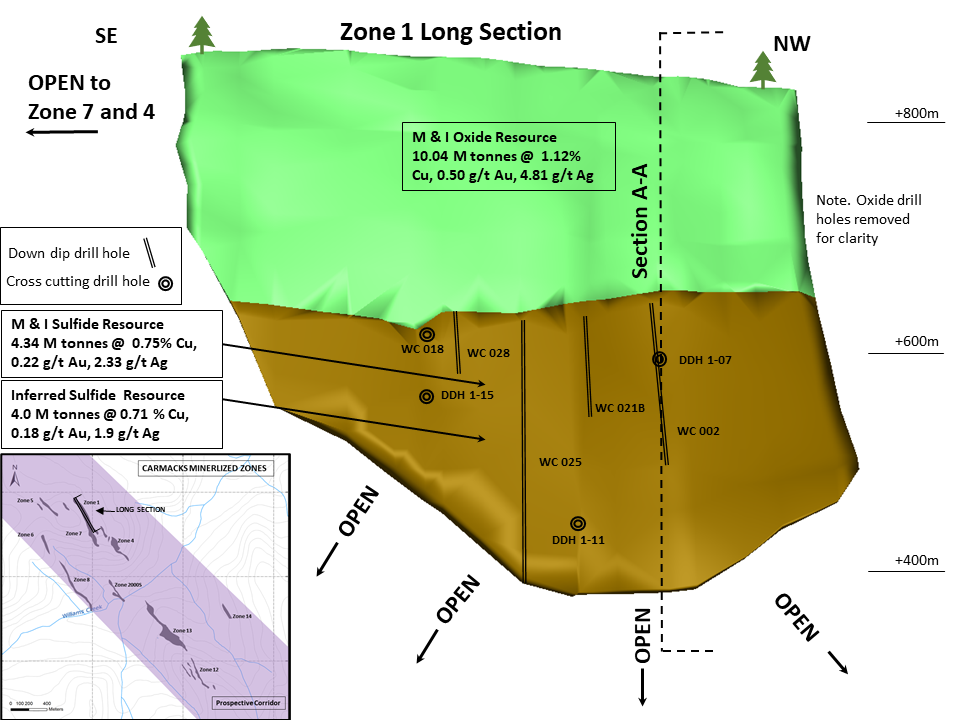

Granite Creek’s 2021 drilling program follows on from last year’s successful drilling. The best drilling at that time returned 127 meters at 0.85% copper equivalent (“CuEq”) in Carmacks Zone 13 and 4.6 meters at 7.51% CuEq in Carmacks North Zone A. This year’s drilling will focus specifically on the deeper sulfide potential in Carmacks Zone 1 (see figures below) as well as continuing last year’s success in Carmacks North Zone A.

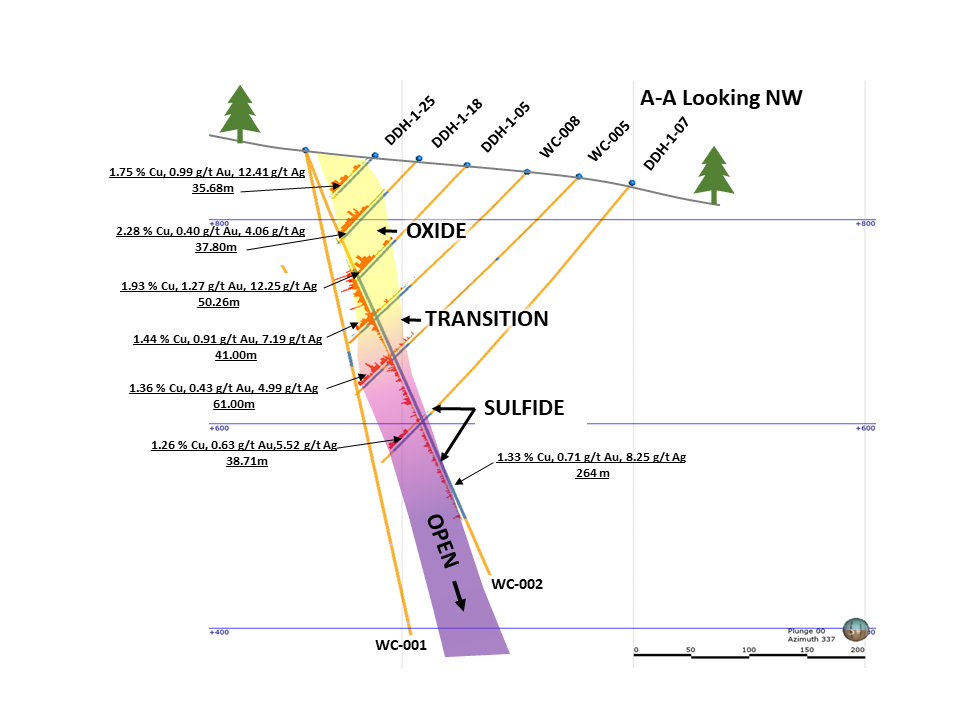

The Carmacks Zone 1 hosts a portion of the total 23.76 million tonnes of the current mineral resource estimate and remains open at depth and along strike. While the oxide portion of Zone 1 has been well defined and is categorized as “Measured and Indicated”, only about half of the underlying sulfide resource is in the “Measured and Indicated” category, with the remainder categorized as “Inferred”. The sulfide in Zone 1, which starts just 200 meters from surface, has the potential to add additional tonnage to the contained resources and could become part of an updated economic study. Results from the 2020 and 2021 drill programs are expected to be incorporated into an updated NI43-101 mineral resource estimate for the project.

Figure 1 – Longitudinal section of historical drill intercepts in the sulphide portion of Carmacks Zone 1.

Figure 2 – Cross section A-A through the northern portion of Carmacks Zone 1.

Tim Johnson, President & CEO of Granite Creek, said, “We are rapidly advancing the Carmacks project with its high-grade, near-surface copper, gold and silver mineralization.”

Johnson said he sees great opportunities to optimize the resource at the project and expand the known high-grade copper mineralized zones – which are open along strike and at depth. In addition, he said, there is a very good chance of success for new discoveries on a number of key untested targets.

Literally, Johnson said, “We see potential for a multi-billion pound copper system.” Currently, the Carmacks deposit contains 446 million pounds of Cu, 237,000 ounces of Au and 2.4 million ounces of Ag in NI 43-101 measured and indicated resources.

{letter}

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Granite Creek Copper and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Granite Creek Copper and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Granite Creek Copper. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Granite Creek Copper. This is another clear conflict of interest.