We are in the midst of a new uranium bull market

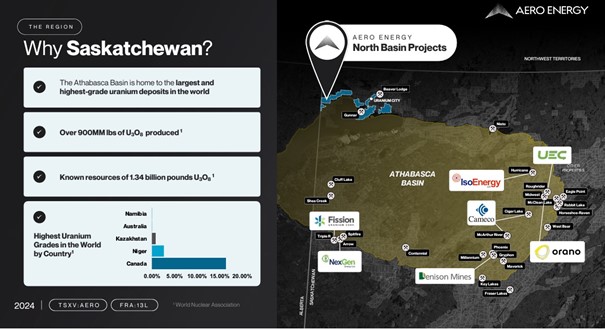

Nowhere in the world are there such high-grade uranium deposits as in the Athabasca Basin in Saskatchewan, Canada. Decades of successful exploration and discovery have refined our knowledge of the special characteristics of uranium deposits in the Basin. This new knowledge has led to the discovery of fresh deposits by Fission Uranium (TSX:FCU) and NexGen Energy (TSX:NXE) in the south of the Basin in the last uranium bull market. The young company Aero Engery Ltd (TSXV: AERO) (OTC Pink: AAUGF) (FSE: UU3) wants to build on the success story in the newly emerging uranium bull market and is using state-of-the-art technology to go exactly where some of the oldest uranium mines in the Athabasca Basin are located, on the north-western edge of the basin.

The Aero thesis is that the old-timers not only harvested the low-hanging fruit, but also mined in the “wrong host rock” from today’s perspective. Today, one would no longer exploit the deposits bound in the granite, but look for structures in which uranium is enriched in the graphite – as is the case with Fission and NexGen. Aero has already identified 50 such near-surface drill targets. Management consists of an A-team for uranium exploration. Interim CEO and Chairman Galen McNamara was Senior Project Manager at NexGen Energy. Technical advisors include industry recognized names such as Garrett Ainsworth, who was involved with both Fission and NexGen in the discovery of their deposits, and Sean Hillacre, President and VP of Exploration of Standard Uranium.

Figure 1: Overview of the Athabasca Basin. Historically, development has been concentrated on the eastern side of the basin. Then came the recent discoveries by Fission and NexGen on the southern edge of the basin. Aero Energy has secured the properties on the opposite northern edge of the basin.

Aero Energy is using state-of-the-art technology and is now launching its first airborne VTEM™ Plus survey on the approximately 1,100 km² license area, which is teeming with historic high-grade surface samples (12.5%, 9.5%, 8.8% uranium). VTEM easily recognizes the electrically conductive, graphite-rich rocks that are the preferred targets for large basement uranium deposits. The planned survey will cover the Sun Dog and Murmac properties (see Figure 2). A helicopter (see Figure 3) will fly 3,350 km flight lines in a grid pattern with 100 m spacing. Aero hopes that this will provide information on which of the existing drilling targets the company should prioritize and which new drilling targets should be identified.

A large part of the survey area is unexplored and has not been investigated using modern methods. New ideas and new vectors: These large properties are significantly under-explored for uranium in the basement. Examples include NexGen Energy’s (TSX:NXE) Arrow deposit and Fission Uranium’s (TSX:FCU) Triple R deposit.

Since 2020, exploration partners Fortune Bay (TSXV:FOR) and Standard Uranium (TSXV:STND) have invested $7.6 million in early exploration, discovering dozens of targets, multiple uranium-bearing EM conductor corridors and ten new near-surface uranium occurrences between 20 and 150 meters below surface suitable for immediate exploration as a starting point.

Galen McNamara, CEO of Aero Energy, commented, “The VTEM™ Plus surveys represent a significant step forward in Aero’s ongoing efforts to utilize advanced technology for exploration success. The survey will allow us to obtain high resolution data on our targeted mineralizing systems that we believe are active throughout the survey area.”

Figure 2: Survey flight line pattern over the Sun Dog and Murmac properties (overlay the flight lines on this map)

Figure 3: This is what the Geotech Ltd. helicopter-borne VTEM™ survey looks like when collecting data in the field.

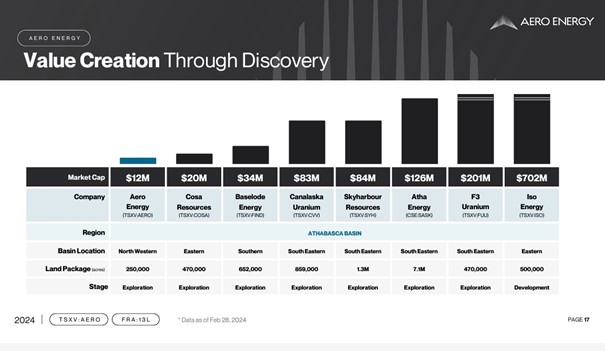

Figure 4: At the current market price of $0.15 CAD, Aero is valued at just $14 million CAD. More advanced uranium explorers in the Basin are valued at a multiple.

Conclusion: The recent rise in the uranium price to briefly over US$100 per pound suggests that we are in the midst of a new uranium bull market. As a reminder: In January 2020, a pound of uranium still cost less than US$ 20 on the spot market – a price at which (to our knowledge) no North American producer could earn money. Exploration was actually out of the question. Aero is now using the long-missing tailwind to possibly continue the success story that Fission and NexGen have written at the southern edge of the basin on the north-western edge of the productive Athabasca Basin. There is an old saying in exploration that past success is no guarantee of future performance. But who, if not this team, could be trusted to deliver the next big discovery in the Athabasca Basin? We will stay tuned to Aero Energy.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute a call to action; it is neither expressly nor implicitly to be understood as a guarantee of share price performance. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. It is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so exclusively at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities is associated with high risks, which can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. However, liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Aero Energy Ltd. and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time, which may affect the price of Aero Energy Ltd. shares. In addition, GOLDINVEST Consulting GmbH is remunerated by Aero Energy Ltd. for reporting on the company. This is another clear conflict of interest.