The company's insiders are sending a clear signal

Element 29 Resources (TSX.V: ECU, FSE: 2IK, WKN: A2QKKG) is developing four copper projects in Peru and is doing something that is currently not very popular with investors: pushing ahead with the search for new copper deposits. But, the world has long since run out of time and it is no longer a question of whether copper prices will one day explode, but only when this will happen and to what heights the copper price will shoot.

Many experts are puzzled as to where the copper that will be needed to realise the energy transition in the coming years will come from. The situation is quite clear. While global copper demand is expected to rise from the current 2.1 million tonnes to 4.2 million tonnes per year over the next ten years, mine production is expected to decline.

In order to compensate for this decline alone, more copper projects will actually have to be developed. However, the topic is not particularly on most investors’ radar at the moment and the sector is receiving correspondingly little attention. Wrongly so, because any investor who takes a more long-term view of the emerging development already knows today that the copper price will explode one day when everyone involved realises that there is no longer enough copper available.

Element 29 Resources is focussing on two projects

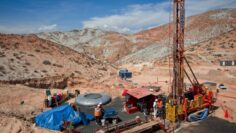

Element 29 Resources is also preparing for this moment. The company has a total of five copper projects in Peru, with two of them, the Elida copper project with an initial reported resource of 321.7 million tonnes at 0.32 per cent copper in the inferred category and the Flor de Cobre project where drilling has returned intervals up to 349 metres grading 0.77 per cent copper (including 123 metres of high-grade 1.42 per cent copper), standing out in particular.

Element 29 Resources is prioritising the development of both projects. Despite the persistently negative sentiment among investors, the company has been able to raise sufficient fresh capital in recent months to finance the next development steps.

The company’s insiders are sending a clear signal

In September, Element 29 issued a total of 19,045,253 new shares at a price of 0.15 Canadian dollars (CAD) per ordinary share. As a result, the company received gross proceeds totalling CAD 2,856,788. If the options issued to the new shareholders are also exercised by 13 September 2025 at a price of CAD 0.25 per share, the company could receive a further CAD 4.76 million in proceeds.

Is this investment worthwhile? The company’s insiders have answered this ever-present question with a resounding yes, as they subscribed for a total of 1,120,000 units. Additionally, management has recently continued to buy shares in the market as well. This is a clear vote of confidence that speaks in favour of both Element 29 and the projects it develops.

As you would expect from an explorer, the net proceeds from the capital measure will be used to finance further exploration activities. The funds are therefore likely to be focussed on the Elida and Flor de Cobre projects.

Coming bottleneck firmly in sight

Although the Elida project is located in the west-central Peru and the Flor de Cobre porphyry copper project is located in Peru’s major southern copper belt, both sites have in common that they are well located for future mine development, as they are anything but high up in the mountains – at least for the Andean country – at 1,600 and 2,700 metres respectively.

In addition, both properties have a well-developed infrastructure, easy access to electricity, water and qualified labour. The transport of the concentrates produced will also be very easy to realise due to the proximity to the Peruvian deep-sea ports.

Investors are therefore well advised to look into copper now that the crowds at the entrance are extremely small. Of course, investments in explorers and developers are always associated with a higher risk. But whenever investor sentiment is as reserved as it is these days, there is a chance of acquiring a comparatively large share in companies that have gone unnoticed by the masses for every dollar invested.

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice, but rather represent advertising / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH hold or may hold shares of some of the mentioned companies and therefore a conflict of interest exists or may exist. We also cannot exclude that other stock letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, between the mentioned companies and the GOLDINVEST Consulting GmbH a consulting or other service contract, directly or indirectly, can exist, with which also a conflict of interest can be or is given. Especially as GOLDINVEST Consulting GmbH is remunerated in this case for the reporting on the mentioned company.