Thesis of Deposit Expansion Confirmed

The Quebec-based exploration company Abitibi Metals (WKN A3EWQ3 / CSE AMQ) is an exemplary resource company. In a short time, the company has raised more than C$20 million in fresh capital from investors to advance a polymetallic deposit, B26, in the well-known Abitibi mining region, previously held by the semi-public company SOQUEM in Quebec. The project is located just five kilometers from the Selbaie mine, which produced for over 20 years and operated until the early 2000s.

B26 almost became part of the Selbaie mine expansion, but the timing of state exploration and weak copper prices at the beginning of the millennium stood in the way. The similarities between Selbaie and B26 are obvious: B26 has a similar surface structure and mineral composition. Additionally, the Selbaie mine was characterized by very high recovery rates, similar to the metallurgical tests conducted on B26 in 2018. The theory of close relationship is also supported by the fact that Selbaie started as an open-pit mine that then went underground. In contrast, B26 was initially considered a purely underground deposit, partly due to copper prices at the time.

Open-Pit Potential to be Demonstrated

Now, however, Abitibi Metals plans to demonstrate through near-surface drilling that the project has significant open-pit potential in addition to the high-grade underground mine. Furthermore, the strategy aims to prove that the two previously unconnected parts of the deposit in the east and west are connected. Abitibi is fully funded for 16,500 meters of drilling for the remainder of 2024 and 20,000 meters in 2025.

Earn-In Completed in Record Time

To acquire 80 percent of the B26 project, Abitibi must invest CAD 14.5 million in exploration and subsequently deliver a Preliminary Economic Assessment (PEA). Instead of the originally planned seven years, Abitibi Metals is expected to complete this earn-in measure in just two years. A new resource estimate is in preparation, and the PEA is planned to be completed in the fourth quarter of 2025 and submitted in the first quarter of 2026. PEAs are often prepared after exploration is completed. However, Abitibi Metals not only wants to complete the mandatory earn-in program but also ensure through further drilling that the market understands that the PEA is just a milestone in, and not the end of, development. According to Abitibi CEO Jon Deluce, the project easily justifies annual drilling of 50,000 to 75,000 meters.

The Neighboring Selbaie Mine Provides the Blueprint for Success

Abitibi’s growth thesis is based on a comparison with the Selbaie mine, which operated until the early 2000s, despite the copper price being significantly lower then than it is today. The reason why the Quebec government, together with BHP, made the discovery of B26 in the late 1990s was the search for additional material for the Selbaie mine’s mill. In 1997, as the mine was nearing its end, the entire contact zone was drilled to find an additional source of sulfide ore.

Although no massive sulfide source was found at the surface at that time, there is no doubt that the project would have gone into production if the continuity of the B26 deposit had been demonstrated in time, which was achieved with the resource calculation for B26 in 2018. The Quebec government was involved in the project and has developed it since its discovery. The government’s mandate was to keep the mining town and the mine open, but the development was not fast at the time and commodity prices were not favorable enough. This is different today: Abitibi is focusing on the open-pit thesis in addition to the previously drilled underground deposit, thus responding to changed commodity prices.

Just the Beginning: Abitibi Metals’ Market Capitalization Has Grown from CAD 5 Million to CAD 40 Million

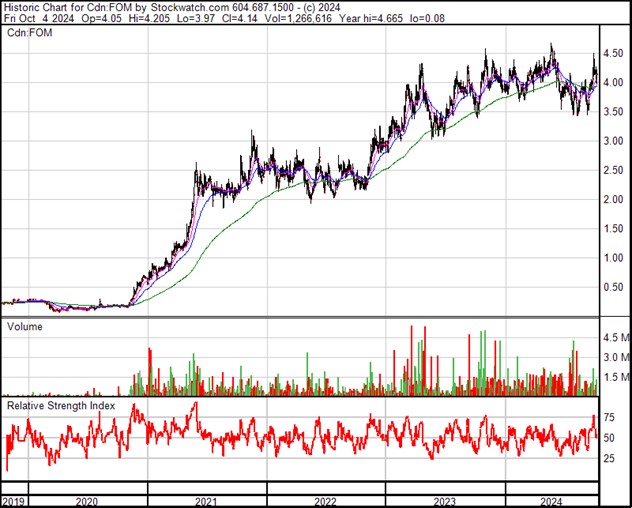

The market capitalization of Abitibi Metals has risen from C$5 million (in November 2023) to C$65 million within a year and is currently at C$40 million, of which about C$15 million is in cash. Abitibi belongs to the category of exploration companies that start with a historical resource and build real value through continuous risk reduction alone – new discoveries are a bonus. The big role model is Foran Mining (TSXV: FOM), which is developing a comparable polymetallic project in Saskatchewan and plans to bring it into production in 2026. Foran Mining was a stock in the 20 to 40 cent range for a long time until the company made some new discoveries. Today, Foran is trading at over C$4.00 with a market capitalization of C$1.6 billion.

Abitibi Metals has secured a historical indicated resource of 7.0 million tonnes at 2.94% copper equivalent and inferred 4.4 million tonnes at 2.97% copper equivalent from 2018. CEO Jon Deluce sees the potential of the B26 deposit more in the range of 30 to 50 million tonnes. Abitibi Metals has the advantage over many competitors that drilling can be carried out year-round. Deluce emphasized to Goldinvest.de: “From now until about May next year, we will be drilling continuously and delivering drill results. A big difference is that we are in the northern Abitibi and our project is next to a former producer. We have a power line, a substation, and a road that is accessible all year round. The government of Quebec has built a gravel road right into the heart of the deposit.”

