New Significant Mineralization Already Discovered

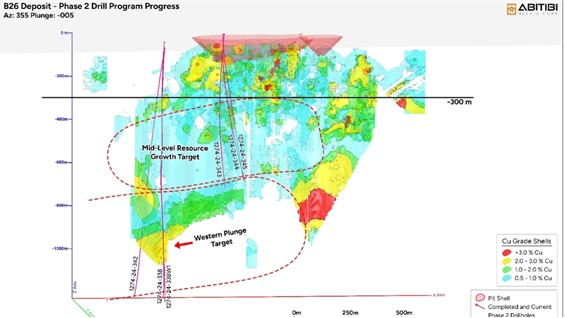

Abitibi Metals (WKN A3EWQ3 / CSE AMQ) is increasing the pace of exploration at its high-grade polymetallic B26 deposit in Quebec and is now deploying a second drill rig on the project. By the end of the year, Abitibi aims to complete 16,500 meters of drilling to move closer to its vision of a 30 to 50 million ton resource. Important step-out drilling is on the agenda: The first drill rig is currently drilling a step-out hole (1274-24-342) up to 400 meters deep to test the western plunge, which would expand the known mineralization, including 5.08% Cu-Eq over 7.1 meters in 1274-16-236.

Furthermore, the first drills of the ongoing drilling phase have already discovered new significant mineralization. The initial drilling from Phase II has yielded strong chalcopyrite stringer mineralization over 81 meters, indicating considerable potential for resource expansion.

Jonathon Deluce, CEO and President of Abitibi Metals, commented: “The additional drill rig underscores our commitment to accelerate the exploration process and build credibility for our target size of 30 to 50 million tons at B26. After successfully expanding near-surface mineralization in Phase 1, this second drilling allows us to test further priority targets in the Mid-Level and Western Plunge targets. Currently, the first drill rig is drilling 1274-24-342, a crucial step-out hole up to 400 meters long to test the western plunge direction. The first hole of Phase II (338) is the deepest intersection in the project’s history. In anticipation of positive assay results, we look forward to cost-effectively further expanding the mineralized zones through additional directional drilling on multiple levels covering the western plunge target.”

Deluce dispelled concerns, “While some shareholders may have concerns about the current drilling depth, it’s important to emphasize that this depth is still considered shallow given the size and scope of our target for a potential underground mine. Comparing the alteration signature with other significant deposits in the Abitibi region, B26’s potential suggests a much deeper system, making this drilling phase essential for a comprehensive understanding of the deposit’s potential.”

Figure 1 – Overview of the drilling targets for the current Phase 2. This phase has two priority targets – the Mid-Level Resource Growth Target and the Western Plunge Target – where drilling has been limited so far. Developing these targets will be a focus.

Conclusion: Abitibi Metals is fully funded for the 80% earn-in into the polymetallic B26 deposit in Quebec and can therefore accelerate drilling. Other explorers can only dream of this. The seven-year deadline originally granted by the semi-state partner SOQUEM for the acquisition of the project shares is expected to be shortened to two years. Already next year, Abitibi aims to complete the minimum expenditure of 14.5 million CAD required for the earn-in and subsequently present a preliminary economic assessment. The new drilling will improve the quality of the resource and multiply the tonnage compared to historical data. The rising copper price provides additional tailwind. A copper price of 5,000 USD per ton was used for the historical resource. Currently, copper is trading beyond 10,000 USD. The market is rewarding Abitibi’s determination and is likely to gradually price in the chance of a significantly larger deposit with further good drilling results. As a possible proxy in the market, one should keep an eye on Foran Mining Corporation (TSX: FOM), which also operates in Quebec and is expected to go into production in 2026. Other major mining companies like Agnico Eagle are already involved there, and the company’s market value is 1.6 billion CAD. Abitibi currently has a market value of 42 million CAD.