{kanada_flagge}With the tailwind of its recent discovery in the Yukon, Sitka Gold Corp. (CSE: SIG; FRA: 1RF) continues to systematically advance its second prospective early-stage project, Alpha Gold in Nevada. As the company now announces, a follow-up 1,500-meter drill program has already started on June 17, which is designed to find gold deposits in the so-called Carlin style at the southeastern end of the Cortez trend about 40 kilometers southeast of Barrick/Newmont’s Cortez gold mine complex in Nevada.

The first hole of this new drilling campaign – which is the ninth hole ever drilled on Alpha (hole #AG22-09) – has already been completed. The drill hole extended to a depth of 171 meters and intersected, as hoped, strong alteration from a depth of 113 meters in sedimentary strata suitable for Carlin-type deposits. Detailed laboratory analysis is pending.

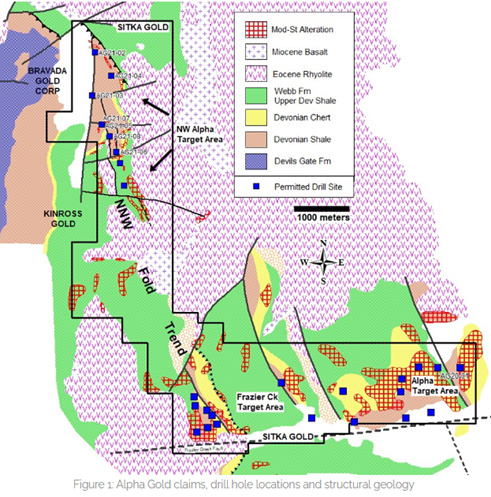

Sitka is following up on Alpha Gold with the valuable insights gained from previous drilling campaigns in recent years. All holes drilled to date have intersected gold mineralization associated with strong Carlin-style pathfinder elements in a zone of strong alteration at surface that extends for approximately 7 kilometers along major fold structures mapped in the area.

Figure 1: Drill pads approved for this drill season are marked with a blue square.

First Hole Details: Strong Alteration from 113 Meters Depth

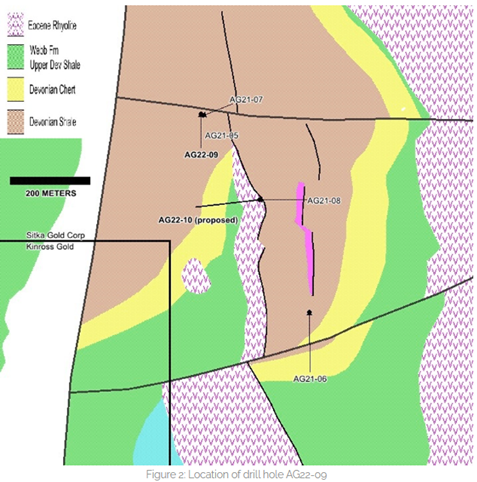

AG22-09 was completed on June 19 to a depth of 171 meters. The hole was positioned to test the hanging wall (west side) of the N-S structure (see Figures 1 and 2). There was a decalcified zone at 58-61 meters, but strong alteration began at 113 meters in the Horse Canyon equivalent unit. A zone of strong silicification, decalcification, and drusen quartz in troughs continued to 143 meters. The section was strongly carbonaceous and often contained zones of 5-10% or more pyrite. The upper part of the section also contained clay spherules and rhyolite chips from thin drifts. This alteration was much more evident than that at the bottom of AG21-05 (see news release dated September 16, 2021). At 143 metres, the hole began to encounter voids and lose flowback. Drill cuttings recovered below 143 metres contained mainly fine succrose jasperoid typical of the strongly altered Devils Gate Limestone. The strong alteration, reminiscent of AG21-08 in this hole (see news release November 16, 2021), is very encouraging for AG21-10, which is currently being drilled and will test the same structure further south and deeper (see Figure 2).

Cor Coe, P.Geo., CEO and Director of Sitka explained, “This is the first drill hole to be completed since we doubled the size of the Alpha Gold property last year. Previous drill holes at Alpha Gold returned intercepts greater than one gram per tonne gold. The initial observations from drill hole AG22-09 are very encouraging and reinforce our belief that Alpha Gold has excellent potential for a large Carlin-type gold deposit.”

Figure 2: Exact location and site of completed drill hole AG22-09 and now planned drill hole AG22-10.

Bottom line: this is what systematic and frugal exploration looks like: Over three years, Sitka has drilled only eight exploration wells on the Alpha Project to date. On the one hand, that’s not a lot, considering that the discovery hole on the Sitka project in the Yukon was hole number 21. But it is still impressive how much information Sitka has already gained with the comparatively small number of drill holes on Alpha. Each additional drill hole seems to bring Sitka closer to the sweet spot of the suspected Carlin-style gold deposit. This is evidenced by the technical success of the first drill hole, which also shows that Sitka has a good understanding of the stratigraphic sequence and its location. That’s half the battle when it comes to Carlin deposits. The blueprint for Sitka in Nevada is the phased discovery of the world-class Goldrush project in 2010 (now Barrick Gold). Sitka believes Alpha Gold also has all the right elements to host a significant Carlin-type discovery.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news at https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.