Abitibi also owes its predecessors a treasure trove of more than 115,000 meters of historical drilling. The old drill cores are stored in a warehouse in Val d’Or. Recent observations suggest that there is a lot of material from the historical drilling that lies outside the high-grade zone and has not yet been sampled. In particular, there is a lot of so-called “disseminated material” that still needs to be sampled and may be included in a potential open-pit model. As Abitibi has access to these drill cores, the company benefits greatly from previous investments. The low copper price over a long period of time apparently led to no value being attributed to the widespread material at the time. However, in the current copper market, half a percent copper near the surface is very attractive and very well suited for successful open-pit mining.

Given the size and scale of similar deposits in the Abitibi area, Abitibi Metals’ geologists see a very good chance that the B26 mineralization could be a much deeper system. The company has therefore recently completed the first deep drilling to a depth of 1,400 meters. Two drill rigs are now in operation, which will be drilling at depths of 500 to 800 meters. This may sound deep, but it is still relatively shallow for projects of this type in the Abitibi region.

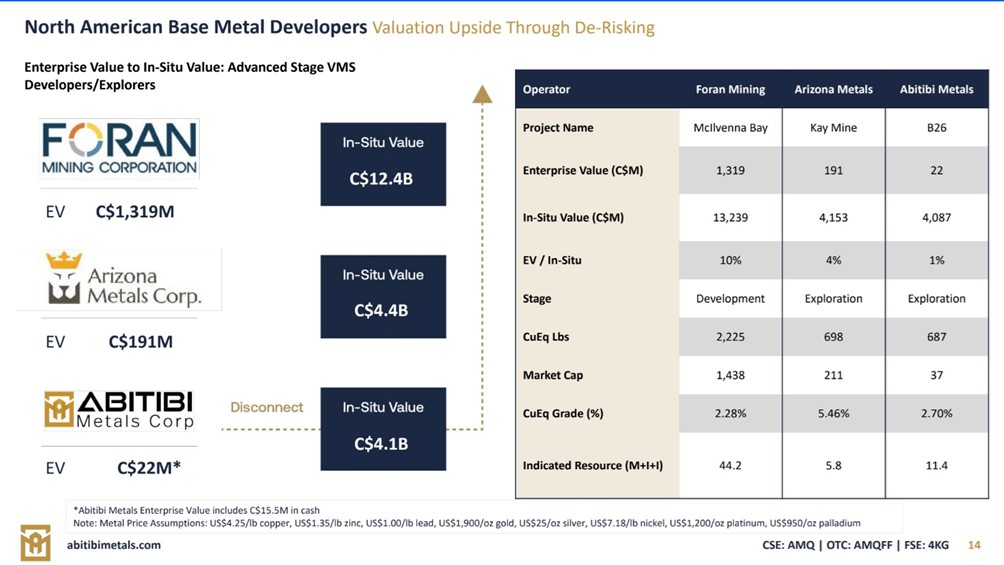

Valuation Gap to Established Competitors

Polymetallic deposits like those of Abitibi Metals, Arizona Mining, or Foran Mining are in demand. The major companies want copper and gold, and they recognize how economical these polymetallic systems are, where they work on the basis of copper revenues and extract the rest as additional profit from the ground. Abitibi wants to show through direct comparison with other deposits that there is great potential for catching up in valuation. The discrepancy becomes particularly clear when comparing the in-situ value and the company value. Deluce says that one of his main goals is to make this valuation gap known to a wider audience, including institutional investors.

Figure 2: There is a valuation gap between Abitibi Metals, Foran Mining, and Arizona Metals Corp. that Abitibi aims to close in the coming months. In particular, the company compares its own enterprise value with the in-situ value of its competitors’ known resources.

Abitibi is also trying to emulate Foran Mining in other ways. Foran received a $100 million financing from a pension fund that bought up the shares, making them no longer tradable. Jon Deluce, CEO of Abitibi Metals, believes that Abitibi has the chance to repeat this success story. After all, Abitibi was able to complete its recent share issue without issuing warrants. ‘This project justifies the issuance of warrants, but we want to ensure that we continue to finance from a position of strength and on the right terms, without being forced into unfavorable financing.’

Figure 3: Abitibi Metals’ role model is Foran Mining. The Foran chart shows the sustainable value of production-ready polymetallic deposits in Canada.

Half of the world’s copper production comes from politically unstable regions, so the focus is increasingly on copper supplies from stable regions. Quebec stands out, also because there is so much financial support, returns on invested capital, and institutional financing from government agencies that provide equity investments and are very patient shareholders. In addition, there are functioning partnerships with First Nations, which are very positive about mining.

Abitibi’s stated goal is to ultimately sell the B26 project to a major corporation. To do this, the project needs a clear path to development and production, as this is what is important to large mining companies. Since Abitibi Metals has a government partner interested in job creation, there is an alignment of interests to develop this project. Jon Deluce is convinced that B26 will one day represent an attractive takeover opportunity for a large company. He can imagine a major mining company securing a 5-10% stake in Abitibi within the next six months. ‘This would give us additional credibility,’ says Deluce.