Partly high-grade gold occurrences on Silver Lime were already known from the past

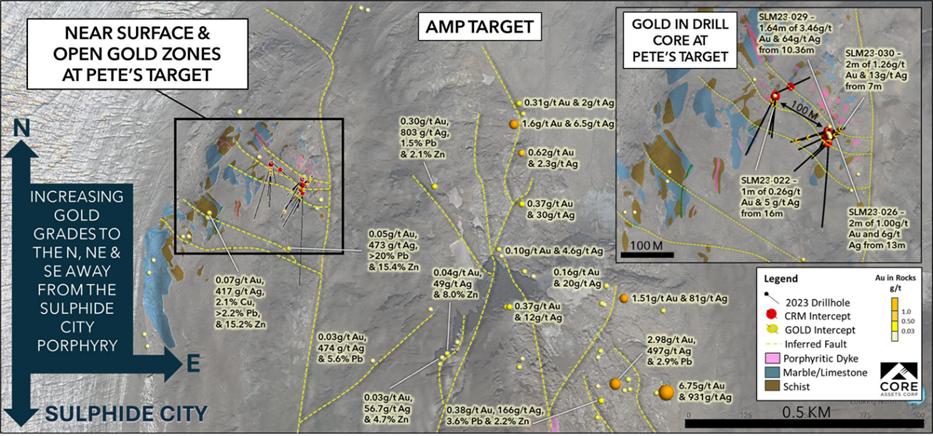

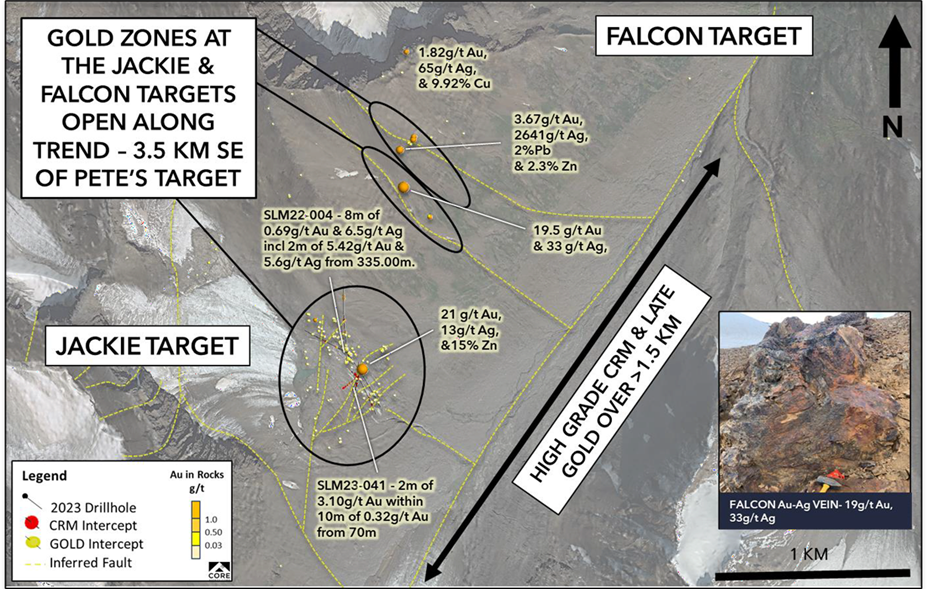

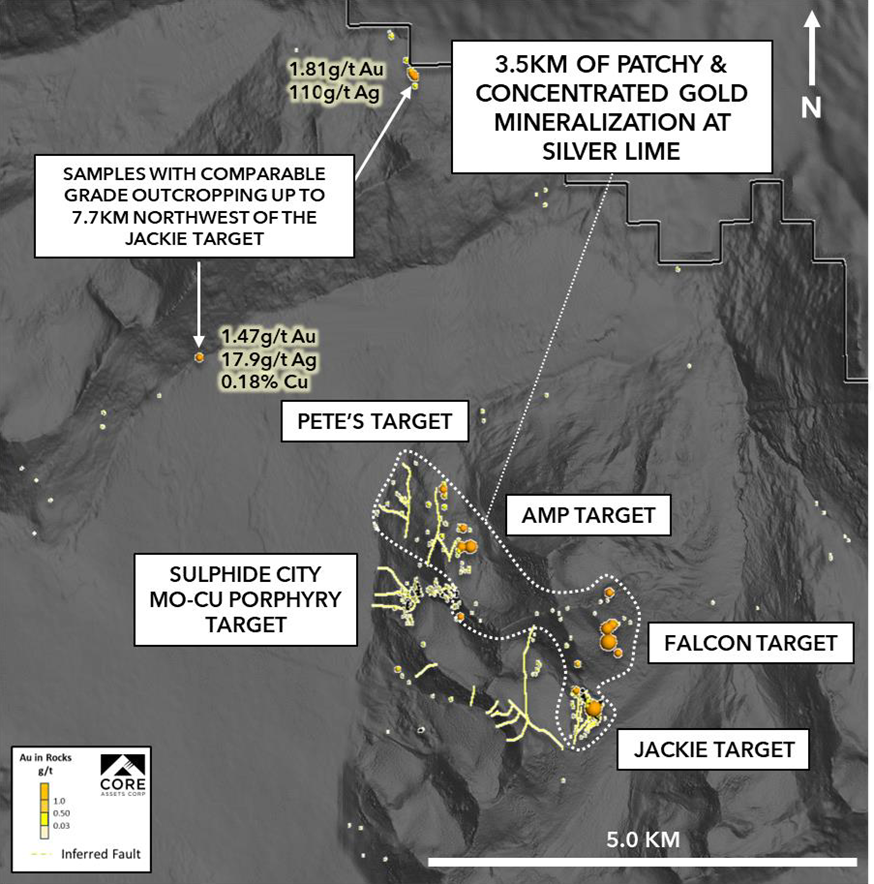

Core Assets Corp. (CSE:CC; FSE:5RJ; OTC. ) has now systematically demonstrated widespread gold mineralization on the central Blue property of its CRD-porphyry project Silver Lime in the Atlin Mining District in northwest British Columbia. The gold mineralization at Silver Lime appears to be in late volatile calcite veins originating from steeply dipping faults affecting schist, marble, local porphyritic dikes, and massive sulfide zones. Geologists suspect that the gold-bearing fluids used the same structural pathways as the earlier massive sulfide-bearing ore fluids in a temporally subordinate manner. Thus, these newly discovered steep channels would be excellent drilling targets for both high-grade massive sulfides and late gold mineralization. Gold could further increase the value of the high-grade skarn and carbonate replacement targets.

The explored extent of the CRD-porphyry project Silver Lime currently measures 10 km by 9.5 km and shows an average grade of 83 g/t Ag, 0.22% Cu, 1.8% Pb, 3.4% Zn, and 0.16 g/t Au (700 samples) at the surface. High-grade carbonate replacement mineralization has been observed in folded marble bedrock with thicknesses of up to 250 meters. In 2022, Ag-Zn-Pb-Cu-bearing mineralization was intersected near the bottom of Sulphide City hole SLM22-006 at a depth of 453 meters.

Nick Rodway, President CEO of Core Assets, commented: “We are thrilled to have intersected gold-bearing zones on the Silver Lime Porphyry-CRD project. We continue to uncover evidence of a district-wide example of the entire mineralization spectrum from the Mo+Cu porphyry hub at Sulphide City through Zn-Pb-Ag-Cu massive sulfide to distal/late gold. In 2023, several shallow-dipping drill holes intersected these steep gold-bearing conduits. These gold zones remain open for exploration, and we look forward to providing further updates as we prepare for our fully funded 2024 exploration program.”

