{australien_flagge}FYI Resources (ASX: FYI; FRA: SDL) is looking to transfer the technological expertise it has gained in developing high purity alumina (HPA) to the rare earths sector in the future. The aim is to work with established industry partners such as Arafura Rare Earths Limited (ASX: ARU) to use refined processes and advanced technology to bring back to Australia a piece of value creation in the mineral sands industry that has been lost to low-cost Chinese competition in the rare earths sector since the 1980s. The high-grade rare earth minerals monazite and xenotime from Australian mineral sands deposits were an important value component of mineral sands deposits until 20 years ago and made a significant contribution as feedstock to the global rare earths market at the time. The strategy to re-use mineral sands as a source of rare earths aligns with the federal government’s Critical Minerals Policy, opening up corresponding funding opportunities.

To rapidly enter the midstream processing of mineral sands concentrates, FYI plans to acquire privately held Minhub Operations Pty Ltd. in stages. Minhub was established specifically to develop, build and operate a mineral processing plant in Australia to facilitate the development of rare earth-rich mineral sands deposits, for which there are currently significant barriers to entry.

For its part, Minhub has already entered into a non-binding collaboration agreement with Arafura Rare Earths Limited (ASX: ARU) (Arafura) under which Arafura can earn up to 50% of the Minhub project if it co-funds a feasibility study on a pro-rata basis. In addition, Minhub is working with potential suppliers of rare earth-rich mineral sands concentrates from Gippsland and the Murray Basin. Arafura has secured the right of first refusal for the neodymium (Nd)- and praseodymium (Pr)-rich monazite and the heavy rare earth-rich xenotime concentrate from the Minhub project. Arafura and Minhub also intend to jointly explore additional downstream development options for separated heavy rare earths, including dysprosium (Dy) and terbium (Tb). The Darwin Haven, Northern Territory, could become a center for rare earths and mineral sands processing in the future. A feasibility study for the Minhub project is expected to be developed by early 2024.

Gavin Lockyer, Managing Director of Arafura Rare Earths Limited, said, “Arafura is pleased to explore the opportunities associated with the Minhub Project as a potential pathway to expand downstream processing at the Nolans Project, further strengthening the Northern Territory’s position in the global clean energy revolution.”

FYI Managing Director Roland Hill commented, “Our commitment is to make an important contribution to Australia’s critical minerals sector. While we continue to advance our high purity alumina (HPA) project, the proposed acquisition of Minhub provides a great opportunity to be part of a unique integrated rare earths production strategy with Arafura that complements our production intentions and supports Australia’s government supply targets for critical minerals.”

