"The right project at the right time"

Only recently, global asset manager Sprott explained that a new “super cycle” is beginning to form in the copper market. This is based on several geopolitical and market trends, which would lead to a “strongly bullish” outlook for the copper price. This is also in line with our observations. Which is why we are once again looking at an extremely promising copper company for our readers.

A “commodity supercycle” is a period of consistent price increases lasting more than five years, in some cases even decades.

According to Sprott – and numerous other experts – the global transition to clean, electrical energy and the protectionist efforts of some countries to secure vital raw materials will lead to an unprecedented increase in demand for copper. At the same time, copper supply will remain limited, primarily due to years, if not decades, of underfunding in the sector, increasing protectionist measures and the continuing tendency among large copper producers to grow through mergers and acquisitions rather than by developing completely new copper mines.

Copper price still up significantly in 2024

More and more market participants obviously became painfully aware of this at the beginning of the year, which is one of the reasons why the copper price switched into rally mode and temporarily reached a record high near the USD 11,000 per tonne mark! Even now that short-term considerations have led to the red metal consolidating, the price is still up by more than 10% since the beginning of the year. And this healthy setback, according to many experts, could actually prove to be an opportunity for investors who want to become active in the copper sector and share the long-term, positive outlook.

Prismo Metals: On the hunt for copper deposits in the Arizona

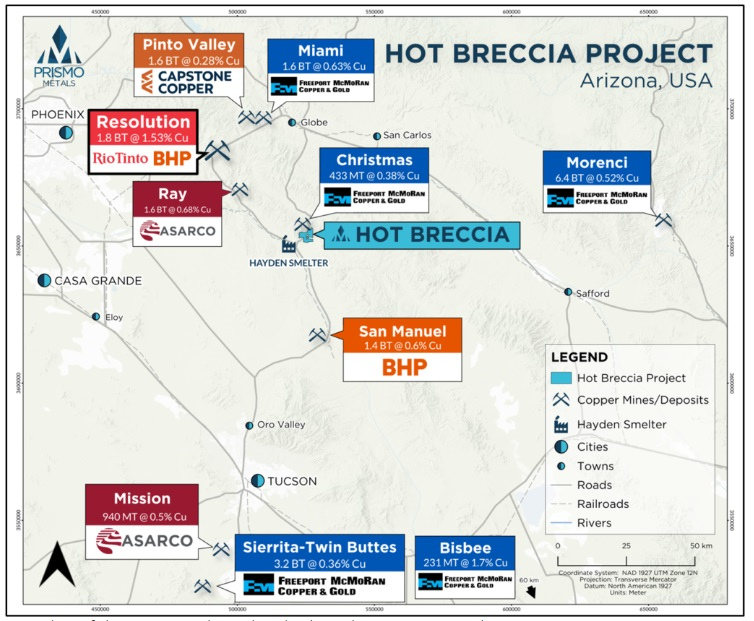

One company that wants to take advantage of the new “copper supercycle” and now has an almost perfect opportunity to do so is Canada’s Prismo Metals (WKN A2QEGD / CSE PRIZ). The company, led by CEO Alain Lambert, a proven capital market expert, has several hot irons in the fire, but none is currently as hot as the Hot Breccia copper project in the world-class Arizona Copper Belt!

The location of the project already speaks for itself on a regional level, as the US state of Arizona produces 23 to 632 million pounds of the industrial metal from ten copper mines every year. This means that the infrastructure – including for water and electricity – is very well developed.

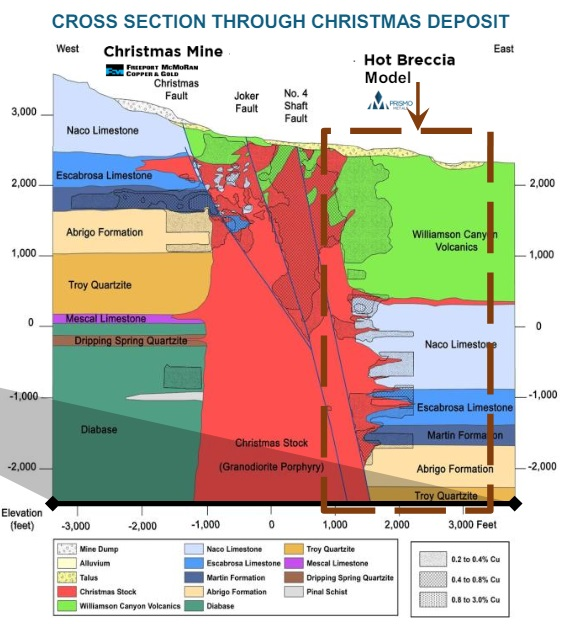

And Hot Breccia is not only just 4 kilometers away from the formerly producing Christmas mine, but also not very far from one of the world’s largest, higher-grade (more than 1.6 BT at 1.5% Cu) copper deposits called Resolution, which is owned by Rio Tinto/BHP and has similarities to the Christmas deposit.

