{kanada_flagge} When the elephants fight, the grass suffers. So goes an African proverb. Tembo Gold (TSXV: TEM; FRA: T23A) and its shareholders can sing a song about how big politics can make life hell for junior exploration companies. Celebrated in 2011 at the IPO and already given the advance praise for a future world-class discovery, the stock today – despite a 3 to 1 amalgamation – is bobbing along at CAD 0.15: market value now only around CAD 12 million!

But: The settlement of the dispute between the mining company Barrick and the Tanzanian government and the change of political course by Africa’s only head of government Samia Suluhu Hassan after the death of President Magafuli finally open a new chance for Tembo. After a forced hiatus of almost seven years, management intends to seize this opportunity and finally start exploring again – right next to Barrick’s 14 million ounce world class Bulyanhulu gold deposit in Tanzania. Fittingly, Tembo announced a round of funding today, placing CAD 3 million at CAD 0.15 in the coming days. The funds will immediately go towards a new 15,000 meter drill program. This program is expected to be completed by the end of Q4 2021.

Figure 1: Stock charts tell a story. Here it is that of fallen stock market star Tembo Gold. It speaks for itself that management has not abandoned the project during no fault of its own, but has quietly even doubled the license area and, with the help of Goldspot’s data analysts, has further underpinned exploration targets. Insiders now hold 70 percent of the shares. Tembo is therefore well prepared for the new start.

The planned drilling is a continuation of previous drill programs that intersected highly significant gold mineralization with exceptional grades. Drilling will focus on previous drilling with good results, with the aim of gaining a detailed structural understanding of the mineralization. Later, further targeted follow-up drilling will follow mineralization along strike and down dip, with the goal of defining an initial resource.

Barrick’s big plans for Bulyanhulu are tailwinds for Tembo

The Bulyanhulu gold mine in Tanzania is one of the few world-class mines. Since October last year, production has finally resumed there after Barrick, settled Acacia Mining’s (formerly African Barrick Gold and 64% owned by Canada’s Barrick Gold (TSE: ABX)) dispute with the Tanzanian government and acquired Acacia’s minority shareholding. The dispute made headlines around the world: In 2016, the Tanzanian government passed a new mining law in a cloak-and-dagger operation and made demands on Barrick worth billions of dollars. During the dispute, which lasted several years, the 2,000 miners of Bulyanhulu had to be sent home. For a long time, it looked as if there would only be losers on all sides. That is now over.

If Barrick CEO Mark Bristow has his way, Bulyanhulu will now become a showcase project again: Barrick wants to develop the mine together with the North Mara Mine into a “Tier 1” production site with more than 500,000 ounces of gold annually at production costs that are in the lower half of the industry average. The New Life at Bulyanhulu naturally spurs explorer Tembo Gold whose eponymous gold project is just two and a half kilometers from Bulyanhulu at its closest point.

The new plan is the old one: A multi-million ounce discovery

As he did ten years ago, David Scott will be doing the exploration at Tembo. He is one of the best experts on Tanzanian geology and has more than 40 years of exploration and mining experience in Africa, including 22 years in Tanzania alone. He knows Bulyanhulu like the back of his hand, having worked there for Barrick as early as 1999 and been responsible for several hundred thousand meters of exploration drilling that has turned Bulyanhulu into the world-class deposit it is today.

Project Manager David Scott on the Tembo project: “After our initial drilling successes in 2011, we thought this was going to be as easy as picking fruit off the tree.”

One would think that finding a second high-grade deposit in the immediate vicinity of a world-class project like Bulyanhulu could not be that difficult. Even more so when the large-scale geological structures and hundreds of pits owned by local gold miners provide tangible evidence that gold is present. But sometimes the sheer abundance of targets can be a problem. Where to start? Where to drill? Tembo has already completed about 50,000 meters of drilling during its previous work. Of 76 holes, 41 were so-called reverse circulation holes (7,952m) and 35 were diamond holes (7,623m). In the case of Tembo, the large number of targets was definitely a problem. This makes the prioritization of drill targets by Goldspot’s state-of-the-art software all the more important. Goldspot has reduced the multitude of possible targets to 54 primary targets.