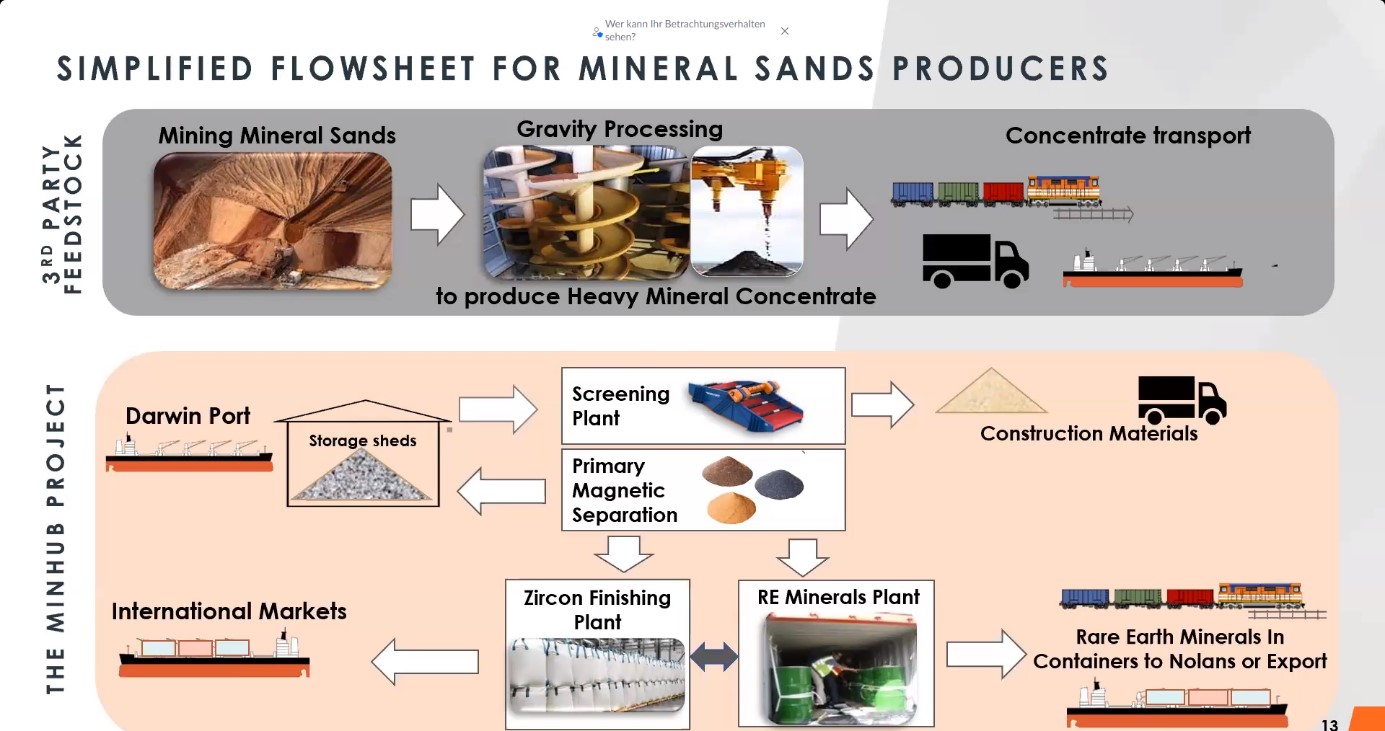

Figure 1: Minhub in Darwin would undertake conventional beneficiation of the mineral sands into zircon, rutile and illmenite on the one hand, but would additionally extract the contained rare earths in a separate value-added step and then send the concentrate to Arafura or for export.

Government support likely

The Minhub project can likely count on government support. The development of the Minhub project is being promoted by the Northern Territory Major Projects Commissioner’s office. Arafura has already received a A$30 million federal grant under the Modern Manufacturing Initiative Collaboration Stream in March 2022. Minhub is well advanced in the planning of the project and has well-developed relationships with stakeholders, particularly potential suppliers of concentrates. FYI expects to move quickly into the development and construction phases by acquiring Minhub with project partner Arafura.

The complex transaction is expected to ultimately bring together public and private partners and is therefore subject to several conditions precedent, including an agreement with Arafura regarding collaboration and co-financing of 50% of the feasibility study expenses. Furthermore, the business plan requires a firm off-take option for heavy mineral concentrates with key suppliers as well as an access agreement with the Port of Darwin and a binding lease agreement for a proposed site and, last but not least, a management agreement with the vendor Neil O’Loughlin .

FYI has paid A$200,000 for the exclusivity of three months of due diligence for the acquisition of Minhub and may subsequently acquire 50 percent of Minhub in exchange for the issuance of 4 million shares as a first step. The remaining 50 percent of Minhub would later cost FYI A$15 million in shares or A$2.5 million, at the seller’s option. FYI agrees to contribute a minimum amount of $450,000 (in addition to the exclusivity fee) to fund the feasibility study for the processing plant (feasibility study).

Summary: The world needs reliable sources for rare earth production. Many markets are looking for suppliers outside of China, which currently dominates global rare earth supply chains. The Australian mineral sands industry could make an important contribution to greater supply chain independence for critical rare earths by closely integrating all stakeholders. Australian mineral sand deposits are known to often contain small amounts of monazite and xenotime (high-grade rare earths), in addition to other valuable minerals (including zircon, rutile, and ilmenite). Minhub at the Darwin port center would handle both conventional processing, but in addition, would connect rare earth extraction and send the recovered concentrate to Arafura or for export. Under completely different circumstances, such an integrated solution would take the industry back to where it was decades ago – before Chinese dominance. Having recognized this opportunity and brought the critical players to the table is no small feat for FYI. We will follow further developments closely.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of FYI Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time which may affect the share price. Furthermore, GOLDINVEST Consulting GmbH is remunerated by FYI Resources for reporting on the company. This is another clear conflict of interest.