{kanada_flagge}Blue Moon Metals Inc. (TSXV: MOON; FRA: 8SX0) reports a new discovery at its advanced Blue Moon polymetallic project in California. Step-out exploration hole BM-83 has intersected visible massive and semi-massive sulphide mineralization over a core length of 30 meters. The significance of this discovery is that the new mineralization is located several hundred meters from historically known zinc, silver, gold and copper deposits. (see Figure 1). The 2018 resource from Blue Moon 43-101 includes 7.8 million inferred tonnes at 8.07% zinc equivalent (4.95% zinc, 0.04 oz/t gold, 0.46% copper, 1.33 oz/t silver) containing 771 million pounds of zinc, 300,000 ounces of gold, 71 million pounds of copper, and 10 million ounces of silver.

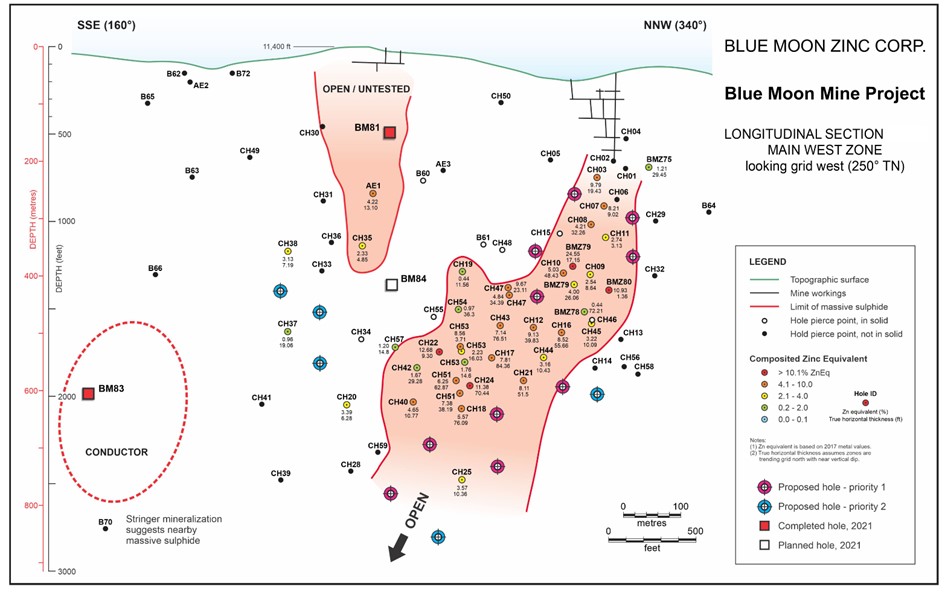

In another drill hole, BM 81, drilled below American Eagle’s historic production shafts (center of photo), Blue Moon has confirmed continuity between American Eagle’s workings and the historic AE1 drill hole. The next drill hole, BM-84, is marked with a white square. It lies between the known ore bodies (highlighted in light red).

Figure 1: Longitudinal section of Blue Moon’s VMS deposit. The red squares mark drill holes BM-83 and BM-81.

The new discovery in drill hole BM83 was made during testing of a geophysical conductor target. The zinc sulfide (sphalerite) encountered in this new discovery has a different hue than the other zones, which may indicate a separate emplacement pulse with slightly different timing that could complement the currently known zones. This conductor was first uncovered in the form of sulfide stringers and bubbles that began at a core depth of 720 meters and continued to the banded and massive interval of 16-meters at a vertical depth from surface of approximately 243 meters. The entire mineral-rich zone extended over a core length of almost 30 meters, although this does not correspond to the true thickness.

Figure 2: Photo from mineralized zone of drill hole BM-83 at a vertical depth of 240 meters. The reddish brown mineral is sphalerite. The brass colored mineral is chalcopyrite.

Conclusion: The Blue Moon Project in California has a long checkered history dating back to the World War II era. The two mine workings on the project date from that time. For 80 years, the project was then passed around like a hot potato. Among the owners are well-known names. But always it seems to have been easier and more rewarding to develop a zinc mine elsewhere than in California. It is very telling that the small explorer Blue Moon is the first company to look outside the known framework for a continuation of the deposit. This courage has now been rewarded by a new discovery. Yet it has long been known that VMS deposits occur in clusters. Where there is one lens, there are usually others. This is exactly what Blue Moon has now proven. This theoretically clears the way to rethink the project entirely. The known 7,8 million tons of ore is certainly not the limit, but just the beginning. The historically high zinc price could finally open the window of opportunity for the Blue Moon project. However, a lot more money would have to flow into the project to make it ripe for a production decision. Contrary to rumors to the contrary, permitting in California would not be the problem. We know of few examples that show as well as Blue Moon how difficult it is to develop new deposits.

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors or employees of GOLDINVEST Consulting GmbH may hold shares of Blue Moon Metals and therefore a conflict of interest may exist. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between GOLDINVEST Consulting GmbH and Blue Moon Metals, which means that there is a conflict of interest. GOLDINVEST Consulting is remunerated by Blue Moon Metals for the preparation of articles about the company, which represents a further conflict of interest.