Only 5 Percent of the Project Area Has Been Explored

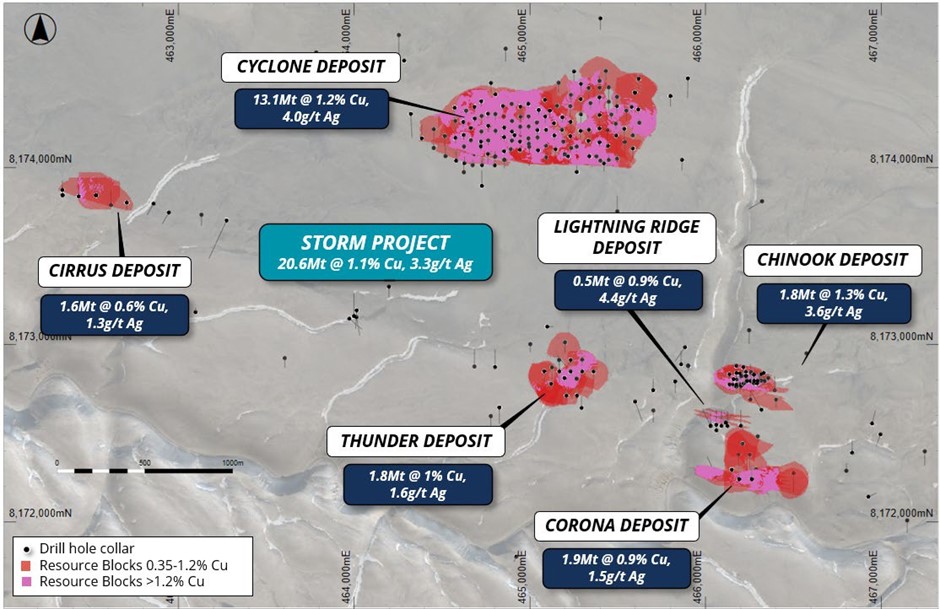

American West Metals (ASX: AW1; FRA: R84) has increased its copper resource on the Storm project on Somerset Island, Nunavut, in the past 2024 drilling season to 20.6 Mt @ 1.1% Cu and 3.3g/t Ag (229Kt copper and 2.2Moz silver) while significantly improving the reliability of the Mineral Resource Estimate (MRE). The Storm MRE includes data from 185 Reverse-Circulation (RC) and 95 diamond drill holes, 49% of which were completed during the 2024 field season. The geologists’ main focus was on upgrading the resource category from inferred to indicated resources.

More than 61% of the contained metal is classified in the ‘Indicated Resources’ category: 10.6 Mt @ 1.3% Cu, 4.1g/t Ag (138Kt copper and 1.4Moz silver). Previously, only about 28% (4.8 MT) of the global resource @ 1.26% Cu was registered in the indicated category. 100% of the MRE is less than 200 m below the surface, highlighting the great potential for open-pit mining. 100% of the MRE is classified as fresh, chalcocite-dominant copper sulfide, with detailed studies confirming suitability for simple processing, including ore sorting. The expansion of the indicated resource is strategically significant for validating future economic calculations, as well as for permitting processes. Investors had apparently hoped primarily for a larger quantitative expansion of the resource. As a result, the stock closed at a year-low of 0.048 AUD with a trading volume of around 500,000 AUD. American West plans a webinar on December 17, 2024, to explain the announcement. Time: 8:30 AM AWST (Perth), 11:30 AM AEDT (Sydney/Melbourne) Registration: https://bit.ly/3VwpV4W The company invites investors to submit questions via the registration page or by email to investors@investability.com.au.

Dave O’Neill, Managing Director of American West Metals, commented: “The updated JORC-compliant MRE for the Storm Project has delivered what we consider to be the foundation for Canada’s next copper mining camp. This year’s drilling has significantly de-risked the Storm resource and brought a large portion of the copper metal in the Cyclone and Chinook deposits into the JORC Indicated category. This classification is essential for permitting and ongoing project evaluation and allows us to develop robust mine plans and economic models. The updated JORC MRE also highlights the strong growth potential of the Storm area, with known copper occurrences remaining open. Additionally, the high-grade Gap and Cyclone Deeps discoveries from 2024 are not yet included in the MRE. Accelerating the definition of additional copper resources within Storm and the regional areas will be a focus of future drilling programs. The updated JORC MRE is already being incorporated into a revised mine plan and development scenario that we believe will highlight the exceptional opportunities at Storm.”

