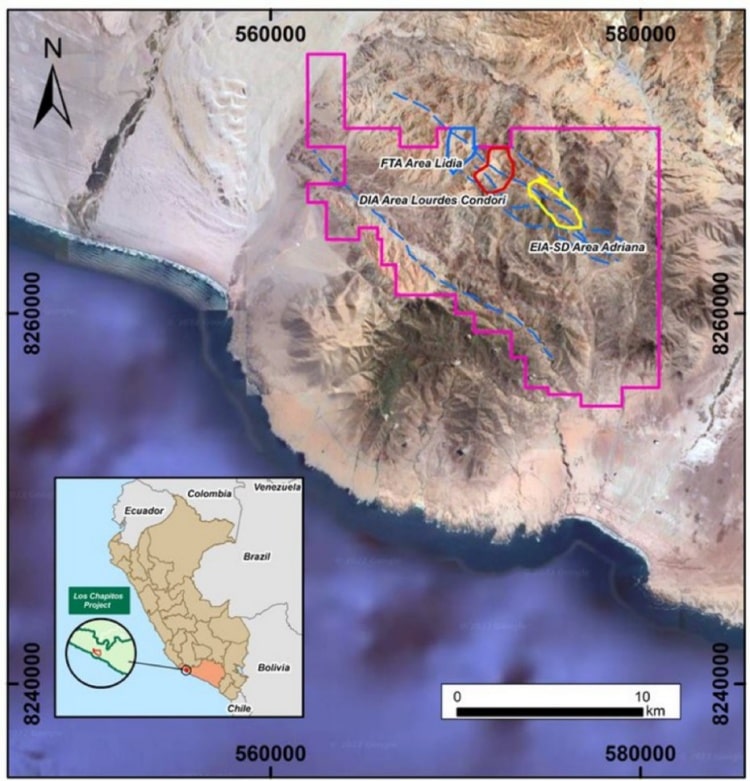

{kanada_flagge}Camino Minerals Corp. (TSXV: COR; OTC: CAMZF; FRA: A116E1) has received drilling approval for its Los Chapitos copper exploration project near the coastal town of Chala, Peru (Figure 1) and expects drilling approval for its second Maria Cecilia copper porphyry project shortly. Los Chapitos is a 220-square-kilometer district-scale project with several permitted areas along the 8-kilometer-long main Diva mineralized fault. The Los Chapitos permit authorizes 33 drill holes spread over 11 platforms, as well as the construction of 9.6 kilometers of access roads and two water storage ponds.

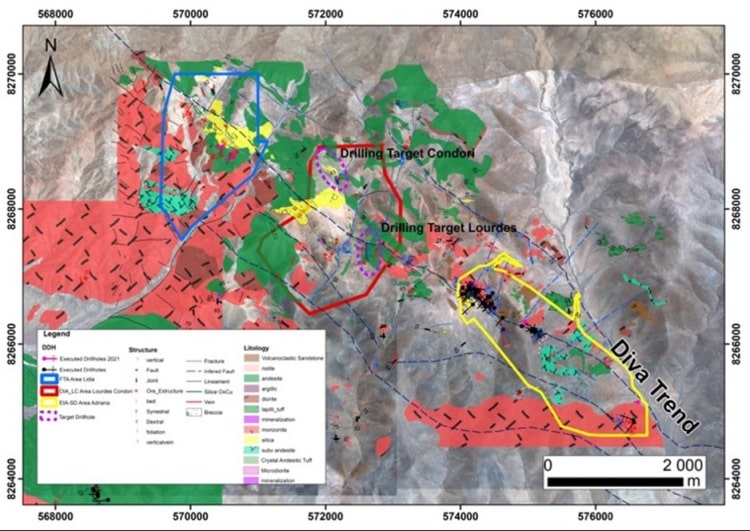

Jay Chmelauskas, CEO of Camino, said, “The new permit at Los Chapitos opens up drill targets in two new oxidized copper zones: the Breccia Zone at Condori and a copper manto zone at Lourdes. The manto mineralization has similar characteristics to the discovery drilling conducted in 2017 at the Adriana outcrop (see press release dated April 18, 2017). We expect to receive a similar drill permit from DIA on our new Maria Cecilia copper porphyry project in the coming weeks. This will enable Camino to drill two world-class copper exploration projects in early 2022.”

Jose Bassan, Camino’s Chief Geologist, said, “Mineralization at Chapitos is structurally controlled and we are finding additional controlling structures with copper mineralization along the main Diva fault. The newly permitted oxidized copper zones at Lourdes and Condori have the potential for large tonnage manto style intercepts similar to previous drilling at Adriana.”

At the Lourdes manto, grades of up to 4.16% Cu and 26.9 ppm Ag were measured in channel samples. The Condori breccias have grades up to 3.94% Cu and 24 ppm Ag in artisanal mining samples.

Figure 1: Approved drill areas within the Los Chapitos copper claims.

Figure 2: The Lourdes and Condori drill targets on Los Chapitos in the center of the image are marked with dashed lines in pink. They are located along the 8.0 km Diva trend of green copper oxide mineralization between the Lidia and Adriana zones.

The Lourdes target is continuous visible copper manto mineralization over 120 m with azimuth N-S and dip of 25°E and varying width from 5 to 20 meters. The mineralization grades up to 4.16% Cu and 26.9 ppm Ag in channel sample intervals of 1.3 to 2 meters. Manto mineralization at Lourdes is coincident with the regional stratigraphy of the Chocolate Formation and is well defined in the Lourdes Zone.

The Condori target is structurally controlled as a feeder breccia filled with malachite and chrysocolla and contains rock samples with grades up to 3.94% Cu and 24 ppm Ag previously mined by artisanal miners. The mineralization extends for 300 meters and is covered by crumbled rocks that follow the diva trend from NW to SE. The green copper oxide outcrops can be seen on Google Earth (click on – Google Earth, Lat: -15.659223° / Long: -74.328591°).

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold shares of Camino Corp. and therefore a conflict of interest could exist. We also cannot exclude that other stock letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between GOLDINVEST Consulting GmbH and Camino Corp., whereby a conflict of interest exists, especially since Camino Corp. remunerates GOLDINVEST Consulting GmbH for the reporting on Camino Corp. This is another conflict of interest.