Partly high-grade gold occurrences on Silver Lime were already known from the past. However, the recent systematic evaluation of more than 40 drill holes in conjunction with surface samples now provides the explanation for these structurally bound occurrences and simultaneously an approach for future targeted drilling. The two best gold-bearing surface samples taken to date were discovered at the Falcon and Jackie targets. The historical sample 89868 (Carmac, 1990) at Jackie assayed 21 g/t Au, 12 g/t Ag, and 15% Zn (+As-Cu-Sb), while sample D935063, taken by Core Assets in 2022 at Falcon, yielded 19.5 g/t Au and 33 g/t Ag from coarse quartz-carbonate veins up to 2 m wide (Figure 2).

Conclusion: The geological structures on Core Assets’ Silver Lime Project can essentially be imagined as the pattern that emerges in valuable Japanese Kintsugi ceramics, where broken pieces are reassembled with gold. Geologists suspect that the gold-bearing fluids used the same structural pathways over time that had previously concentrated the massive sulfide-rich ore fluids. This explains the ‘spoke structures’ that Core Assets now finds on its targets, providing first-class clues for future drilling. The company has so far identified seven highly promising target areas covering the entire mineralization spectrum from porphyry Mo-Cu to Fe-Zn-Cu-Ag massive sulfide skarn (Sulphide City) to Ag-Pb-Zn-Cu-Au carbonate replacement mineralization (Gally, Pete’s, Grizzly, Jackie). The subsequently added gold is likely to further increase the value of the high-grade mineralization. With this knowledge, preparations for the upcoming drilling are underway. So far, Core Assets has only completed 5,565 meters of diamond drilling in an initial drilling program in 2022 on the project. Core Assets is thus only at the beginning of its discoveries on Silver Lime.