{australien_flagge}Australian explorer Conico Ltd. (ASX: CNJ; FRA: BDD) has reported mixed results from last year’s drill program at its flagship Ryberg project in East Greenland. It was the first ever drilling program on the 4,500 sq km license. The share price initially lost about 40 percent after the results were released in Australian trading. Overall, the company has released approximately 80 percent of a total of 3,600 meters of drilling on its three sub-projects, Miki, Sortekap and Cascata. None of the projects immediately returned drill results that could be classified as ore grade.

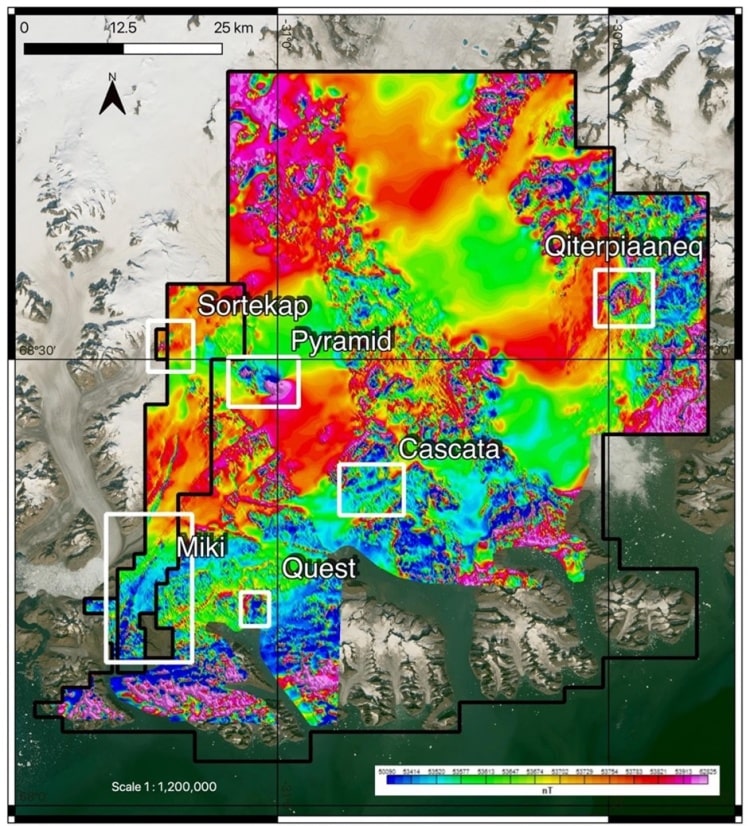

Approximately 400 samples and an additional 600 meters of drill core are still pending, particularly from Sortekap and Cascata. The project-wide magnetic evaluation now available for the first time for the 4,500 km² Ryberg project provides valuable information on where exploration can start in 2022. All three known projects “remain fully intact,” according to Chief Geologist Thomas Abraham-James. In addition, the overall airborne magnetic evaluation shows four new significant targets: Pyramid, Qiterpiaaneq, Quest, and a crustal structure near Sortekap (Figure 1).

Figure 1: Prospect locations within the Ryberg project area on the recently acquired magnetic intensity map. This magnetic evaluation of the entire area was originally planned for as early as 2020, but then prevented by the Covid pandemic. Instead, Conico had only done a land-based electromagnetic survey on a 1km² plot near Miki in 2020.

The new overall magnetic survey (Figure 1) confirms the special location and exceptional geological richness of the Ryberg project. Conico geologists suggest that Ryberg is intruded by a deep continental scale structure (Crustal Scale Feature). All of the identified targets are associated with this major structure, which is shown on each of the maps with white dashed lines (Figures 3 and 4). If this magnetic map had been available for the 2021 exploration, Conico would have been able to drill in a much more targeted manner. This is shown in particular by the evaluation of Miki. Based on current knowledge, the main Miki Dyke anomaly was missed and instead a structure not directly related to the Miki intrusion was drilled. Future drilling will test the newly identified targets (red) (Figure 2). Miki thus remains a high priority target.

Figure 2: The Miki prospect, with the Miki trench represented by magnetic low points (deep blue) in the NNE-SSW direction. The magnetic ridges (magnetic high points in red) are indicated, as are the drill collars and traces from the 2021 drilling further south.

Something similar to Miki can be said of the Sortekap and Cascata targets, which also correlate with low-lying major crustal structures. There, too, magnetic interpretation has greatly improved the understanding of the targets.

