{kanada_flagge}Goldshore Resources Inc (TSXV: GSHR; OTC Markets: GSHRF; FWB: 8X00), led by Research Capital Corporation and Eventus Capital Corp, as co-lead agents and joint bookrunners, is launching a further private placement of up to CAD 5 million. The offering comprises conventional common shares at CAD0.17 with one full warrant at CAD0.25 and tax-advantaged flow-through shares at CAD0.195 with one-half warrant, also at CAD0.25. The term of the warrants is 24 months from closing.

{kanada_flagge}Goldshore Resources Inc (TSXV: GSHR; OTC Markets: GSHRF; FWB: 8X00), led by Research Capital Corporation and Eventus Capital Corp, as co-lead agents and joint bookrunners, is launching a further private placement of up to CAD 5 million. The offering comprises conventional common shares at CAD0.17 with one full warrant at CAD0.25 and tax-advantaged flow-through shares at CAD0.195 with one-half warrant, also at CAD0.25. The term of the warrants is 24 months from closing.

Goldshore will pay intermediaries a cash commission equal to 6% of the gross proceeds of the offering. In addition, the Agents will receive performance-based warrants to purchase common shares equal to 6% of the securities sold in the Offering, at a price of CAD0.17 and CAD0.195, respectively.

The Company intends to use the proceeds from the Offering as working capital and for future exploration work at its Moss Lake gold deposit in northwestern Ontario, Canada. The gross proceeds from the issuance of the FT Units will be used for “Canadian exploration expenditures” as defined in the Tax Act. The offering is expected to close on or about April 12, 2023

Goldshore owns the Ontario-based Moss Lake gold project with a resource of 4.2 million ounces of gold at last count, including a higher-grade shear zone with 2.2 million ounces at 2.0 g/t gold. Goldshore is deploying multiple drills in parallel on its 100,000 metre drill program and has already completed over 100 holes since August 2021 alone. The company is targeting the current drilling to confirm historical results while transitioning a larger portion of the resource from the inferred category to the higher indicated category. The company has already announced a new resource estimate for April this year. Goldshore then intends to use this as the basis for an initial Preliminary Economic Assessment (PEA) on Moss Lake. The subsequent feasibility study is planned for next year.

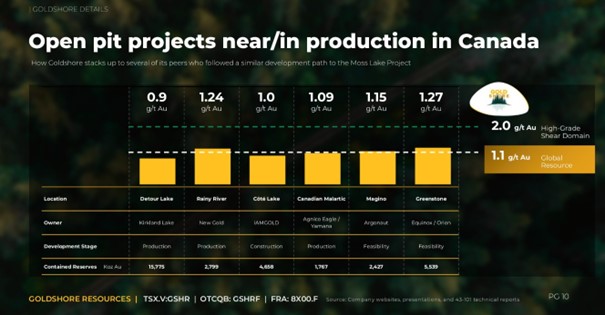

Figure 1: Goldshore’s Moss Lake project compared to the peer group.

Summary: Goldshore is a full-throttle company, led by a thoroughbred exploration team that has repeatedly demonstrated its ability. The scale (100,000m planned) and pace of exploration is not inconsequentially reminiscent of a gold producer’s approach – the difference being that Goldshore is paying for its high level of activity entirely with equity. So far, the market has not rewarded Goldshore’s efforts, even though the project is already one of the top six new open-pit gold projects in Canada at 4.2 million ounces and an updated resource estimate is due shortly. The five other projects in the peer group include Kirkland Lake (Detour Lake), New Gold (Rainy River), IAMGOLD (Côté Lake), Agnico Eagle/Yamana (Canadian Malartic), Argonaut (Magino) as well as, Equinox/Orion (Greenstone). Just recently, analysts at Laurentian Bank Securities assigned Goldshore Resources a “speculative buy” rating and a $2.00 price target. Wesdome Gold Mines Ltd. is currently a large shareholder in Goldshore with an approximate 22% equity position in the company. The upcoming new resource estimate along with the PEA should finally bring the project’s outstanding quality to the attention of a broader group of investors.

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as a promise of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for actuality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and according to Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Goldshore Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Goldshore Resources and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.