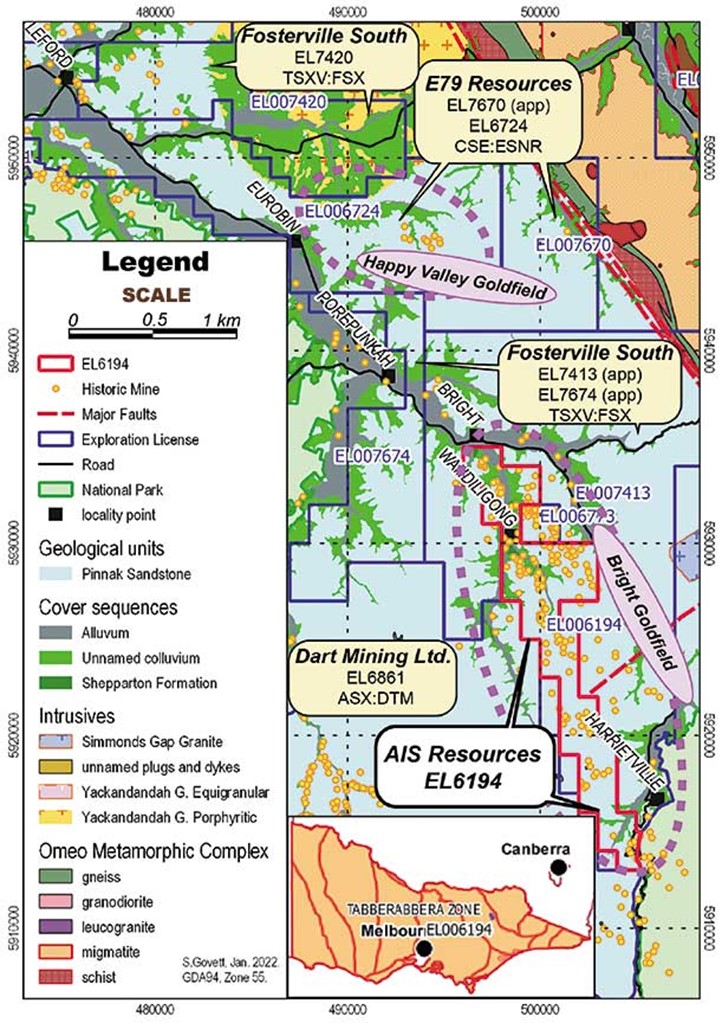

{kanada_flagge}E79 Resources, with its spectacular success at Happy Valley in Australia, has provided the blueprint for what modern exploration can achieve from a forgotten but high-grade 19th century mining district. A.I.S. Resources Limited (TSXV: AIS, FRA:5YHA) has taken inspiration from this blueprint and has now secured the 57 km² Bright Project in neighboring license EL006194, which also includes a significantly higher number of historic gold mines (9 vs 250). Initially, AIS is acquiring a 60% interest from Clarus Resources Pty Ltd. with an option to acquire 100%. The Bright project is in a prime location and is only six kilometers from E79’s Happy Valley project.

EL006194 contains more than 250 historic gold mines, reefs (quartz veins) and gold deposits dating back to the 1890s. Historically, EL006194 has recovered 341,000 ounces of gold at grades ranging from 7-99 g/t and averaging 22 g/t Au.

The Bright Gold Project and surrounding area hosts many large historic pits and historically recorded production of over 730,000 ounces mined from both alluvium and rock. The largest producers at the project were the Rose, Thistle and Shamrock mines with a combined 140,000 ounces at average grades of 22.2 g/t gold and the Oriental mine with 6,194 ounces at an average of 28 g/t gold.

AIS CEO Phil Thomas commented, “This is a significant acquisition for AIS Resources as well as a potential game changer as the historic area provides us with numerous well defined targets and the opportunity to use modern exploration techniques. Very little systematic exploration has been conducted in this area, with only a few drill holes below 60 meters drilled in the past. At the end of last year, an initial drill program on the Golden Bar prospect was completed with two drill holes at 104 and 119 meters. Drill core will be submitted for assaying shortly.”

Figure 1: Golden Bar Prospect drill core intercept showing massive sulphide mineralization from quartz. Will be submitted for assay shortly. Figure 2: Drill rig with unnamed adit in Golden Bar Prospect in background.

Figure 2: Map of A.I.S. Resources EL006194 and surrounding area.

The terms of the acquisition were A$150,000 in cash and the issuance of 10 million shares at C$0.06 per share for a 60% interest. AIS has the right to acquire 100% by exercising two options for an additional 20% each at a pre-determined price based on indicated and measured gold mineral resources. Full details of the acquisition will be announced in a separate news release. AIS also announces that Stewart Govett, the vendor’s principal and renowned, highly experienced geologist from Exact Geoscience, has entered into a contract with the Company. AIS Resources will benefit from his experience and detailed knowledge of the area.

Rose, Thistle & Shamrock Gold Mine

The Rose, Thistle and Shamrock (RTS) Gold Mine, including the Landtax Reef, is an area of significant potential. According to official Victorian Government mining records, over 140,000 ounces of gold at an average grade of 22.2 g/t were mined between 1860 and 1934. Mining was carried out to a maximum depth of about 330 m. Since the closure of the RTS mine almost 80 years ago, no significant exploration work has been carried out in or around the mine.

AIS owns a number of other promising properties, most notably the 28 km² Fosterville-Toolleen gold project, just 9.9 km from Kirkland Lake’s Fosterville gold mine. Similarly, AIS holds a 60% interest in the 58 km² Yalgogrin gold project in New South Wales (with the right to acquire 100%) and a 100% interest in the 167 km² Kingston gold project in Victoria Australia near Stawell and Navarre. The company also has joint venture interests with Spey Resources Corp. in lithium brine deposits in Argentina in the Incahuasi and Pocitos salars.

Summary: CEO Phil Thomas rightly sees the latest acquisition as a game-changer. Importantly, drill results from two drill holes drilled by the previous owner are still pending. Looking at the historical map with its hundreds of historic projects, and taking into account the circumstances of the 19th century, it would have to be a devil’s bargain if the results were not high-grade. Hopefully, this new acquisition will allow AIS to reinvent itself and finally raise the capital that its portfolio of first-class projects deserve. The technical team is already top-notch. It wouldn’t take much and AIS could also shine like its neighbor E79.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of both Spey Resources and A.I.S. Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the companies at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by A.I.S. Resources for reporting on the company. This is another clear conflict of interest.