Graphit prices set to rise

China’s has enormous influence over the global supply of critical minerals and does not hesitate to use its dominance as political leverage. Last week, China announced controls on exports of natural and synthetic graphite, citing national security concerns, which could jeopardise the supply of electric vehicles outside the country. Observers see China’s move as a reaction to the European Union’s announcement to investigate Chinese subsidies for electric vehicles.

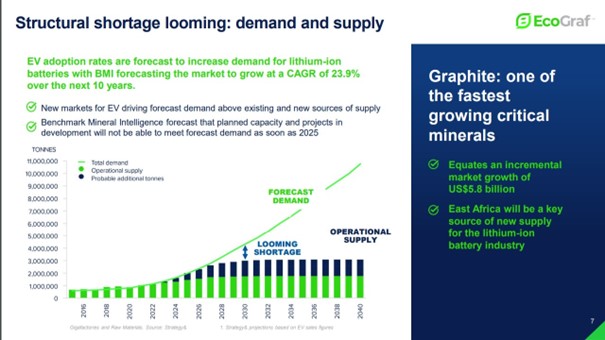

China dominates graphite mining, processing and anode production and will produce 67% of the world’s natural graphite this year, according to Benchmark Graphite Forecast. China’s restrictive export policy is likely to accelerate the expansion of alternative battery anode supply chains in the West. The stock market reacted immediately: Ecograf (ASX: EGR; FRA: FMK) was up 24% to A$0.14 in its Australian home market; Gratomic Inc (TSXV: GRAT; FRA: CB82) was up 15% with and 2.8 million shares traded. At www.goldinvest.de, we have been following both companies for a long time – Ecograf for several years.

In the short term, policies could make it harder for foreign companies to buy Chinese graphite raw material products, depending on how tightly they restrict export licences, Benchmark said. Some overseas anode producers, such as those in South Korea, rely on imports of nodular graphite (USPG) from China.

Benchmark expects the Chinese measures to support graphite prices, which it estimates have fallen 30.8% so far in 2023 for (94-95% C) -100 mesh (FOB China). However, in the longer term, policies could accelerate the expansion of the battery anode supply chain in the West, which has already been supported by measures such as the Inflation Reduction Act in the US.

The development of battery recycling capacity could be another route to Western supply security, although the US and EU are taking very different approaches to building this sector. The EU has opted for recycling share targets, and two companies that could benefit are Li-Cycle and Redwood Materials – the only battery recyclers with facilities in both North America and Europe. Both companies could also become future interlocutors for Ecograf, which has demonstrated in extensive testing that its technology is highly suitable for battery graphite recycling.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of EcoGraf and/or Gratomic and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the companies at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by EcoGraf and/or Gratomic for reporting on the company. This is another clear conflict of interest.