Everythings points to further growth in resources

Just a few days ago, when Abitibi Metals (WKN A3EWQ3/ CSE AMQ) presented a new, already significantly increased resource for the B26 copper and gold project, we pointed out that even now there is still excellent potential for further expansion of the deposit. Which has now been impressively confirmed!

Abitibi has now presented the first results from the ongoing second drilling phase at B26. Not only did they show high metal grades, but mineralization was also found at depths at which the company had not found any before!

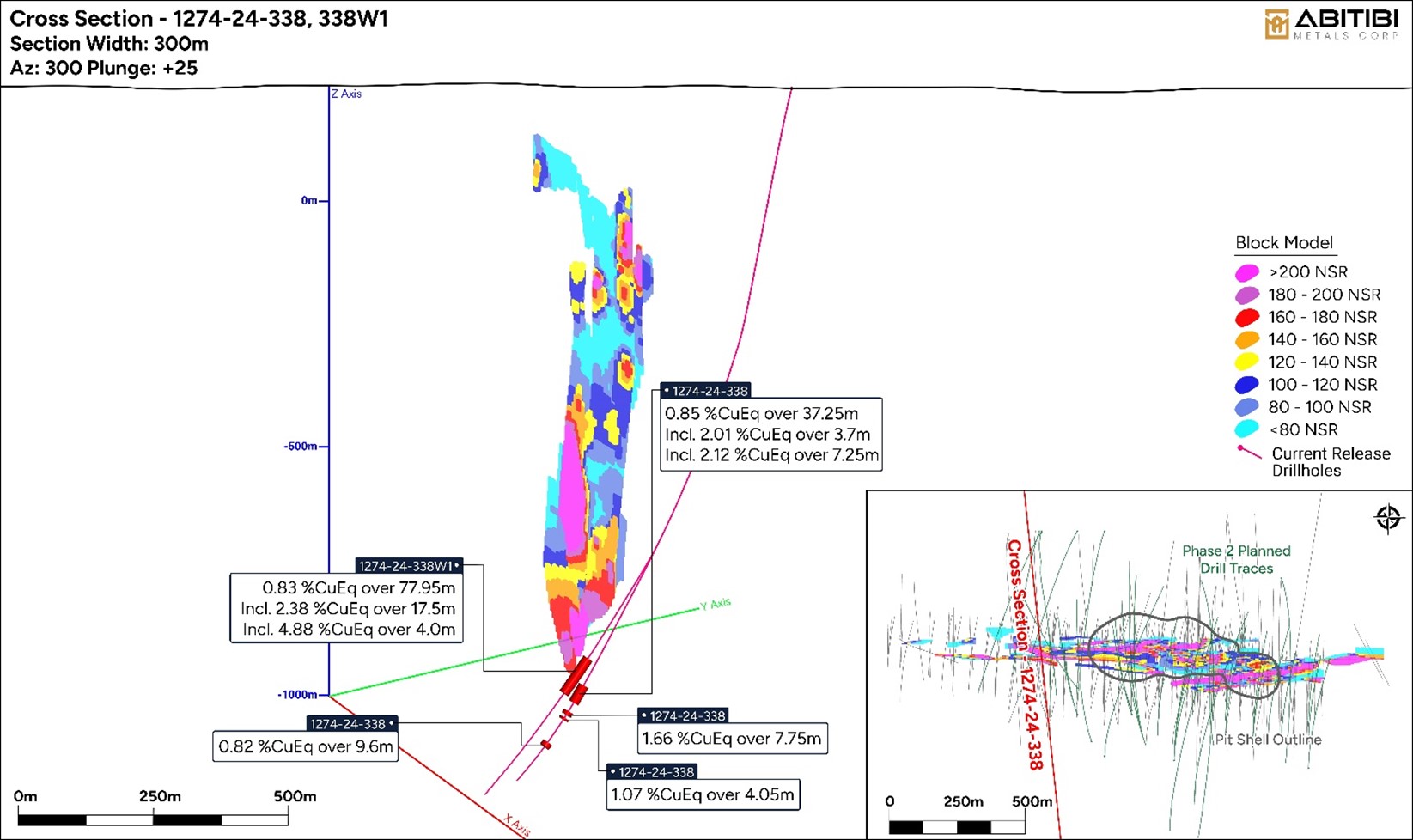

Specifically, Abitibi drilled 4.9% copper equivalent over 4 meters with hole #338W1 within a thicker interval of 17.4 meters of 2.4% copper equivalent – from a depth of 1,186.6 meters! Which was an increase in grade from the values recently reported in the resource estimate. These higher-grade intercepts were part of an interval of 77.95 meters at 0.83% copper equivalent.

In addition, hole #338 intersected 2.1% copper equivalent over 7.25 meters within 37.3 meters of 0.86% copper equivalent from 1,206 meters depth – and in the same hole another intercept of 1.7% copper equivalent over 7.8 meters.

Overall, these results confirm the continuity of the chalcopyrite-bearing veins outside of the current resource envelope and outline the interpreted dip of the mineralized system at the scale of the deposit.

Hole 338W1, a so-called “wedge hole”, i.e. a kind of branch-off from the original hole, intersected the mineralized zone encountered in #338 about 50 metres above the mentioned mineralized intersections. 338W1 intersected the same high-grade zone, with 2.4% and 4.9% copper equivalent, demonstrating the potential of the B26 zone for high-grade mineralization down dip.

Breakthrough in the exploration of B26!

The new exploration area is located approximately 200 meters below historical drilling and importantly outside the western boundary of the B26 deposit. Abitibi management considers the extension of the down-dip target to be a breakthrough in the exploration of B26. This is because it supports the modeling of a structurally controlled gold-bearing quartz vein system with chalcopyrite. According to the company, if the disseminated, lower-grade material is added, the overall mineralized system reaches an average thickness of 140 meters!

Conclusion: Abitibi Metals is continuing where it left off with the recently published resource estimate for B26 – with growth. In view of the breakthrough in the exploration of the deposit proclaimed by the company, the signs are good that it is still a long way from reaching its full size.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.