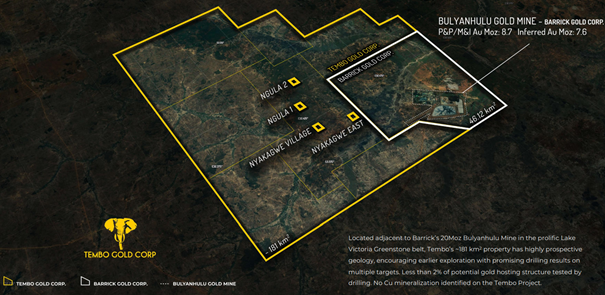

Figure 2: Tanzania is literally “Elephant Country.” There are six modern mining operations within a hundred kilometer radius of Tembo Gold’s project. Bulyanhulu is the closest, only two and a half kilometers from the Tembo licenses. The Tembo project covers an area of 174 square kilometers and is 100 percent owned by Tembo.

Figure 3: At approximately 174 square kilometers, the Tembo license is many times larger than that of its prominent neighbor Barrick.

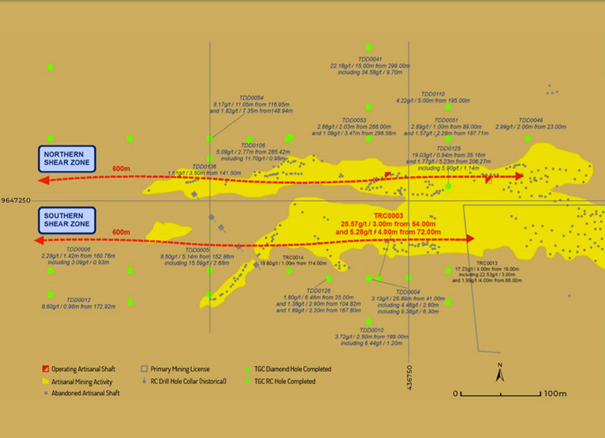

Figure 4: More than 1,000 local miners work dozens of shafts, some to depths of more than 50 meters along a 10-kilometer corridor of high-grade gold. They regularly unearth grades ranging from 5 to 58 g/t. A survey of the surface topography using laser-based LIDAR measurement methods has made the locations of old workings visible in a digital terrain model. Tembo now intends to use this valuable preliminary work by local miners for its own exploration.

Tembo has set itself ambitious goals. As soon as the financing is in place, drilling is to continue practically until the 4th quarter. This should provide a good news flow. Among other things, Tembo wants to continue drilling where it has historically had the best results to date: for example, at drill hole TDD0041, which returned 15 meters of 22.81g/t gold from a depth of 299 meters. If results warrant, Tembo would like to model an initial resource as early as the first quarter of next year. A scoping study and a continuing economic assessment (PEA) including preliminary mine planning, metallurgical studies, design of a process plant, determination of optimal production rate and estimation of capex & opex costs could be developed from the second half of the year to the first half of 2023 at the earliest.

Conclusion: The elephant’s head still adorns the Tembo Gold logo. Management and insiders have been extremely patient at Tembo Gold over the past few years. They not only safeguarded Tembo Gold’s assets during a nearly seven-year forced hiatus, but actually expanded them. Computer-aided evaluation of extensive data has significantly improved the geological understanding of the targets, which is why the 15,000 meters of drilling are being used very selectively. Even after the now announced CAD 3 million capital round, the capital structure remains tight with a high proportion of management & insiders. The team, led by David Scott, brings all the experience one could ask for in a potential world class project of this nature. We will hence be following Tembo intensively on Goldinvest from now on. Here’s to a new Tembo Gold!

{letter}

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish commentaries, analyses and news on http://www.goldinvest.de. This content serves exclusively to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly, and is not to be understood as an assurance of any price development. Furthermore, it does not in any way replace individual expert investment advice and does not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offerings, as our information only relates to the company and not to the reader’s investment decision.

The purchase of securities involves high risks which can lead to the complete loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the guarantee of the topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares in Tembo Gold Corp. and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Furthermore, a contractual relationship exists between Tembo Gold Corp. and GOLDINVEST Consulting GmbH which involves GOLDINVEST Consulting GmbH reporting on Tembo Gold Corp. This is another clear conflict of interest.