Phase 2 already underway

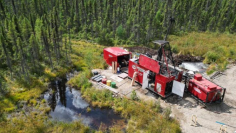

The “summer break” is over! Gold and copper explorer Abitibi Metals (WKN A3EWQ3 / CSE AMQ) has already started the second drill phase at its exciting B26 copper and gold project. A further 16,500 meters are to be drilled this year with one drill rig on the project so far, in order to build on the success of the first phase of drilling. These have provided exciting information, among other things, so that CEO Jonathan Deluce’s company is now facing a decisive step in its exploration strategy!

In particular, the potential of the Western Plunge (down-dip) Extension has appealed to the company after reviewing the results of the first phase of drilling and adjusting the geological model for B26. Abitibi will continue to focus on developing existing targets to demonstrate the deposit’s potential for high-grade mineralization.

Phase II drilling is designed to extend the known historical mineralization by testing for precious and base metal mineralization down dip along the western slope with up to 400 metre step-out holes west of the B26 boundary. And Abitibi geologists see significant exploration potential both laterally and at depth.

Initial interpretations based on historical data indicate mineralized structures with elevated metal concentrations trending west-southwest. Here, both historical drill results and the results of the first drilling phase demonstrate the potential to extend the mineralization trend to depths of more than 1,000 metres!

Abitibi is currently drilling a hole with a planned length of 1,250 meters (hole 1274-24-338). This is intended to test a potential down-dip extension to the west of historic drill hole 1274-16-236, which encountered 5.08% copper equivalent over a length of 7.1 meters. If successful, this will be the deepest western extension hole in the history of the B26 project! In any case, Abitibi’s objective at B26 is to demonstrate both the continuity and the high-grade nature of the B26 mineralized system.

Near surface exists the possibility of large-tonnage deposits

Abitibi will also incorporate the data collected in the first phase of drilling into the detailed review of the block model and updated internal resource estimate using an open pit optimization model created by SGS experts. Surrounding areas of disseminated mineralization will also be included in this model.

Abitibi will then use the Phase II drilling to test the extension potential of near-surface mineralization within and beyond the current open pit resource. This is expected to ultimately provide a better understanding of the structural controls on mineralization at B26. Which in turn should help to determine the final geometry of the deposit. Additional definition and extension drilling is also planned, with Abitibi targeting a large-scale deposit with continuous mineralization and grades.

Expansion potential even at medium depth

Abitibi also sees considerable potential at medium depth at B26 to expand the known deposit compared to the historical resource. This is because, the company emphasizes, the previous operators had not drilled sufficient holes to cover the mineralization corridor along strike and down dip!

Here, particularly promising drill targets have been identified at vertical depths of 300 to 625 meters now that a better understanding of the B26 deposit model has been achieved. This model includes the identification of quartz-sulphide veins that have formed at a sub-volcanic intrusive contact. This intrusive and contact zone is believed to influence the mineralized system over a strike length of approximately 1 km. Based on structural analysis, Abitibi suspects a possible correlation between the distribution of metals and the dip of the mineralization. Strategic drilling is planned to extend these mineralized lenses.

To test this thesis, Abitibi is designing steeply dipping pilot holes to install so-called wedges and test the use of directional drilling. The aim is to investigate the resource expansion of these central targets at medium and greater depths. If successful, the next targets could be investigated with fewer meters of drilling and therefore more cost-effectively.

Conclusion: With the second drilling phase already underway, Abitibi Metals is making decisive progress in its exploration strategy for B26. In particular, the potential of the Western Plunge appears significant, where the company’s geologists believe the amount of contained metal could be significantly increased. The review of historical data in conjunction with the results from the first phase of drilling also suggests significant expansion opportunities along lateral trends and at depth where previous drilling has intersected copper and gold mineralization in widely spaced holes. All in all, we believe the signs are pointing to significant resource growth!

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.