In the past, the Christmas mine produced around 25 million tons of ore containing 363 million pounds of copper, 2.1 million ounces of silver and 55,026 ounces of gold. And according to Prismo, Resolution is a kind of model for the mineralization of Hot Breccia, as Hot Breccia has the same geological units that were productive at the time – only under a cover of volcanic rock.

Past drilling at Hot Breccia, mainly between 1972 and 1981, included 23.45 meters of 0.54% copper at 640 meters depth, 18.29 meters of 1.4% copper and 4.65% zinc at 883.92 meters depth, 7.62 meters of 1.73% copper and 0.11% zinc at 702.56 meters depth and 4.57 meters of 1.4% copper and 0.88% zinc at 716.28 meters depth (Kennecott). In addition, there were 387.10 metres of variably mineralized skarn with several intercepts greater than 1% copper and a high of 3.16% copper.

A mineralized fragment brought up from depth by brecciation within the intrusion also graded 5.7% copper, 32.8 g/t silver and 0.24 g/t gold. According to Prismo management, this is a clear indication of a strong mineralized event at depth. This is also indicated by a geophysical survey (ZTEM) carried out by the company last year, which found a large conductive anomaly at depth beneath a dyke swarm and the eponymous breccia, as well as copper mineralization at surface.

An AI-supported target generation company now evaluates the available data, including the ZTEM survey. The AI-supported modeling is intended to show where and at what depth drilling should take place. Understandably, Prismo Metals then wants to test these targets as quickly as possible. Five diamond core drill holes, each 1,000 meters deep, are initially planned for this summer, so that the drilling program will comprise a total of 5,000 meters of drilling.

They are in the starting blocks and are now just waiting for the drilling permit. And according to the company, this could arrive any day now!

Two more exciting projects in the portfolio

A few days ago, Prismo Metals concluded a financing deal that brought the company around CAD 1.15 million (gross). According to the associated press release, this money is initially intended for the exploration of the Palos Verdes silver project. Palos Verdes is located in the Sierra Madre gold and silver belt in the Panuco silver and gold district of Sinaloa, Mexico. One of the exciting things about the project is that it is surrounded by land belonging to Vizsla Silver, which is also Canadian. And Vizsla is a strategic partner, holding as much as 9.6% of Prismo!

Palos Verdes is therefore located in an important mining region with several active and former exploration projects such as Panuco, Picachos and Plomosas & Trinidad. It is also located on the highway from Mazatlan to Durango and, according to Prismo, has excellent infrastructure.

To date, Prismo has delineated an area of mineralization known as the Palos Verdes Vein with 6,000 metres of drilling in 33 holes at Palos Verdes, with strong results including the following:

- 0.5 meters with 11,520g/t silver (Ag) and 0.3 meters with 512g/t Ag

0.7 meters at 1,234 g/t Ag and 1.2 meters at 302g/t Ag

0.9 meters 189 g/t Ag

0.3 meters 450.2 g/t Ag

0.35 meters at 112.7 g/t Ag, 0.3 meters at 105.6 g/t Ag and 0.75 meters at 253.4g/t Ag

In addition, detailed sampling along structures has identified a possible second blind mineralized shoot. Studies also indicate the potential for the mineralization drilled to date to continue down plunge due to a cross fault! According to Prismo CEO Lambert, Vizsla is closely monitoring and actively supporting his company’s work.

Gold also covered

The third project in Prismo Metals’ portfolio, Los Pavitos, is also highly exciting. This is a gold project in Sonora, Mexico. Last year, Prismo drilled 6.7 meters of 10.2 g/t gold and 47 g/t silver in its first ever program there, among other results.

Interestingly, the company has also identified and sampled a new zone with multiple structures in the previously unexplored north-eastern part of the property. Surface samples there returned up to 1,130 g/t silver and 1.33 g/t gold!

However, the Prismo team will probably devote itself to Los Pavitos at a later date. For now, Palos Verdes and, above all, Hot Breccia are on the agenda!

Conclusion: Copper, silver and gold are three metals for which many experts expect prices to rise sharply in the coming months and, above all, years. While the megatrends of electrification and artificial intelligence (keyword: data centers) are having a particularly strong impact on copper, silver is particularly affected by the ever-increasing industrial demand from the solar energy sector. And the number of experts expecting gold to rise significantly is enormous. Prismo Metals appears to be in an excellent position to potentially benefit threefold from the emerging commodity super-cycle. The next silver drill holes at Palos Verdes are likely to follow shortly and if, as expected, the permits for Hot Breccia also arrive in the near future, it could be a hot summer for the company in the truest sense of the word – despite all the risks that, of course, exist.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Prismo Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, there is a contractual relationship between Prismo Metals and GOLDINVEST Consulting GmbH, which involves GOLDINVEST Consulting GmbH reporting on Prismo Metals. This is another clear conflict of interest.