The rapid upgrade of copper resources from the ‘inferred’ to ‘indicated’ category underscores the continuity and quality of the current mineral resources. This gives the company a high degree of confidence regarding further resource growth and the potential definition of new copper resources on the Storm project. All mineralization defined within the MRE is classified as fresh sulfide and predominantly consists of chalcocite. The deposits remain open in most directions and require further drilling to determine the full extent of copper mineralization.

Figure 1: Plan view of the total MRE blocks (indicated + inferred) for the Storm project overlaid on aerial imagery. The resource blocks are colored using a 0.35% cut-off grade and also illustrate the portion of the MRE that is above 1.2% Cu.

Large Exploration Potential: Only 5 Percent of the Project Area Has Been Explored

The open mineralization of the known deposits, the recent discoveries of high-grade copper mineralization in the Storm area, and the largely untested 100 km long prospective copper horizon underscore the outstanding potential for the discovery and definition of additional resources within the project area. Six immediate opportunities for expansion and addition of further resources at Storm have been identified, including the recently discovered high-grade The Gap Prospect as well as the early-stage Squall, Hailstorm, Tornado/Blizzard, Seabreeze, and Tempest areas.

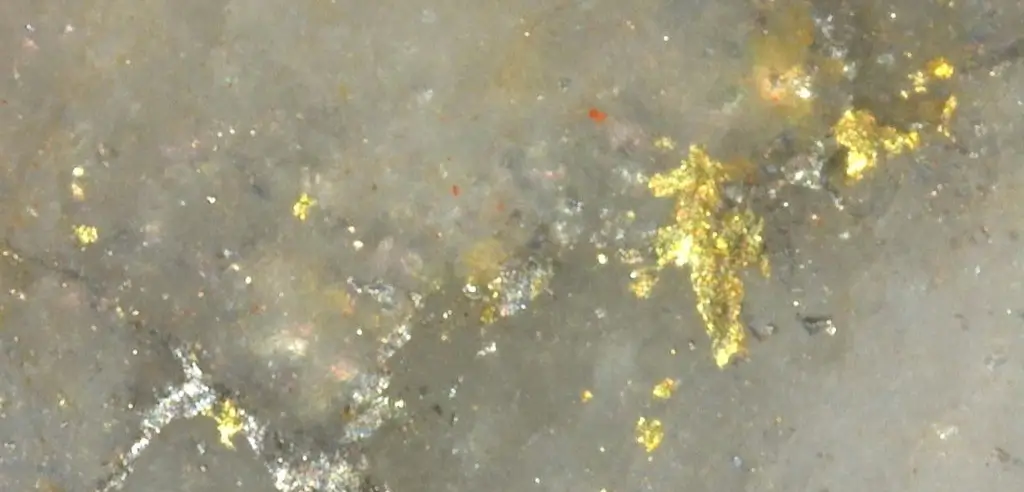

Hailstorm is a new discovery in the 2024 season, where massive chalcocite boulders were identified at the surface during exploration activities. One of the chalcocite boulders (sample Y007193) yielded a grade of over 50% copper. The exploration work was followed by a close-spaced soil survey, which identified a 250 m x 250 m copper anomaly that remains open to the south. No drilling has been conducted at Hailstorm to date, and it represents a high-priority target for drilling in the 2025 season.

Conclusion: In 2024, American West deliberately chose a cautious strategy that focused more on increasing the quality of the resource rather than its rapid expansion in the low ‘inferred’ category. Investors, including many retail investors, apparently hoped for the latter, based on the impression of rapid resource growth from the previous year, and perhaps also for new discoveries within the 100 km long, prospective copper-bearing horizon in the project area, of which only 5 percent has been explored so far. One could almost get the impression that management has disappointed its audience for professional reasons. It is therefore extremely important that American West better explains its actions: The new resource estimate primarily serves to prepare for a DSO mining scenario at Storm! The company has already conducted detailed mining and economic studies, which are a crucial step in preparing future mining permit applications. In addition, American West’s ongoing metallurgical studies have confirmed that the ores are suitable for a range of cost-effective ore sorting and processing methods. In our view, the current share price is not based on supposedly disappointing results, but on insufficient expectations management. We maintain our position: American West stands out among other copper explorers because very few have the chance to mine DSO material in an open pit – especially with average grades of 1.3 percent copper. This is precisely where the opportunity lies for investors.