Further Mine Development Already in Planning

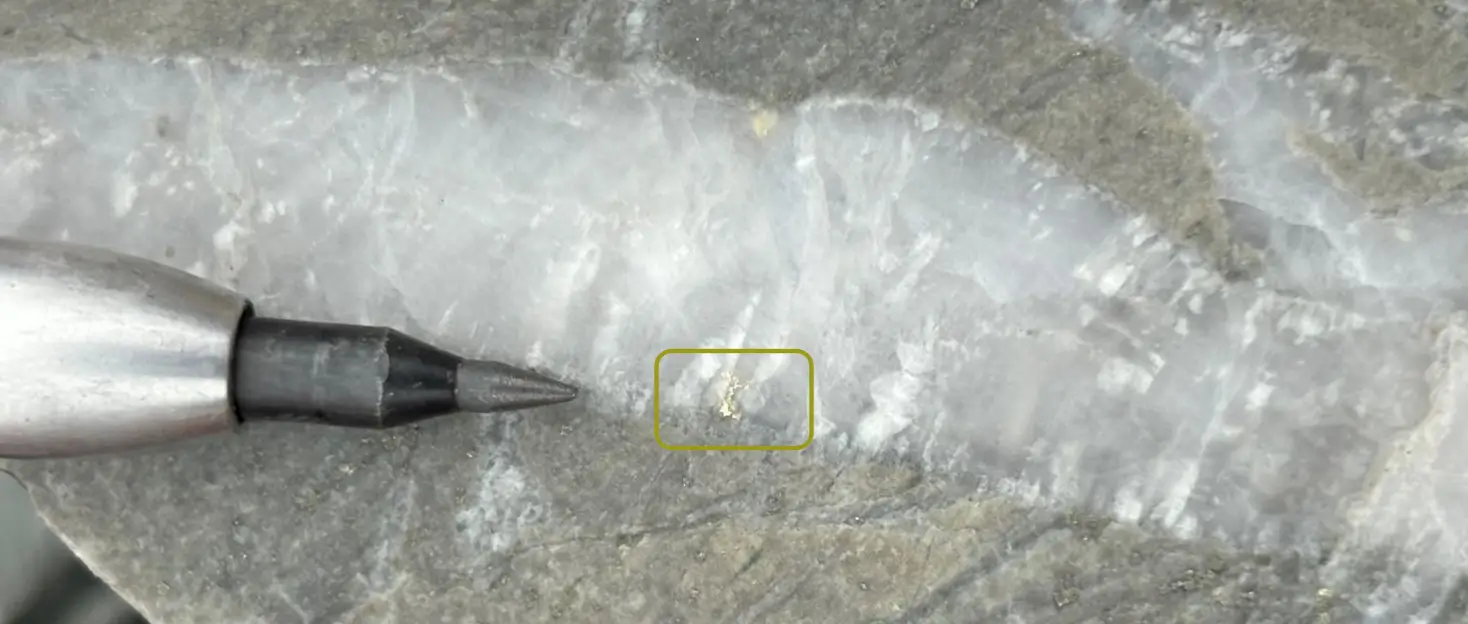

It’s starting! The transport of iron oxide, copper, and gold mineralized material from the historic Santa Beatriz Mine to the processing plant of Altiplano Metals (WKN A2JNFG / TSXV APN) in Chile is beginning. The material is being extracted as part of bulk samples.

This is intended to supplement the utilization of the plant named El Peñón, which is located just 13 kilometers from Santa Beatriz. As stated by the company, the mineralized material will be mixed with inventory and third-party deliveries while simultaneously continuing to review development plans for the historic mine. As Altiplano’s CEO Alastair McIntyre says: “Santa Beatriz offers a unique opportunity to combine production and processing, which sets us apart from other exploration companies.”

500 Tons of Material Expected per Month

Altiplano Metals expects to be able to extract around 500 tons of material per month over the coming three months – February to April. This copper, gold, and iron mineralized material, which will then be transported to the plant, comes from the floor and ceiling of the historic mining areas.

So far, the company has stored 400 tons of this material on the surface of the Santa Beatriz Mine, so it is ready for delivery. Recently, Altiplano improved the access road to the mine site, making it suitable for the coming and going of 30-ton ore haulers. Now, two loads of 30 tons each per day will deliver this material to the El Peñón processing plant.

At the same time, the company is examining a mining plan to gain access to the deeper levels of the mine. This plan is expected to be based on a short program of diamond core drilling. A decision on this is expected to be made in the coming months, it was further stated.

Altiplano Metals has reported continuous progress from Chile since the beginning of the year. In addition to improvements at El Peñón, the company has not only advanced the extraction of bulk samples from Santa Beatriz but also concluded an off-take agreement for the iron ore concentrate that is also produced at the processing plant. Additionally, interesting new projects have been acquired that could potentially provide new material for processing in the future. We are excited to see what happens next.