A Standout target: The Pyramid prospect area

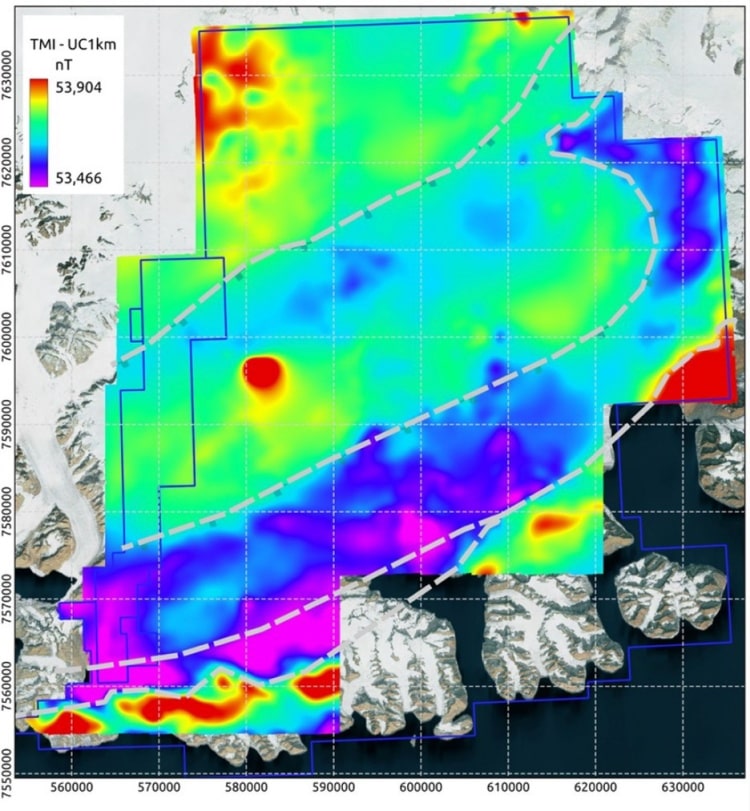

Among the newly discovered targets on Ryberg, the nearly three-kilometer-wide Pyramid anomaly stands out. The measured magnetic signature is extremely strong at 10,000 nT. Software projections have shown that the anomaly would still be clearly visible from an altitude of more than one kilometer. Accordingly, Conico classifies Pyramid as a high priority exploration target. Encouragingly, Ni-sulphide mineralization has been found in the adjacent Sortekap. The Pyramid anomaly probably extends several kilometers deep (Figure 3).

Figure 3: The Pyramid prospect area showing magnetic high points and nearby crustal structure (white dashed line).

Figure 4: The location of the Pyramid intrusions is obvious and highlighted in red. The image shows the total magnetic intensity (TMI) from 1 km altitude. The white dashed lines are interpreted as deep major structures of the Earth’s crust.

Figure 5: The Pyramid prospect area, looking NW. Note the dark geology in the foreground, which is likely the intrusive rock, compared to the lighter brown color of the sediments in the background. A significant rust zone can be seen in the center right of the image.

Conclusion: No amount of window dressing will help. Conico’s results initially have the effect of a cold shower on investors and cause disillusionment. Once again, it can be painfully learned that the optics of drill cores are not very meaningful and that exploration is not a wishful thinking concert. Regardless, Ryberg’s long-term prospects are fully intact and bigger than ever. This is true for the known three projects and even more so for the four new projects – and especially for the mega-project Pyramid. After the 2021 exploration, there is no longer any doubt that Ryberg is a world-class district – not just a single project. In particular, the release of the overall magnetic data with the large-scale fracture zones changes the picture in favor of Ryberg. The majors will certainly take a close look at this data. Even their geologists don’t see targets like Pyramid every day. Conico may have found the key to future exploration by interpreting the deep-reaching large-scale structures from the earth’s crust at Ryberg.

For the Conico team, the motto now is “forget the present and look forward.” Unfortunately, in the short term, it is proving to be a liabilty for Conico that the Conico Board turned down the “binding financing commitment from broker RM Capital” last fall. This financing would have injected another A$3 million of fresh capital at A$0.06 into the company. As can be seen from the quarterly report, Conico currently has around AUD 2.6 million in cash reserves. This is too little for an ambitious exploration program Ryberg deserves in the upcoming season. Conico will need fresh cash very soon, especially if, as indicated, the company starts work earlier this year. The question is not “if,” but how much, from whom and at what price. The Conico Board’s call is now.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Conico Ltd and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Conico Ltd for reporting on the company. This is another clear conflict of interest.